GBP/USD Ripe To Short

Since breaking through major support formed by the lows of 2011 and 2012, the GBP/USD looks ripe for shorts with the next major support level sitting all the way down at 1.48. In this article I will breakdown the current technical environment and highlight potential short opportunities in two zones as well as address some fundamentals.

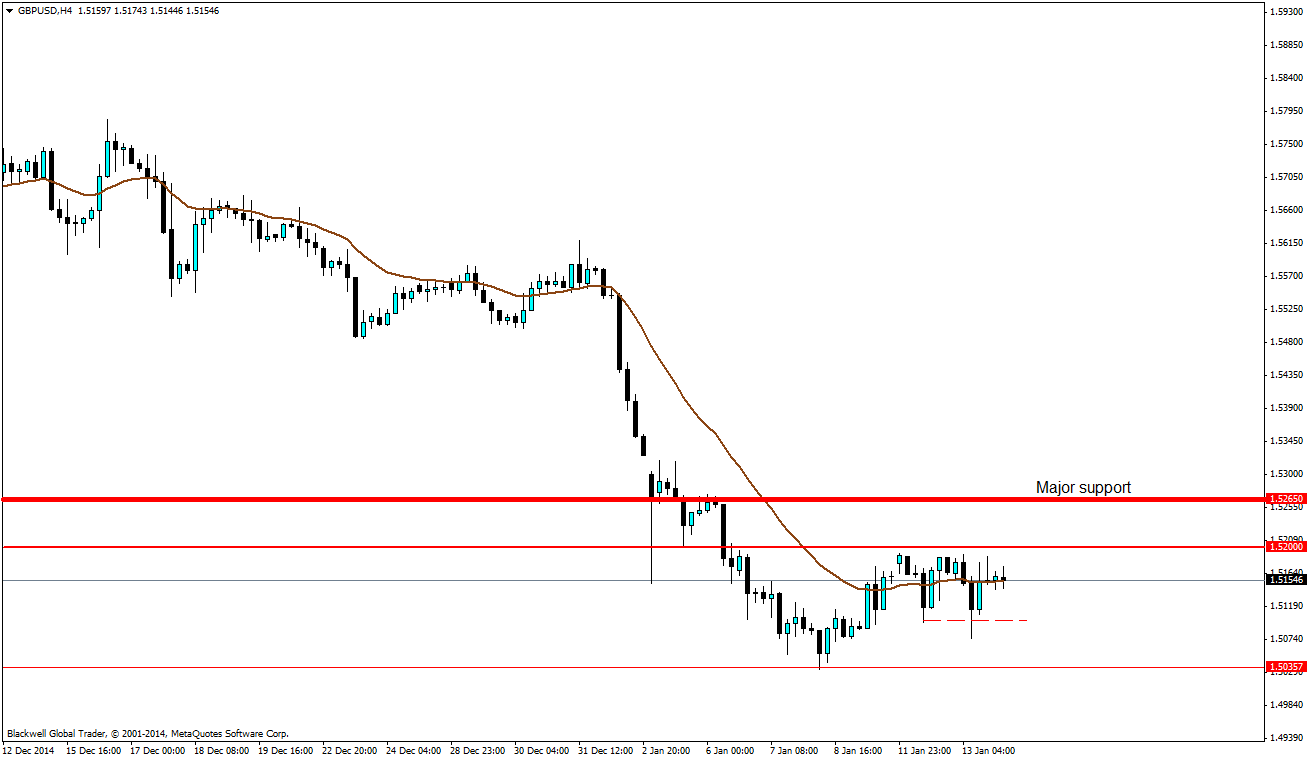

The 1.5200 warzone

The GBP/USD is sitting in a range bounded environment which is very clear on the H4/H1 charts. There is a clear short term resistance of 1.5200 that is being challenged by the bulls after they built a base at around 1.5100. This base suggest that the bulls are gaining some ground in the short term with a bulk of the bulls still holding back under 1.5200.

The question is on my mind is this - Are there strong bears parked at that level slowly adding onto their positions each time price reaches there? It certainly looks that way to me at the moment. I am looking to short off that level with one provision; I am out if there is no aggressive follow-through within the next trading session.

Source: Blackwell Trader

The 1.5265 major support zone

Not too far away from the warzone is the major support at 1.5265 that has been tested once before as resistance last week. I think that this level is a stronger one to play off from and those who don’t want to battle it out in the warzone can certainly look to make bearish plays on the GBP/USD here.

Fundamentals

Yesterday’s UK CPI data printed lower than forecasts with CPI y/y at 0.5%. This is largely caused by lower energy prices and is not in itself a bad thing as long as prices do not keep falling. BOE Governor Mark Carney re-assured markets that the BOE has the means and mandate to bring UK inflation back up to 2% within a 2 year horizon and this fall is not cause for concern unless there is more generalised deflation.

In layman terms “oil is to blame this time around, keep calm the UK economy is still doing ok”, that is probably why price didn’t sustain its tumble on after the UK CPI data release. I do not expect Governor Carney to say anything different later on in his speech at 1415 GMT.

Do note that most of the USD pairs have been riding on USD strength and the pound is no exception to this. US Retail data is due out at 1330 GMT and some there could be some volatility at this time so try not to have stop losses too tight or place any orders leading into this event risk.