The GBP/USD did well at the end of last week, reversing and recovering a little back above 1.51 after having fallen strongly to a new two month low close to 1.50 during the days prior. About a week ago, for a few days, it found some support around 1.5160 however this level has now been clearly broken.

The 1.5160 level may however provide some resistance in the near future as the pound continues to try and rally higher. In moving down to near 1.50 last week, the pound was at levels not seen since early March.

Indeed, the pound has now experienced a strong fall over the last few weeks. It experienced all sorts of bother at 1.56 as it made several pushes to this significant level, however it was turned away with excessive supply. For about a week it ran into a wall of resistance right around the 1.56 level. This showed how much buying pressure there was on the 1.56 level but equally, how well that level provided resistance to any movement higher. The pound had enjoyed a very solid couple of weeks moving from the support level at 1.52 to reach new highs at 1.56, a new ten week high.

Back around mid April the pound experienced solid support at 1.52 for about a week which greatly assisted the recent surge higher, and recently this level was called upon again to offer some support and a soft landing, however the pound fell strongly through it on its way down to near 1.50.

A couple of weeks ago, we saw some evidence that the decline had been slowed down as it traded around 1.52 for about a week whilst receiving solid support from around 1.5160. The last few weeks have seen the pound fall strongly and return almost all of its gains from the few weeks before that. About a month ago the 1.54 level provided a little piece of resistance and this level has since been broken as it offered limited support. Now that the pound has drifted back down below 1.54, it may provide some resistance again although presently it has some other levels to deal with beforehand.

Over the last month or so, the GBP/USD has been experiencing a variety of different levels which have played a role on the price action. Towards the end of March the GBP/USD was trading within a range roughly between 1.51 and 1.5250 and now on a couple of occasions it has been able to move outside that range and push higher.

A few weeks ago, the 1.5350 level was one of significance as it offered resistance before the GBP/USD was able to move higher through to 1.56. In early March the pound moved to new lows around 1.4830 from a starting point near 1.64 at the beginning of the year. With the surge higher over the last couple of months, the GBP/USD had completely turned around its fortunes from earlier in the year, however it is starting to ease off and return most of the good work.

The GBP/USD continues to struggle even as employment numbers were positive in the UK. The pound sterling (GBP) continues trending lower toward US$1.50 and recent British retail sales figures are the culprit. Though analysts had expected little to no decline, Great Britain’s April retail sales were 1.3% lower than the previous month. As a result, the GBP continued to lose ground versus the greenback.

During the early hours of the Asian trading session on Monday, the GBP/USD is consolidating in a very narrow trading range right around 1.5130 after having recently finished last week moving back above 1.51. Throughout the first part of this year, the pound fell very strongly from the key resistance level at 1.63 level down to levels not seen in two and a half years and has done well the last month to rally well and move back up above 1.56. Current range: Right around 1.5130.

Further levels in both directions:

• Below: 1.5000.

• Above: 1.5150, 1.5300 and 1.5600.

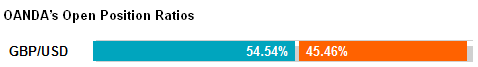

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved back up above 50% after the GBP/USD has fallen down to the two month low near 1.51. Trader sentiment remains in favour of long positions.

Economic Releases

- 06:00 DE Retail Sales (27th-31st) (Apr)

- 07:30 NL Producer Confi dence (May)

- 07:30 SE Retail sales (Apr)

- 08:00 NO Unemployment (AKU/LFS) (Mar)