GBP/USD has posted modest gains on Friday, as the pair trades just at 1.5350 in the European session. In Friday’s economic news, British GfK Consumer Confidence dipped to 2 points, marking a 4-month low. In the US, there are two key releases – US Employment Cost Index and the UoM Consumer Sentiment Index.

British releases have not had a good week, but nonetheless, the pound has managed to hold its own against the dollar. BBA Mortgage Approvals dipped to 44.5 thousand, short of the forecast of 46.2 thousand. CBI Industrial Order Expectations slumped badly, with a reading of -18 points, its lowest level since July 2013. This points to weaker manufacturing growth due to less demand for British products both domestically and abroad. On Tuesday, British Preliminary GDP in the third quarter posted a gain of 0.5%, shy of the estimate of 0.6%. This is certainly a cause for concern, as Final GDP in the second quarter posted a gain of 0.7%.

On Thursday, US Advance GDP for the third quarter posted a gain of 1.5%. This was a much softer reading than the Final GDP in Q2 of 3.9%, but was very close to the forecast of 1.6%. Unemployment Claims beat the estimate for a fourth straight week, coming in at 260 thousand. The estimate stood at 264 thousand.

The Federal Reserve had a surprise in store for the markets on Wednesday. The markets had lowered expectations about a rate hike before the end of the year, but the Fed statement revived the possibility of a December hike, stating that it would raise rates when there is further improvement in the US labor market and when inflation rises closer to the 2% target. The Fed provided some clarity in the following excerpt, something which has been sorely missing from previous statements:

“In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation” [emphasis mine]

The next Fed meeting is mid-December, and the markets will be in alert mode for any further hints about a rate hike. As well, key US numbers will be closely monitored, especially employment and inflation data, as the strength of these numbers in the next several weeks will play a critical role in determining whether the Fed will press the rate trigger in December. Still, traders should keep in mind that the markets sometimes overreact to Fed statements or comments from Fed policymakers, and the central bank could easily continue to wait on the sidelines until 2016.

GBP/USD Fundamentals

Friday (Oct. 30)

- 12:30 US Employment Cost Index. Estimate 0.6%

- 12:30 US Core PCE Price Index. Estimate 0.2%

- 12:30 US Core Personal Spending. Estimate 0.2%

- 12:30 US Core Personal Income. Estimate 0.2%

- 13:45 US Chicago PMI. Estimate 49.5 points

- 14:00 FOMC Member John Williams Speaks

- 14:00 US Revised UoM Consumer Sentiment. Estimate 92.6 points

- 14:00 US Revised UoM Inflation Expectations

Upcoming Key Events

Monday (Nov. 2)

- 15:00 US ISM Manufacturing PMI. Estimate 50.2 points

*Key releases are highlighted in bold

*All release times are GMT

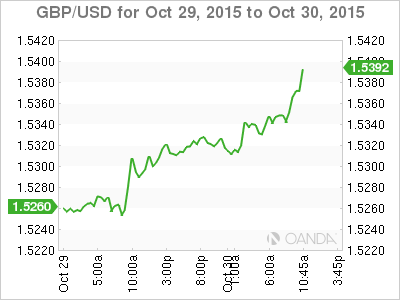

GBP/USD for Friday, October 30, 2015

GBP/USD October 30 at 10:45 GMT

- GBP/USD 1.5356 H: 1.5359 L: 1.5308

GBP/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.5163 | 1.5269 | 1.5341 | 1.5485 | 1.5590 | 1.5660 |

- GBP/USD was flat in the Asian session and has posted modest gains in the European session.

- 1.5341 remains busy and has switched to a support level. It is a weak line and could see further action during the day.

- 1.5485 is a strong resistance line.

- Current range: 1.5341 to 1.5485

Further levels in both directions:

- Below: 1.5341, 1.5269, 1.5163 and 1.5026

- Above: 1.5485, 1.5590 and 1.5660

OANDA’s Open Positions Ratio

GBP/USD ratio has not shown any movement on Friday. The ratio has a slim majority of short positions (52%), pointing to a lack of trader bias as to what direction GBP/USD will take next.