Investing.com’s stocks of the week

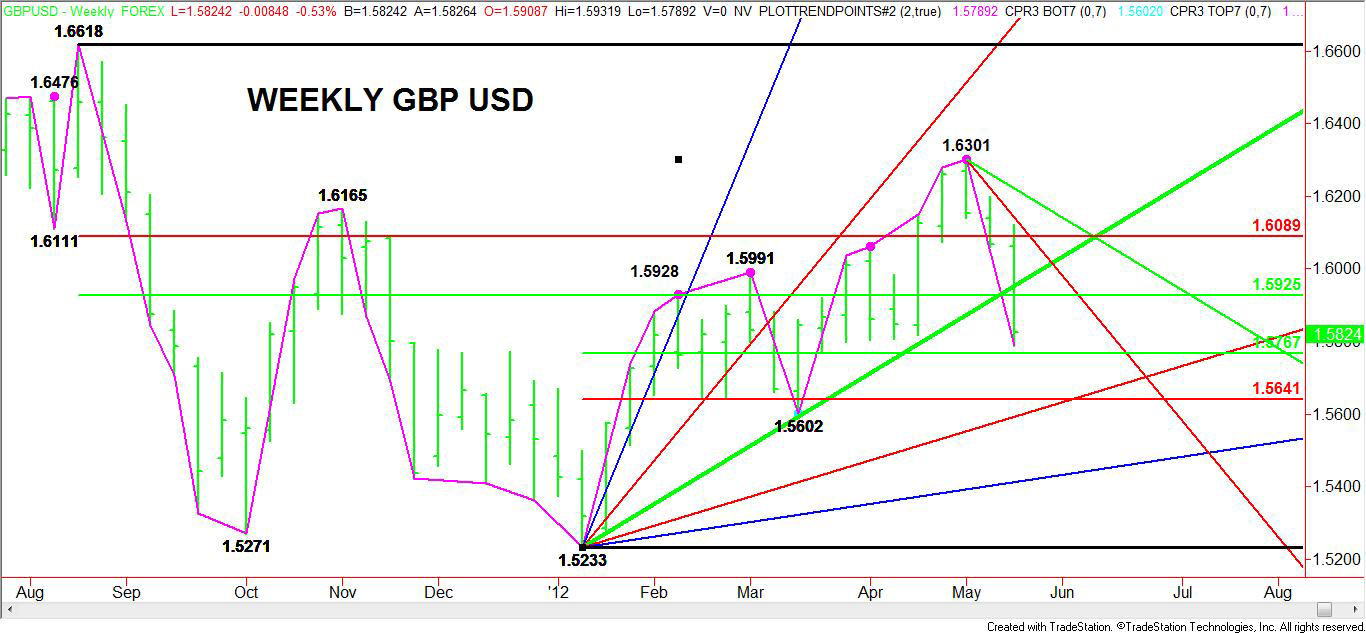

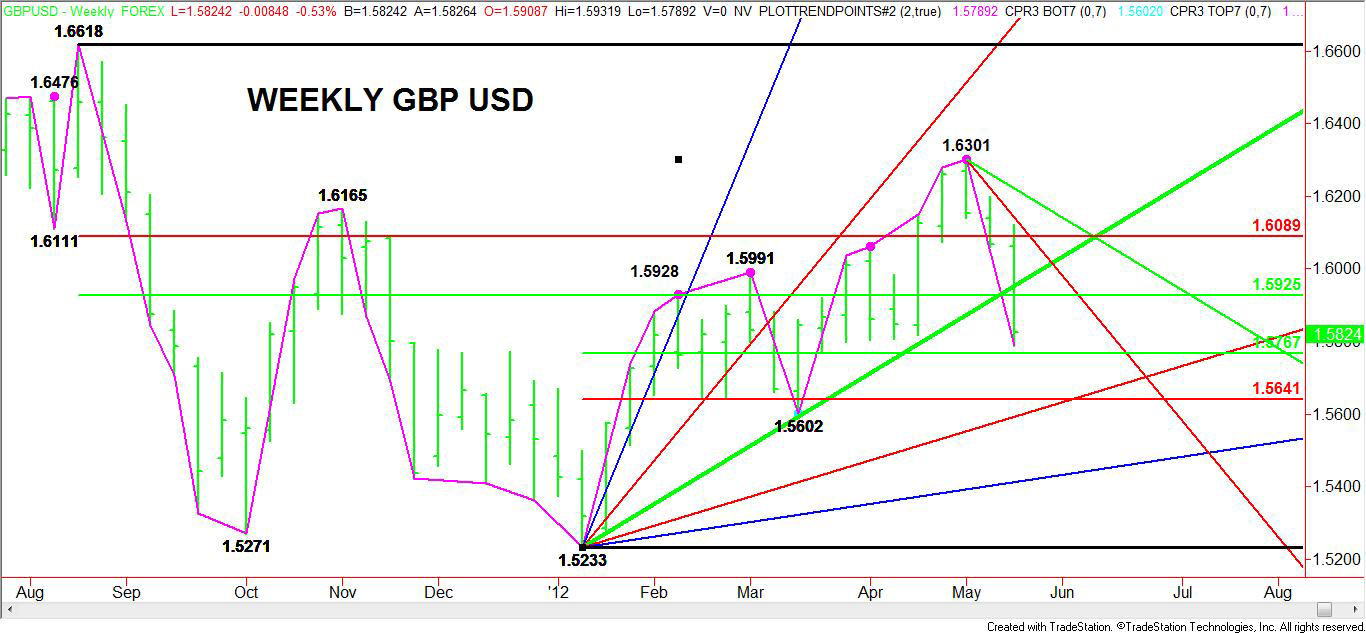

The Weekly British Pound/U.S. Dollar, symbol GBP USD, collapsed through an uptrending support line and a key 50% level, triggering a sharp break to the downside. To technical traders, the sell-off did not come as a surprise since the currency pair formed a potentially bearish closing price reversal top at 1.6301 two weeks ago.

Now that uptrending Gann angle support from the 1.5233 bottom has been penetrated at 1.5953, the market is likely to test the next uptrending Gann angle at 1.5593 this week. Next week it moves up to 1.5613 and nearly crosses a 61.8% level at 1.5641, making it a loose support cluster.

Although the momentum is to the downside at this time, the main trend is up until 1.5602 is broken. This may mean that buyers will be waiting to step in near 1.5641 to 1.5613 next week. On the upside, the GBP USD is walking down a steep Gann angle at 1.6141. This is the best resistance. This Gann angle drops to 1.6061 next week.

In summary, next week’s expected range is 1.5613 to 1.6061 based on the Gann angles and 1.5641 to 1.6089 based on the Fibonacci price levels. If volatility falls, the British Pound may even ping-pong between a pair of 50% price levels at 1.5767 to 1.5925.

Now that uptrending Gann angle support from the 1.5233 bottom has been penetrated at 1.5953, the market is likely to test the next uptrending Gann angle at 1.5593 this week. Next week it moves up to 1.5613 and nearly crosses a 61.8% level at 1.5641, making it a loose support cluster.

Although the momentum is to the downside at this time, the main trend is up until 1.5602 is broken. This may mean that buyers will be waiting to step in near 1.5641 to 1.5613 next week. On the upside, the GBP USD is walking down a steep Gann angle at 1.6141. This is the best resistance. This Gann angle drops to 1.6061 next week.

In summary, next week’s expected range is 1.5613 to 1.6061 based on the Gann angles and 1.5641 to 1.6089 based on the Fibonacci price levels. If volatility falls, the British Pound may even ping-pong between a pair of 50% price levels at 1.5767 to 1.5925.