GBPUSD – Price Action Bottoms, More Upside?

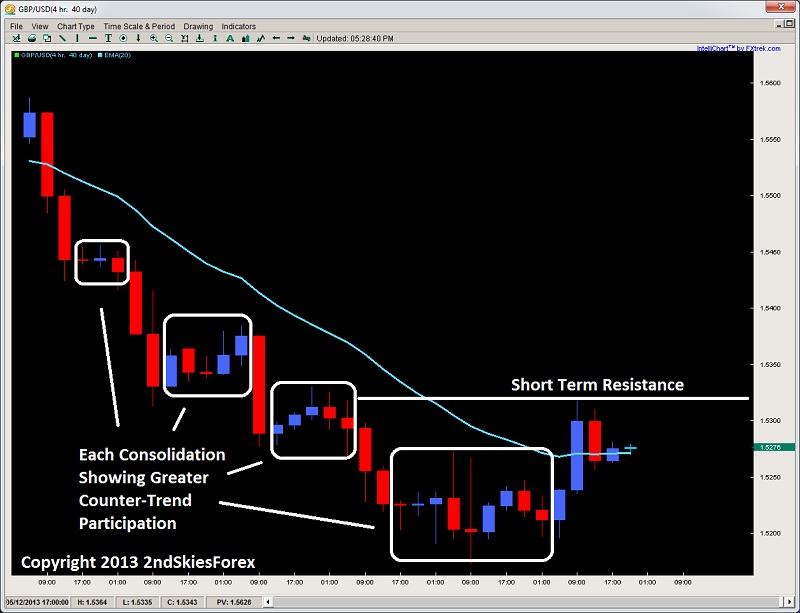

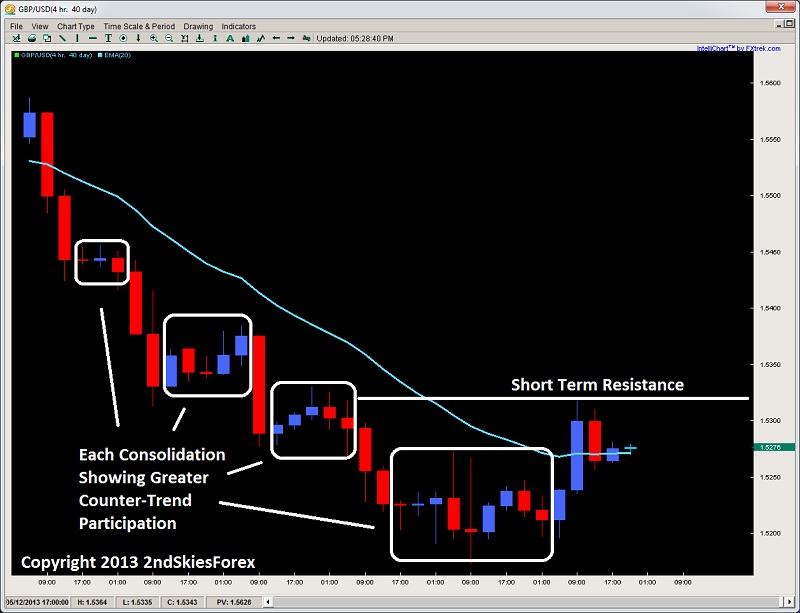

As discussed in my FX market commentary yesterday, the GBP/USD was showing intra-day price action signs of a bottom forming via the trend transitions and two way order flow. You can see this in the consolidations which were increasing as the trend went on, signaling a greater participation from the counter-trend players. When you can learn to read these (on any time frame), you can use them to spot likely trend reversals and counter-trend setups.

The pair took out the 1.5272, and once it did, headed quickly to our first target at 1.5320 as discussed Wednesday, which savvy price action traders profited from. The pair did sell of heavily into the close, so sellers might have used this pullback to test the bulls. It is currently resting on support at 1.5275, and should this break, 1.5245 will be under attack, then 1.5200. Bulls will need to take out the daily highs at 1.5321 to bring in new longs and trip short term stops.

Original post

As discussed in my FX market commentary yesterday, the GBP/USD was showing intra-day price action signs of a bottom forming via the trend transitions and two way order flow. You can see this in the consolidations which were increasing as the trend went on, signaling a greater participation from the counter-trend players. When you can learn to read these (on any time frame), you can use them to spot likely trend reversals and counter-trend setups.

The pair took out the 1.5272, and once it did, headed quickly to our first target at 1.5320 as discussed Wednesday, which savvy price action traders profited from. The pair did sell of heavily into the close, so sellers might have used this pullback to test the bulls. It is currently resting on support at 1.5275, and should this break, 1.5245 will be under attack, then 1.5200. Bulls will need to take out the daily highs at 1.5321 to bring in new longs and trip short term stops.

Original post