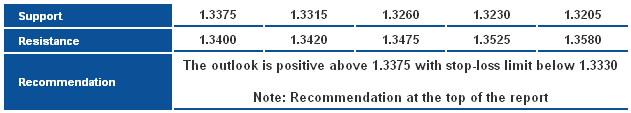

EUR/USD

We witnessed last Friday another bullish rebound as the pair stabilized above 50% correction at 1.3375 as showing on graph. The attempts to break the referred to level failed, as the pair faced this week Linear Regression Indicator 55 at 1.3415 - 1.3420.

Failing to stabilize below 1.3375 forces us to suggest an upside move this week that depends on breaching 1.3420 and stabilizing above it. From the downside, breaking 1.3330 and stabilizing below it fails any bullish correction and enter a new bearish wave targeting 1.3230.

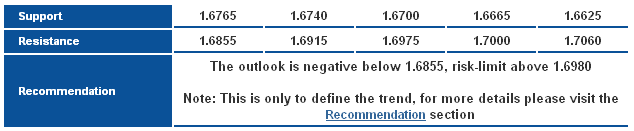

GBP/USD

The pair is still moving to the downside affected by the negative pressure of SMA 100, forcing us to wait to move towards the main expected target at 1.6625. Stochastic is crossing over negatively supporting the suggested bearishness that remains valid unless the pair breaches 1.6855 pushing the pair towards 1.7000.

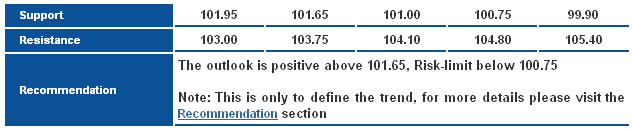

USD/JPY

The pair rebounded to the upside after retesting the previously breached resistance showing on graph, while Stochastic is almost showing a positive crossover on the daily graph supporting extending the overall positive expectations targeting 105.00 mainly, while achieving them require stability above 101.65 - 100.75.

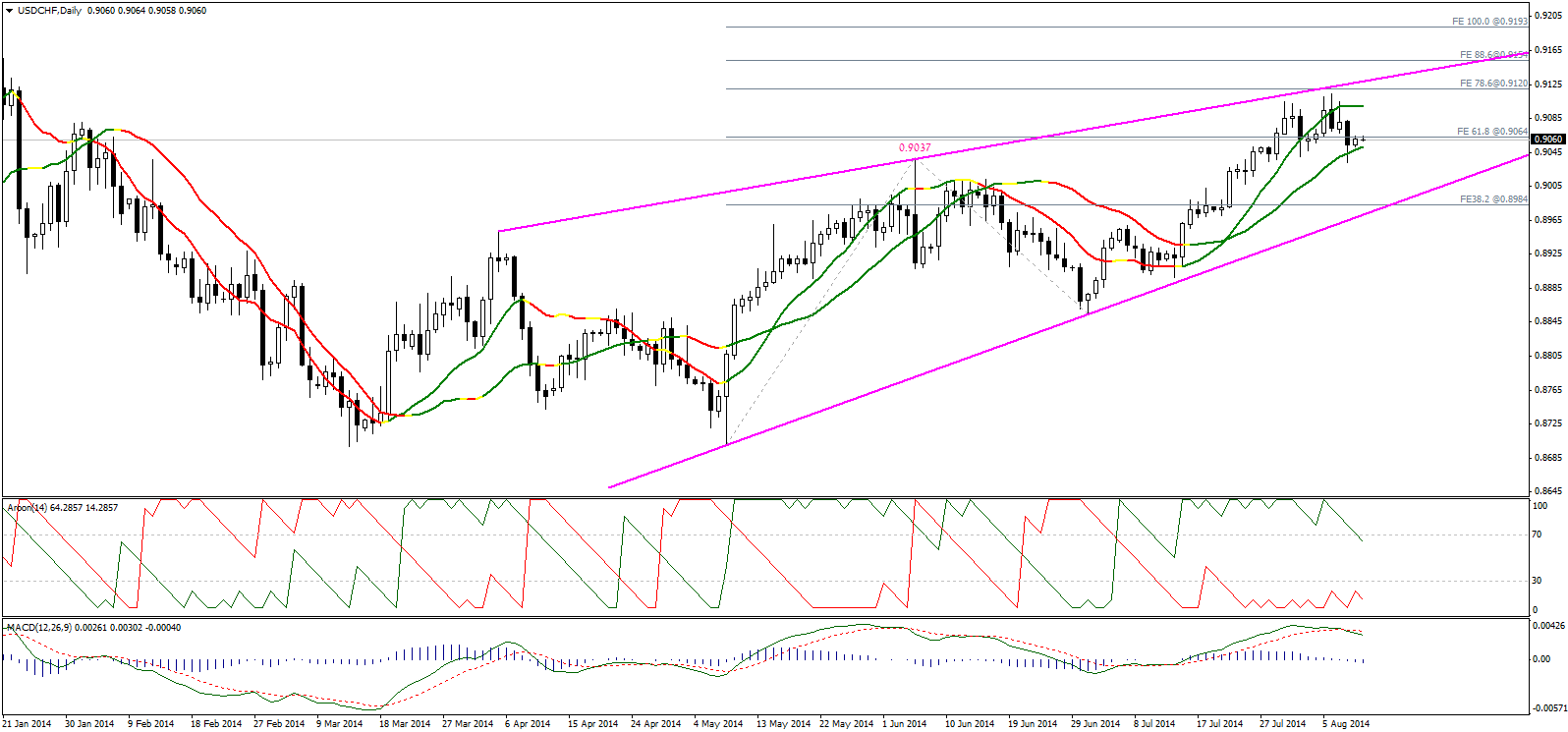

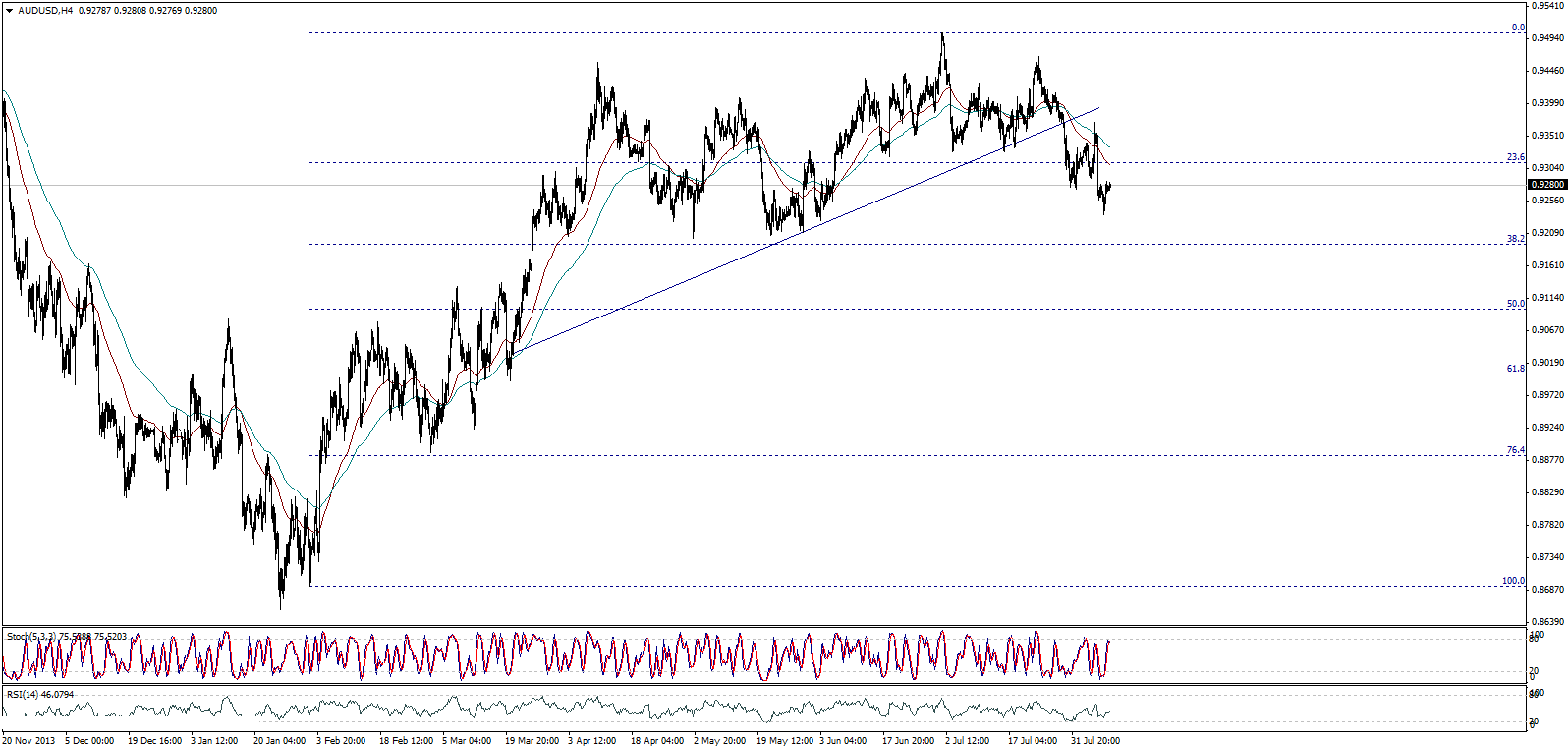

USD/CHF

Last week's volatility and the bullish attempts remained limited below 0.9120 - 0.9130 taking the pair back to the downside. Trading below the referred to levels keeps the bearish possibility to test 0.8985 levels first. A break below 0.8985 extends the losses this week.

MACD has crossed over negatively and AROON is showing a bearish correction signal represented in breaking the positive line 70 to the downside. On the other hand, breaching 0.9130 pushes the pair to the upside towards 0.9195.

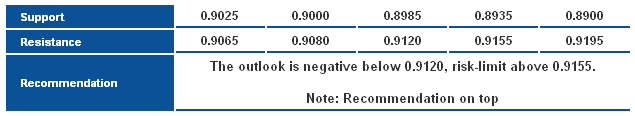

USD/CAD

The pair inched higher last week, and started this week above 50% correction as showing on graph represented in 1.0950, as stabilizing above this level strengthens the possibility of extending the upside move. Of note, its significant to breach 1.1025 at 61.8% correction to confirm extending the upside move.

Stability above SMA's and the positivity of technical indicators supports the possibility of extending the upside move unless the pair breaks 1.0870 this week.

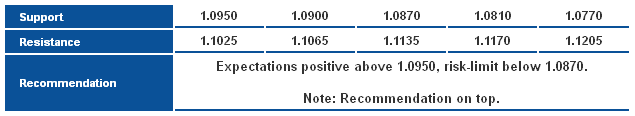

AUD/USD

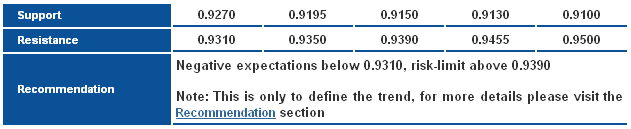

The pair remained stable below 0.9310 forcing us to keep our bearish intraday expectations targeting 0.9190 mainly. Stochastic is reaching overbought areas supporting the awaited bearishness, as breaching 0.9310 halts the bearish expectations and triggers attempts to bring back the upside move.

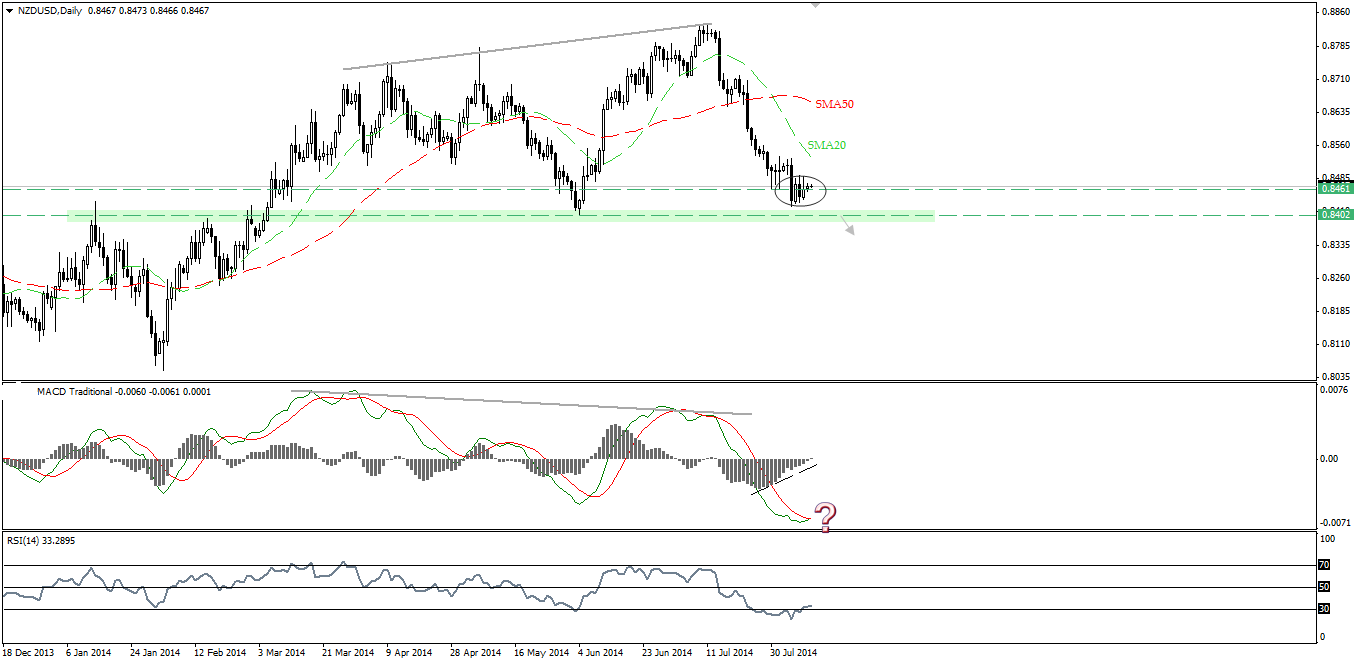

NZD/USD

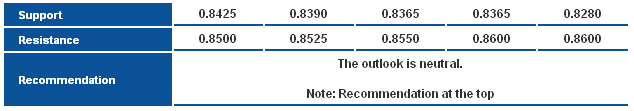

The NZD/USD pair has been locked in a consolidation mode last week after achieving aggressive downside actions earlier. Facing the interim support at 0.8460 has stopped the bearishness, but the pair couldn’t show any confirmed signs of starting a considerable recovery. Of course, the market shows oversold case but we will be neutral due to the sensitivity of current trading levels. It is worth mentioning that, a break below 0.8400 will bring panic sell-off actions.