Overnight, the Pound has started to slide south slowly as markets went on a buying rampage for riskier assets, as Russia’s president Vladimar Putin announced that he would annex Crimea and leave the rest of Ukraine to itself.

This move was felt heavily in the UK, which should come as no surprise given how close it is to Europe and the crisis which has evolved recently.

It looks unlikely that Europe will do anything but sanction Russia and accordingly, the UK will follow suit. What seems more likely now is a return to market action without the weight of risk aversion we have seen over the past few days.

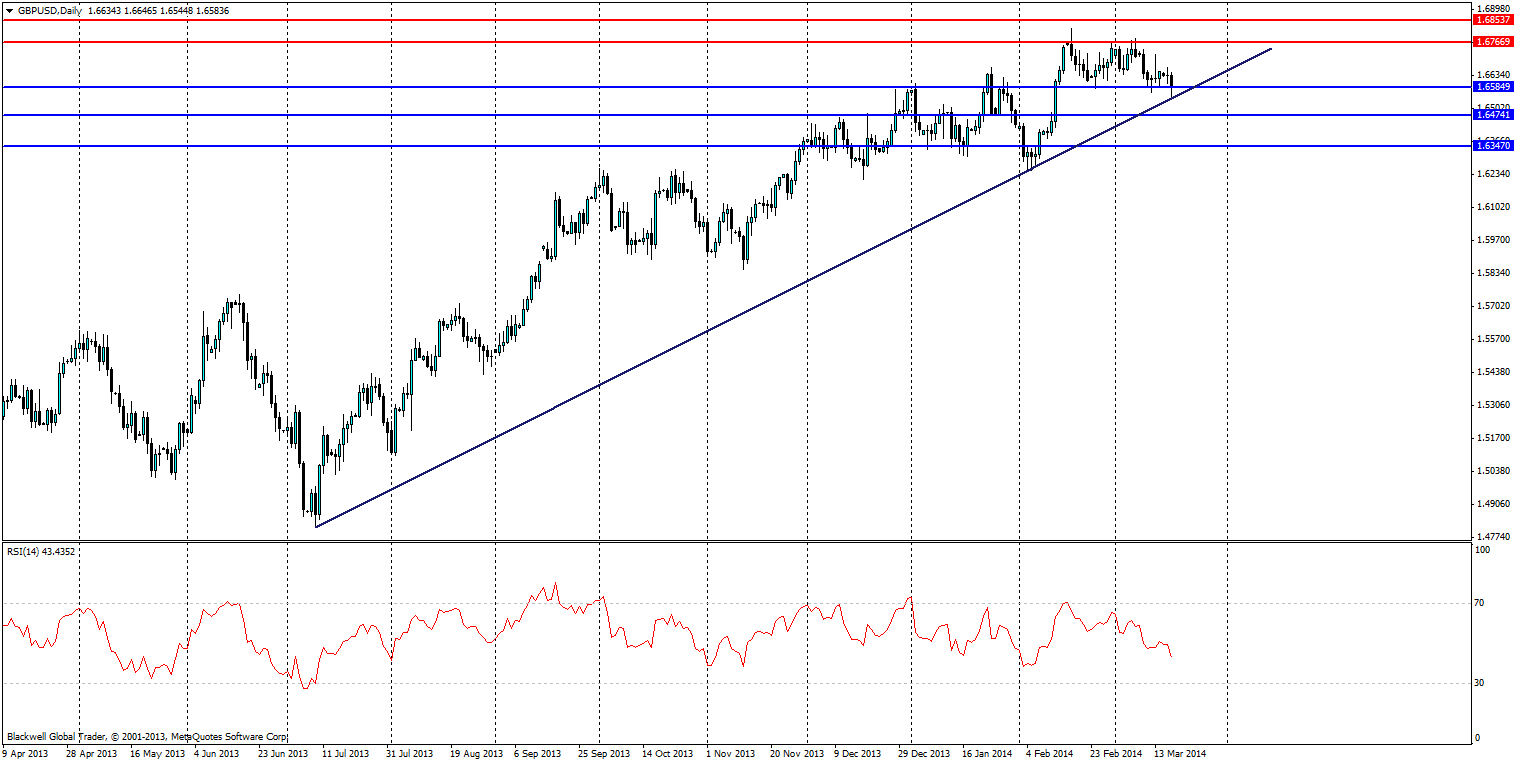

GBP/USD 1" title="GBP/USD 1" name="Picture 1" align="bottom" border="0" height="303" width="602">

GBP/USD 1" title="GBP/USD 1" name="Picture 1" align="bottom" border="0" height="303" width="602">

The Pound is the key place to start as right now it is starting to get into a bit of difficulty. After ranging higher over the last year, it’s now starting to touch on its bullish long term trend line. This trend line has been in play since June 2013 – it is not very steep and has been tested three times now.

While the RSI has shown selling pressure over the last week, this could be markets looking to test the current trend line and getting a taste of market sentiment for the Pound. I would certainly look at it this way and expect the Pound to pull back off this trend line, given how strong the trend line is.

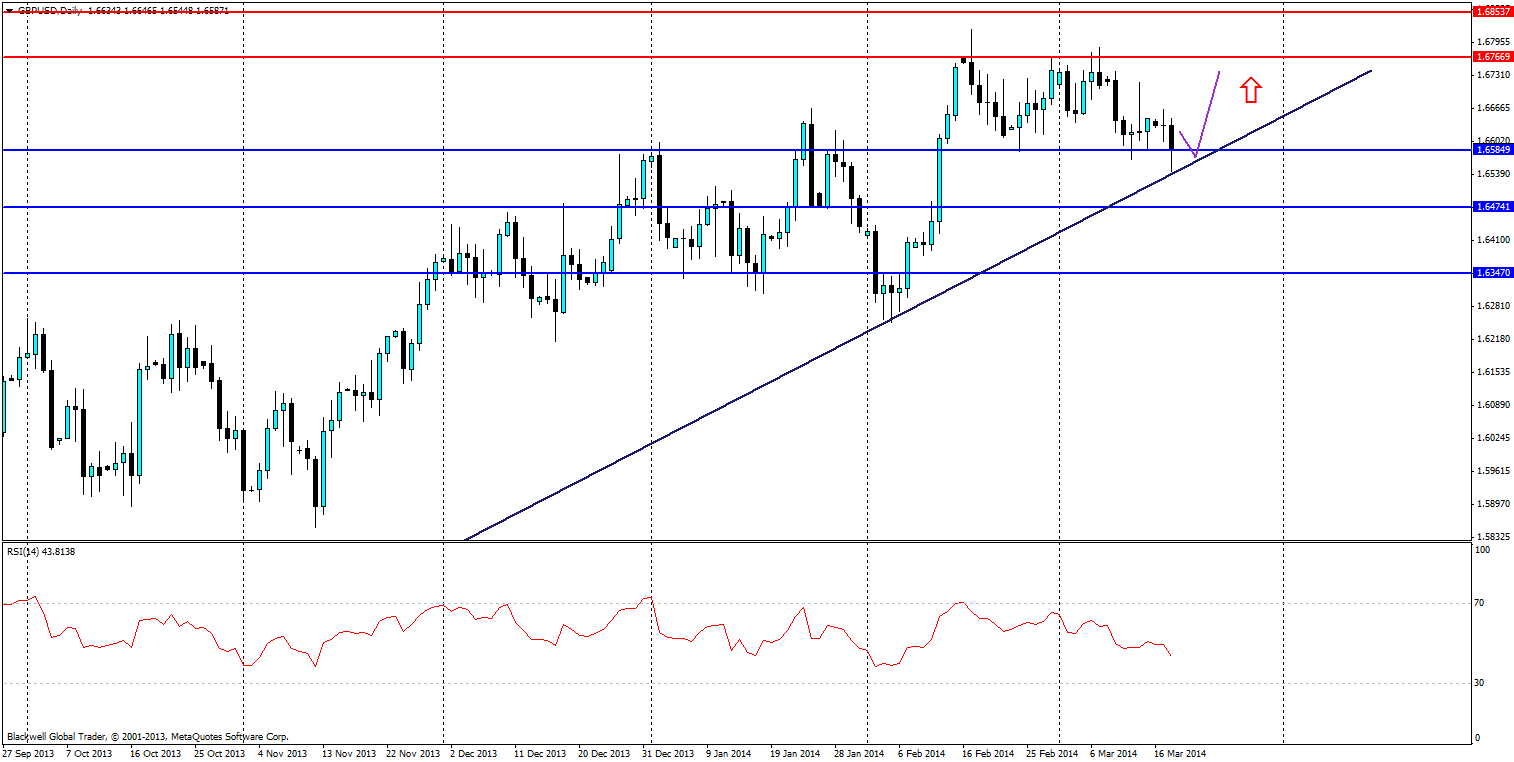

GBP/USD 2" title="GBP/USD 2" name="Picture 2" align="bottom" border="0" height="303" width="602">

GBP/USD 2" title="GBP/USD 2" name="Picture 2" align="bottom" border="0" height="303" width="602">

As shown above, to me this looks likely to be the most logical scenario, with the 1.6766 resistance level likely to be tested by the upward movement.

Despite the technical side of things, there is a large fundamental risk factor tonight as we have heavy data from the UK economy with claimant count and unemployment rate due out. Though it’s expected to stay flat, any spike upwards would certainly have a negative effect on the trend line.

Additionally, FOMC is due out tonight and we all know the power of Yellen when it comes to talking up a storm regarding tapering and future interest rate rises. However, I believe markets have priced in the fact she won’t slow tapering at its present level as the labour market is still looking semi-healthy and markets appear to be growing moderately.

With all the news going on around the Pound, it's easy to lose focus on the basics, but one thing is clear, the trend line is likely to hold given the long term nature of it. Markets have looked to test it overnight and have pulled back and from this, I see more upward movement for the Pound against the US Dollar, especially given the recent weakness in the Dollar, as investors move out of it and into riskier assets. Certainly, markets are looking for strong economies and the UK is one of the strongest and fastest growing in Europe.