The U.S. dollar traded mixed and rallied versus the yen as the Bank of Japan released a statement indicating it will increase bank loans and expand the monetary base. The greenback has remained under pressure since Friday when U.S. economic reports confirmed that Manufacturing Production slipped in January, signaling that winter has taken a toll on the world’s largest economy. On Tuesday, the New York Federal Reserve Bank revealed that the General Business Conditions index posted at 4.48 this month, a dramatic plunge from the 20-month high of 12.51 it posted in December. Gold Prices surged to a three-month high but then retreated during the London trading hours as investors increased speculation that the commodity’s hike could dampen demand. Bullion advanced 9.2 percent so far this year, recovering from the largest plunge since 1981, as speculators sought safety in light of the possibility that the U.S economy could be slowing down. Gold for immediate delivery slipped 1 percent and traded at $1,316.08, while Futures for April delivery fell 0.2 percent to $1,316.10 on the New York Mercantile Exchange.

The euro gained against the U.S. dollar despite weak fundamentals out of Germany revealing that the index which gauges Economic Sentiment went down in February. The shared currency remained strong as market traders remained concerned over the welfare of the American economy and the situation in the emerging markets. On the positive side, the Current Conditions Index rose to a 2½ year high this month. The Sterling dipped versus the greenback as an announcement confirmed that inflation fell below the Bank of England’s target, fueling speculation that the central bank may not raise the interest rate any time in the near future.

The Japanese central bank opted for leaving the benchmark interest rate at the current level but indicated that it will engage in more lending in order to bolster the effects of the monetary easing program. The news prompted the yen to drop to a two-week low against the U.S. dollar. A release published on Monday showed that the country’s economy grew 1.0 percent in the last quarter of 2013, well below the predicted 2.8 percent. The yen also slipped versus the euro.

The Reserve Bank of Australia issued the minutes from its most recent policy meeting, which showed that policy makers have no plans for a rate hike, a factor that kept the Aussie at a one-month high versus the U.S. dollar while trading higher against the New Zealand dollar.

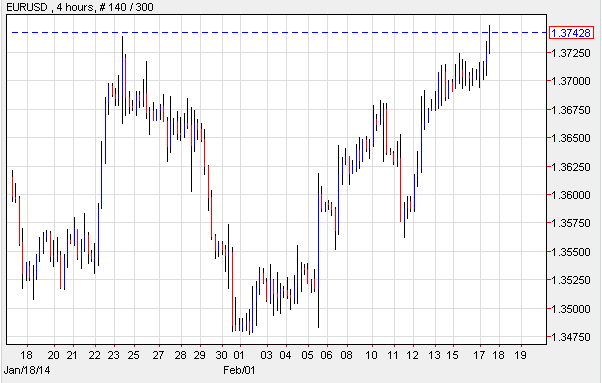

EUR/USD: ZEW Falls

The EUR/USD remained strong despite news from the ZEW Centre for Economic Research which revealed that Economic Sentiment in German deteriorated this month. Analysts believe that the drop was caused by worries over the welfare of the U.S. economy and the low inflation levels posted by the E.U. The index which measures Economic Sentiment in Germany read at 55.7, which was lower than the 61.7 posting of January. The Current Conditions Index rose to 50.0 in February after coming in at 41.2 the prior month, surpassing forecasts for a hike to 44.0. Economists say that investors are still optimistic, while the President of the ZEW, Professor Clemens Fuest, indicated that the ZEW data should not be taken to heart. The EUR/USD surge to a six-week high after the U.S. released data which confirmed that Manufacturing activity in the New York region plummeted in February, signaling that the U.S. economy has cooled off.

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242" />

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242" />

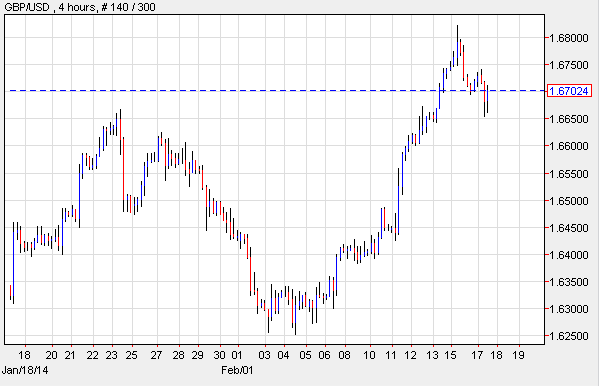

GBP/USD: Inflation Drops

The GBP/USD traded lower following releases out of the U.K. divulging that Consumer Price Inflation slipped below 2 percent. According to official metrics issued by the British Office for National Statistics, consumer inflation went up at a rate of 1.9 percent even though economists thought it would remain at 2.0 percent as it posted in December. The report showed that consumer prices went down 0.6 percent in the initial month of 2014 with Core CPI rising 1.6 percent. The core CPI does not take into account the prices of certain items like food, tobacco, alcohol or energy products. The Retail Price Index which is the benchmark for inflation related bonds climbed 2.8 percent, surpassing forecasts for a 2.7 percent hike. Lastly, the House Price Index surged 5.5 percent despite predictions for a jump of 5.8 percent.

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242" />

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242" />

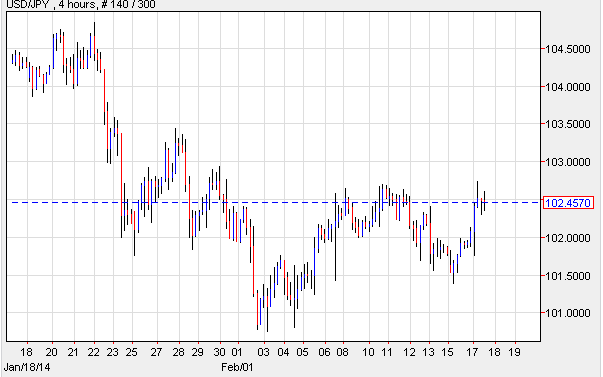

USD/JPY: BOJ Speaks Of More Loans

The USD/JPY rose as the Bank of Japan decided to expand its lending program in order to increase the impact of the current stimulus program. The USD/JPY slipped as the central bank of Japan announced that it will leave the key cash rate unchanged, and suggested that policy makers still hold a positive assessment of the economy. The report suggested that there won’t be any changes to monetary policy any time soon, but the bank will engage in a loan program geared for financial institutions to borrow twice what they can at this time. The bank placed emphasis on its efforts to emerge from deflation.

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242" />

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242" />

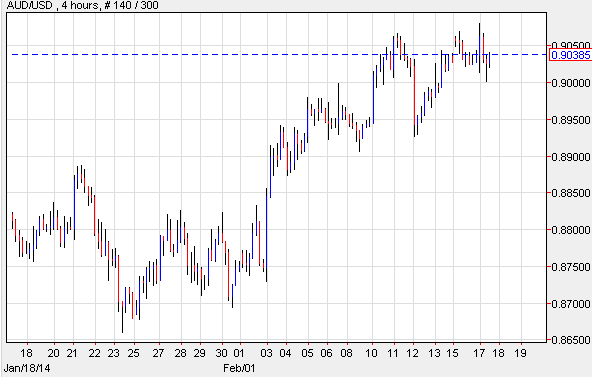

AUD/USD: RBA Posts Minutes

The AUD/USD traded at a one-month high subsequent to the Reserve Bank’s announcement confirming that the economy is showing signs of improvement given the weakening of the currency. The bank also intimated it will leave the benchmark interest rate at the current levels in order to obtain some stability while Australia moves away from an economy dependent on mining. The pair remained to the upside as the U.S. released further lackluster economic reports which increased the possibility that the Federal Reserve may refrain from additional cuts to the asset purchasing program for now.

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242" />

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242" />

Daily Outlook: Today’s economic calendar shows that the U.K. will report on Claimant Count Change and the BOE will release the Monetary Policy meeting minutes. The U.S. will issue Building Permits, Core PPI, Housing Starts, PPI, and the FOMC meeting minutes. New Zealand will announce PPI Input and Output. Japan will publish the Adjusted Trade Balance and Trade Balance. And China will provide HSBC Manufacturing PMI.