GROWTHACES.COM Forex Trading Strategies

Taken Positions

USD/CHF: short at 0.9265, target 0.9080, stop-loss 0.9345, risk factor *

AUD/USD: long at 0.7865, target 0.8080, stop-loss moved to 0.7995, risk factor *

EUR/GBP: long at 0.7165, target 0.7450, stop-loss 0.7090, risk factor **

EUR/JPY: long at 134.20, target 136.70, stop-loss 132.95, risk factor *

EUR/CAD: long at 1.3490, target 1.3800, stop-loss 1.3390, risk factor *

CHF/JPY: long at 129.50, target 132.10, stop-loss 128.40, risk factor *

Pending Orders

EUR/USD: buy at 1.1190, if filled - target 1.1450, stop-loss 1.1115, risk factor *

GBP/USD: buy at 1.5550, if filled – target 1.5880, stop-loss 1.5450, risk factor ***

USD/CAD: sell at 1.2050, if filled - target 1.1840, stop-loss 1.2130, risk factor **

NZD/USD: buy at 0.7370, if filled – target 0.7600, stop-loss 0.7285, risk factor **

GBP/JPY: buy at 186.35, if filled – target 190.00, stop-loss 185.35, risk factor ***

AUD/JPY: buy at 95.20, if filled – target 97.40, stop-loss 94.15, risk factor **

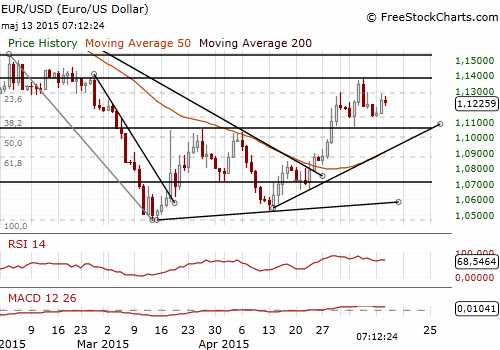

EUR/USD: Eurozone GDP Grows At Fastest Rate In Almost Two Years

(buy at 1.1190)

- Eurozone economic growth amounted to 0.4% qoq in the first quarter, in line with our forecast and slightly weaker than median consensus of 0.5% qoq because of slower than anticipated expansion in Germany. It was still the fastest rate of growth in almost two years.

- Germany grew 0.3% qoq after pulling off a 0.7% expansion in the final three months of 2014. German growth was far weaker than in neighbouring France, where the economy expanded by 0.6% qoq, its strongest rate in two years, beating market expectations of a 0.4% expansion. Italian GDP rose 0.3% following stagnation in the last quarter of 2014.

- Eurozone GDP figures confirmed that the growth was higher than in both the US and UK in the first quarter. The breakdown of Eurozone GDP is not published at this stage. But country-level information suggests that household spending rose quite strongly. Net trade appears to have acted as a drag on growth despite weaker EUR, which suggests relatively strong imports. Low inflation should continue to support consumption the coming quarters and the lower EUR should help exports. However, PMI data suggest that GDP recovery may have flattened off in the second quarter.

- ECB Executive Board member Benoit Coeure said cheaper oil prices and a lower euro exchange rate were helping the euro zone economy pick up, but these are temporary factors with an impact that is expected to wane.

- San Francisco Fed President John Williams (voting this year) said the Federal Reserve's ability to delay its initial interest rate hike to head off economic shocks is now more limited than its ability to quickly tighten monetary policy in response to positive surprises. He added that he is now reasonably confident inflation will rise to the U.S. central bank's 2% target over the medium term, and that the labor market would continue to improve. He stressed that policy changes would be data dependent.

- German sovereign yields are rising at a faster pace than U.S. ones despite weaker German GDP data. The gap between 10-year Bunds and U.S. Treasuries narrowed to around 157 basis points, from around 180 basis points about a month ago. The narrowing gap is a strong support to the EUR/USD rise. That is why we keep our buy offer on the EUR/USD at 1.1190.

Significant technical analysis' levels:

Resistance: 1.1279 (high May 12), 1.1290 (high May 8), 1.1392 (high May 7)

Support: 1.1209 (hourly low May 13), 1.1131 (low May 11), 1.1067 (low May 5)

GBP/USD Retreats From 5-Month Highs On Inflation Report

(buy at 1.5550)

- The Office for National Statistics said total average weekly earnings in the three months to March, including bonuses, rose 1.9% yoy, from 1.7% in February. Excluding bonuses, pay rose by 2.2%. Investors forecast total earnings would rise by 1.8% and that earnings excluding bonuses would increase by 2.1%. Inflation plunged to zero percent in February and in March, pushed down by tumbling oil prices, meaning living standards are rising after a long period of earnings falling in real terms.

- The number of unemployed people fell by 35k in the first quarter to 1.83 million, bringing the unemployment rate to 5.5%, its lowest level since the three months to July 2008. The number of people claiming unemployment benefit in April fell by 12.6k, the smallest decline since March 2013.

- The BOE cut forecast for wages today, seeing them rising by 2.5% at the end of this year compared with an earlier forecast of 3.5% growth, before rising to 4% next year.

- The Bank of England cautiously backed market expectations that it will only start to raise interest rates in around a year's time. The BOE said: “A path that implied only gradual rises in Bank Rate over the next few years, broadly in line with the current market path, remained consistent with absorbing slack and returning inflation to the target within two years.”

- The BOE cut its forecasts for British economic growth over the next three years. The central bank now expects growth this year to come in at 2.4%, it said in its quarterly Inflation Report, down from a 2.9% projection in February. It also lowered projections for 2016 and 2017 to 2.6% and 2.4% respectively. The BoE said its growth downgrade was due to interest rates being likely to increase faster than markets had expected three months ago, as well as a stronger currency and a weaker outlook for house building and productivity.

- The BOE said that it expected inflation, which currently stands at a record-low zero percent, to return to its 2% target in two years' time, little changed from its forecast three months ago.

- The GBP/USD was volatile today. It powered to a five-month high at 1.5749 after data showed British earnings growth picking up more than expected in the first quarter. The GBP fell back soon after the Bank of England cut its forecasts for British economic growth over the next three years and backed expectations it will only start to raise interest rates in around a year's time.

- We are looking to get long on dips. In our opinion the 1.5880 (50% fibo of the July 2014-April 2015 slide) is the next bull target. If our buy order at 1.5550 is filled, the stop-loss should be set below the previous peak (1.5498).

Significant technical analysis' levels:

Resistance: 1.5753 (high Dec 17, 2014), 1.5785 (high Dec 16, 2016), 1.5826 (high Nov 27, 2014)

Support: 1.5642 (hourly low May 12), 1.5618 (200-dma), 1.5498 (high Apr 29)

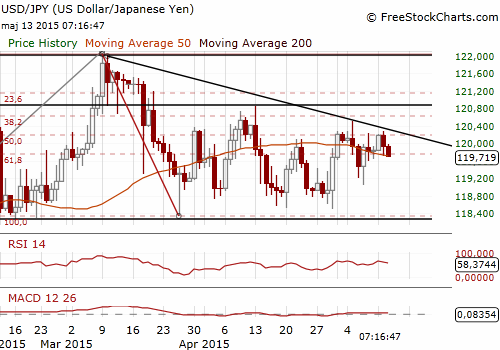

USD/JPY: BOJ Will Adjust Monetary Policy If Needed To Achieve 2% Inflation

(stay sideways)

- Bank of Japan Governor Haruhiko Kuroda said excessive JPY strength has been reversed since the introduction of the bank's massive stimulus programme in 2013. He also said the main transmission channel of the BOJ's quantitative and qualitative easing was to lower real interest rates by pushing down nominal interest rates and heightening inflation expectations. He acknowledged that last year's sales tax hike imposed bigger damage on the economy and prices than initially expected.

- Kuroda reiterated that he expected to see CPI hit 2% around the first half of the fiscal year 2016 and that he would not hesitate to adjust monetary policy if needed to achieve 2% inflation.

- Japan's current account logged a surplus for the ninth straight month in March, as a weak yen boosted income from overseas investments and falling oil prices helped the trade balance swing to a surplus. The current account surplus stood at JPY 2.795 trillion against a median forecast for JPY 2.06 trillion surplus.

- The technical situation suggests rises in the USD/JPY. The recent repeated failures below the Ichimoku cloud base, now a 199.34, means the overall bias remains on the upside as the downside has been rejected. However, the picture is unclear and we stay sideways. In our opinion no positions are justified from the risk/reward perspective.

Significant technical analysis' levels:

Resistance: 120.27 (high May 12), 120.51 (high May 5), 120.84 (high Apr 13)

Support: 119.40 (low May 11), 119.06 (low May 7), 118.51 (low Apr 30)

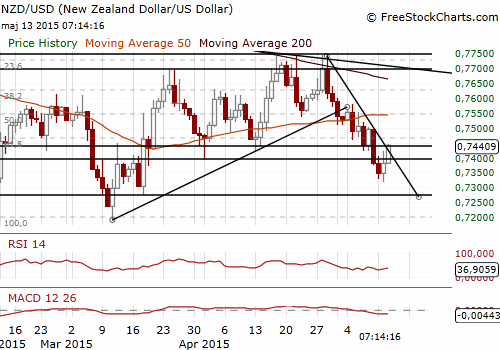

NZD/USD: No Rate Cuts Hints From RBNZ

(buy at 0.7370)

- The Reserve Bank of New Zealand said that the recent fall in the NZD, notably against the AUD, was helpful, but the kiwi continued to trade above sustainable levels versus a currency basket.

- RBNZ governor Graeme Wheeler said: “We still see the exchange rate unjustified and unsustainable, so we would like to see more movement downwards in the exchange rate.”

- The RBNZ is planning new loan restrictions to tackle record-high house prices in Auckland, which it said is posting significant risks to the country's financial system. The RBNZ said residential property investors in Auckland would be required to have a deposit of at least 30% on bank loans, while restrictions on high loan-to-value mortgages in the rest of the country would be loosened.

- The market was looking for any rate cuts hints, but the RBNZ did not comment directly on monetary policy and disappointed traders. The NZD/USD recovered today from yesterday’s low at 0.7318. Investors are now focused on inflation data due to be released next week.

- In our opinion a rise in the AUD/NZD lowers probability of a rate cut in June. Our trading strategy for the NZD/USD is to get long at 0.7370.

Significant technical analysis' levels:

Resistance: 0.7481 (10-dma), 0.7520 (55-dma), 0.7524 (high May 11)

Support: 0.7318 (low May 13), 0.7276 (low Mar 18), 0.7273 (low Mar 12)

Source: Growth Aces Forex Trading Strategies