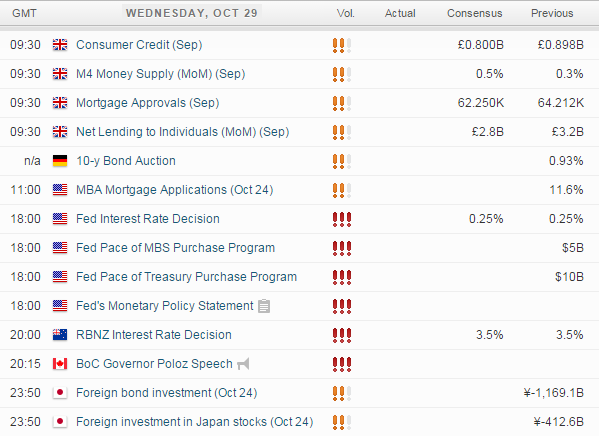

UP NEXT:

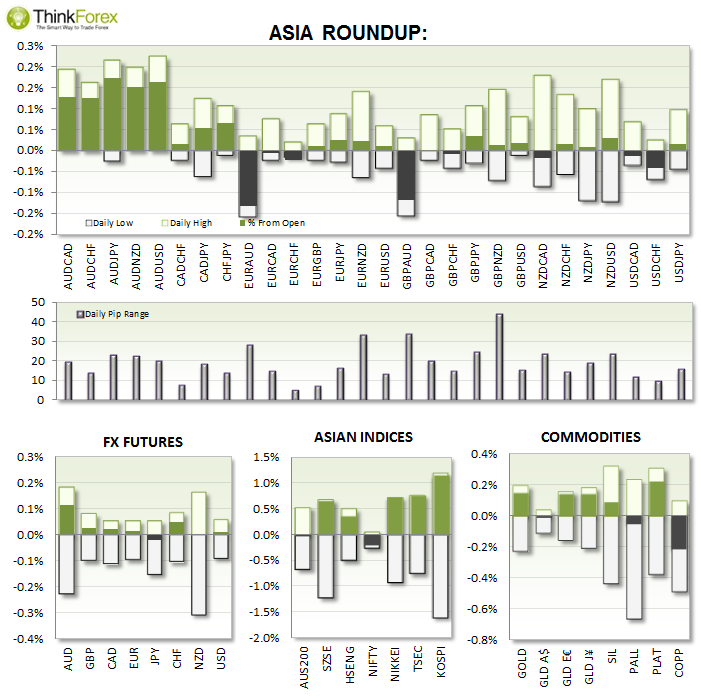

Could be an interesting few hours as we see FED, RBNZ and BoC release rate decisions and statements leading up to Asia open tomorrow. Volatility is almost an assurance but what we would also like is a sustained movement. Obvious pairs to watch for action will be USD/CAD, NZD/USD and NZD/CAD.

TECHNICAL ANALYSIS:

Due to volatility expected to be high (to say the least) and 3 Central Banks talking, I am not picking directional biases, but instead provide key levels and basic scenario's to consider. Good luck.

AUD/USD:

Currently trading at 3-week highs the intraday price action appears poised to test 0.89. A break above here would be a significant victory for the bulls and open up 0.895. This would require a very cautious FED and perhaps even a delay to the end of QE (and outside chance, but one to consider).

My bias is for price to remain below 0.89 and continue to trade in a Choppy sideways range.

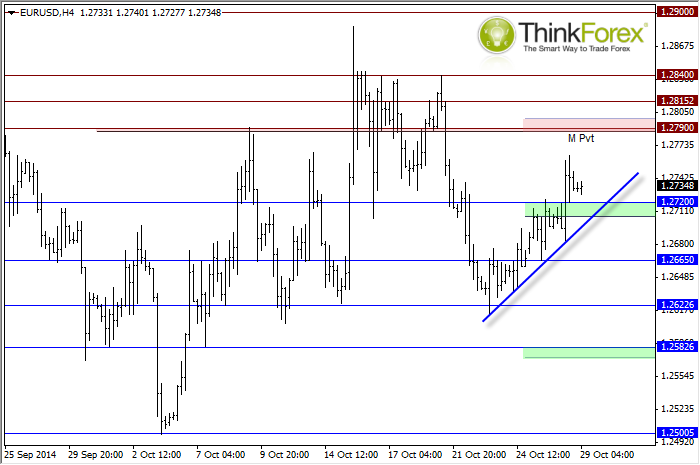

EUR/USD:

We may see continued USD weakness leading up to FOMC, which would favour intraday bullish setups. If the FED does deliver something particularly Hawkish then we can use a break of the trendline to initiate shorts, or sell into resistance levels.

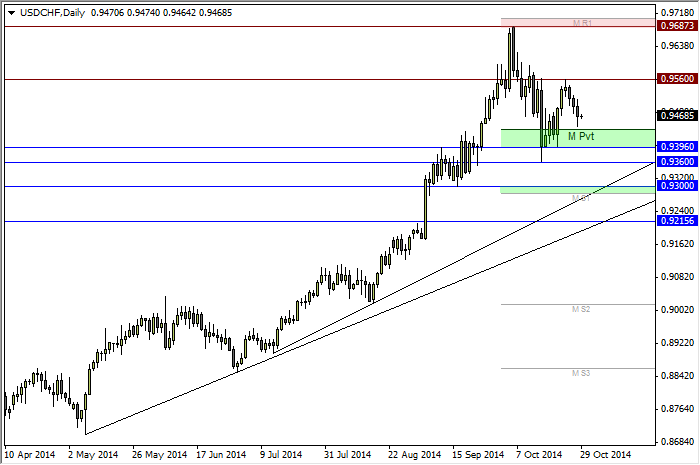

USD/CHF:

One to trade following the release as this is the Daily timeframe. If the FED deliver a Hawkish statement then we can assume the bullish trend will continue and for price to target the 0.956 and 0.968 highs over the coming sessions. However if they do not then I'll assume the correction from the 0.968 high is not yet complete and will favour a move back towards 0.930 or 0.936.

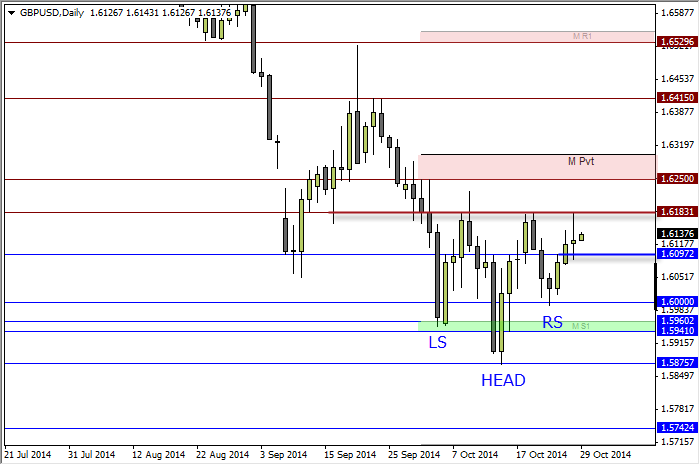

GBP/USD:

Interesting price action is forming which suggests a Head and Shoulders may be forming, with a break above 1.618 required to confirm. However a bullish USD should see Cable retreat back within the 1.66-09 zone and within corrective territory.

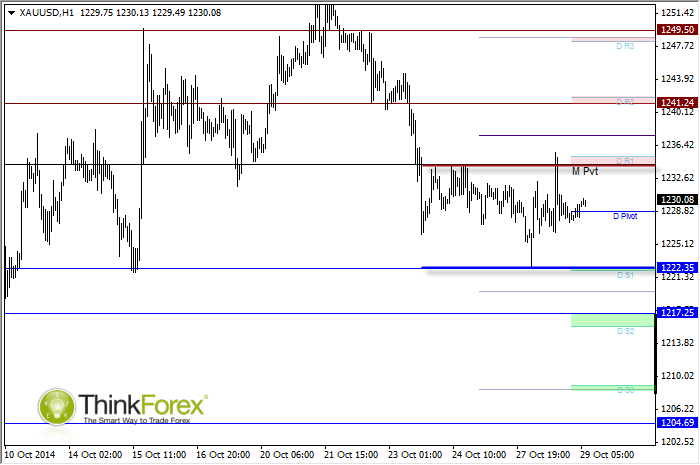

Gold:

A bullish scenario could be expected if the FED do the unexpected and delay the end of QE.