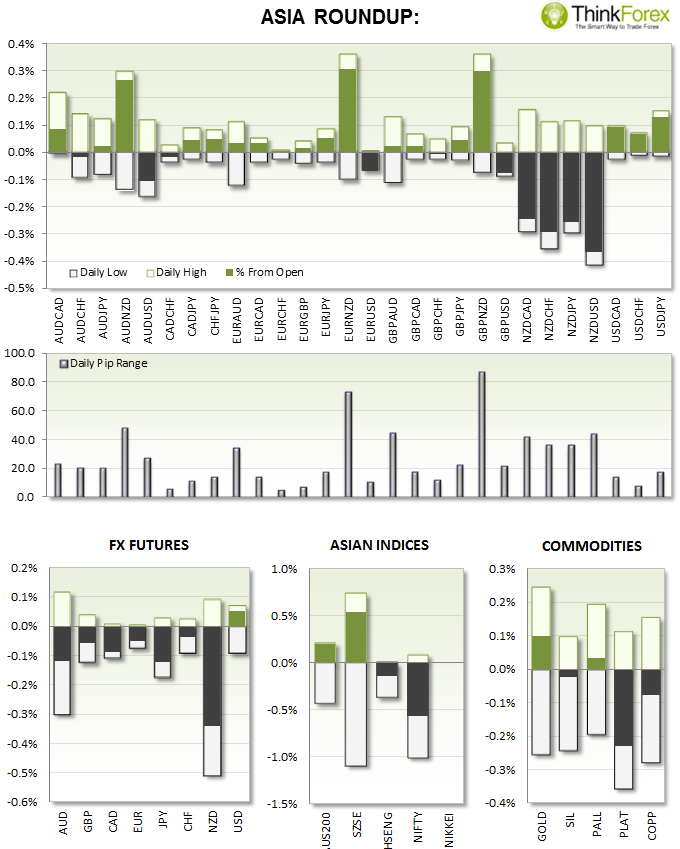

- JPY household spending beat expectations to contract by -3.0% y/y (-3.7% expected) and at a much slower rate than -8% previously.

- JPY unemployment rises 3.7%, above expectations and from the previous 3.5%

- AUD New Home Sales up 1.2% m/m, compared with -4.3% previous

- NZD Dollar continued its downward path after Frontera reduced its forecast for 2014/15 season payout to $6 per kilo of mil solids, down from $7

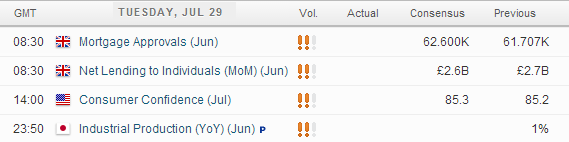

UP NEXT:

- GBP Net Lending is within a steady uptrend, so a surprising shortfall would cause more of a reaction and help GBP/USD break to new lows. However a number above expectatios could see Cable retrace closer to 1.7 which may entice further selling from bearish swing traders

- US Consumer Confidence is forecast to be its highest since Jan 2008. A reading above 85.2 (last reading) should still be bullish for USD even if slightly below expectations

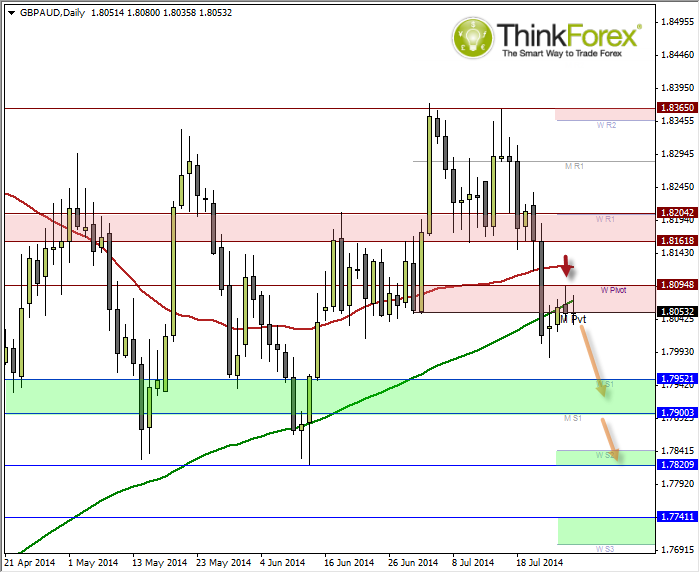

TECHNICAL ANALYSIS:

GBP/AUD: Setting up for potential swing trade short

Yesterday saw an intraday break above the 200-day MA with the high of the day testing the Weekly Pivot, but failed to close the session above either.

At time of writing we are meandering around the Monthly Pivot which when combined with the 200 MA and weekly pivot, provides a wide band of resistance between 1.0853-94.

Looking at the nature of the decline from 1.8365 and the [so far] shall pullback from the lows last week, the plan is to take a swing trade short to target 1.795, 90 and 1.782.

Factors which may help with this scenario are that

- AUD is one of the stronger Majors (along with USD)

- GBP continues to look fragile against several crosses

- UK data out tonight which could be GBP bearish if the numbers fall short of expectation

The decision you are left with is if you want to enter after breaking below the Monthly pivot (safer) or fade the move with any retracement within the resistance zone highlighted.

A break above the Weekly Pivot invalidates the setup (or yesterday's high) but the bearish bias remains as long as we remain below 1.816.