- U.K. Jobless Claims to Increase for Second-Consecutive Month.

- Average Weekly Earnings ex-Bonus to Hold at 2.8%- Highest Reading Since February 2009.

Trading the News: U.K. Jobless Claims Change

Another 1.0K expansion in U.K. Jobless Claims may produce headwinds for the British Pound and spur a near-term decline in GBP/USD as it raises the risk of seeing the Bank of England (BoE) further delay its normalization cycle.

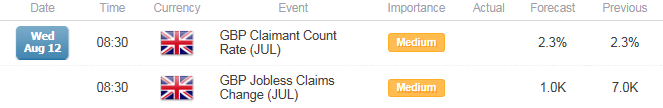

What’s Expected:

Despite the 8-1 split at the August 6 interest rate decision, a slowdown in job growth may encourage the BoE to carry the record-low benchmark interest rate into 2016, and the sterling may struggle to hold its ground over the remainder of the year should the key developments coming out of the U.K. economy drag on interest rate expectations.

For more updates, sign up for David's e-mail distribution list.

Expectations: Bearish Argument/Scenario

|

Release |

Expected |

Actual |

|

58.5 |

57.1 |

|

|

Retail Sales ex Auto Fuel (MoM) (JUN) |

0.4% |

-0.2% |

|

Construction Output s.a. (MoM) (MAY) |

0.8% |

-1.3% |

Lower consumption paired with slowdown in building activity may encourage U.K. firms to scale back on hiring, and a dismal Jobless Claims report may dampen the appeal of the British Pound as it undermines the BoE’s expectations for a faster recovery in the second-half of 2015.

Risk: Bullish Argument/Scenario

|

Release |

Expected |

Actual |

|

Manufacturing Production (MoM) (JUN) |

0.1% |

0.2% |

|

Purchasing Manager Index- Manufacturing s.a. (JUL) |

51.5 |

51.9 |

|

CBI Business Optimism (JUL) |

1 |

8 |

However, improved confidence along with the pickup in business outputs may boost job growth, and a positive development may spur greater demand for the sterling as market participants ramp up bets for higher borrowing-costs in the U.K.

How To Trade This Event Risk(Video)

Bearish GBP Trade: Unemployment Benefits Increase 1.0K or Greater

- Need red, five-minute candle following the print to consider a short GBP/USD trade.

- If market reaction favors selling sterling, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: Job/Wage Growth Report Tops Market Forecast

- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in opposite direction.

Read More:

CADJPY 94.50 - Line in the Sand

GBP/USD Rebounds into Resistance

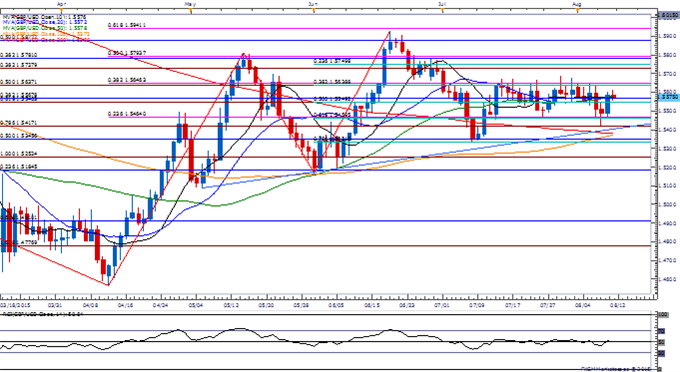

Potential Price Targets For The Release

GBP/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- Will retain a constructive view on GBP/USD as it retains the upward trend carried over from May, but the pair may continue to consolidate over the near-term amid the tightening rate between the BoE/Fed to normalize monetary policy.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long GBP/USD since July 1, with the ratio off of recent extremes to hold at +1.16 as 54% of traders are long.

- Interim Resistance: 1.5750 (23.6% retracement) to 1.5780 (38.2% retracement)

- Interim Support: 1.5330 (78.6% retracement) to 1.5350 (50% retracement)

Impact that the U.K. Jobless Claims Change has had on GBP during the last release

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

May 2015 |

07/15/2014 08:30 GMT |

-9.0K |

7.0K |

-32 |

-22 |

May 2015 U.K. Jobless Claims Change

U.K. Jobless Claims unexpectedly increased 7.0K in May after contracting a revised 1.1K the month prior to mark the first rise since October 2012. At the same time, the ILO Unemployment Rate unexpectedly rose to an annualized 5.6% from 5.5% during the three-months through May as employment slipped 67K from the previous month. Despite the slowdown in job growth, expectations for stronger recovery should keep the Bank of England (BoE) on course to lift the benchmark interest rate off of the record-low as Governor Mark Carney continues to prepare U.K. households and business for higher borrowing-costs. Nevertheless, the market reaction was short-lived as GBP/USD managed to hold above the 1.5600 handle, but the pair continued to consolidate during the North American trade to end the day at 1.5632.