GBP/USD has edged higher in Thursday trading. The pair was trading in the high-1.51 range early in the North American session. The pound got some good news as British Secondary GDP posted a gain of 0.3%, matching the forecast. Preliminary Business Investment, however, was well below the estimate. US key releases looked sharp, as both Unemployment Claims and New Home Sales beat their estimates.

The markets were pleased with British GDP, which rebounded from a 0.3% decline in Q4 of 2012, and posted a respectable 0.3% gain, which matched the forecast. It was just the second time GDP has posted a gain since Q4 of 2011, underscoring a weak British economy. The news was not as good from Preliminary Business Investment, which improved to -0.4%, but was nowhere near the estimate of a 1.7% gain. Index of Services rose 0.6%, just shy of the estimate of 0.7%. In the US, Unemployment Claims rebounded from last week’s poor numbers, and fell to 340 thousand claims, better than the forecast of 347 thousand. New Home Sales hit its highest level since 2010, with 454 thousand. The estimate stood at 429 thousand.

In Washington, Bernard Bernanke testified before a Congressional committee, as the markets listened closely. Bernanke initially stated that tightening monetary policy could hurt the US recovery. However, he later said that a decision to scale back QE could be taken in the “next few meetings” if the US economy improves. The bottom line? Bernanke’s comments still leave the markets guessing as to the Fed’s plans regarding the current quantitative easing (QE) program. The Fed is not making any changes to its monetary policy, but that could change if the US economy improves and unemployment falls.

Almost overshadowed by Bernanke’s remarks in Congress was the release of the minutes from the FOMC’s last policy meeting. The minutes indicate that the US recovery will have to gain more traction before the Fed winds down QE. Policy members were split, as some suggested scaling back QE in June (at the next policy meeting), while others wanted to increase QE, given the weak inflation readings we are seeing. It should be noted that the FOMC minutes relate to a meeting which took place at the beginning of May, in contrast to the fresh testimony of Bernanke on Wednesday.

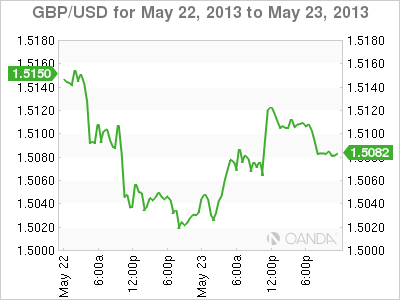

GBP/USD May 23 at 14:40 GMT

GBP/USD 1.5072 H: 1.5094 L: 1.5014

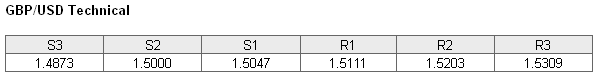

GBP/USD has edged higher in Thursday trading. The pair touched a high of 1.5094, but didn’t have the momentum to cross above the 1.51 line. GBP/USD is facing resistance at 1.5111. This is followed by resistance at 1.5203. On the downside, the pair continues to receive support at 1.5047. This is a weak line, and the pair could push to the all-important 1.50 level if it can break below this resistance line.

Current range: 1.5047 to 1.5111

Further levels in both directions:

- Below: 1.5047, 1.5000, 1.4873 and 1.4781

- Above: 1.5111, 1.5203, 1.5309, 1.5432, and 1.5524

The GBP/USD ratio continues to show little movement. This is consistent with what we are seeing from the pound, which has settled down and is trading quietly. The pair is close to an even split of open long and short positions, as traders remain split as to what direction the pair will take.

The pound made up for some week numbers earlier in the week, as GDP posted a gain and matched the estimate. The pair is trading quietly in the high-1.50 range, and this could continue for the remainder of the day.

GBP/USD Fundamentals

- 8:30 British Secondary Estimate GDP. Estimate 0.3%. Actual 0.3%.

- 8:30 British Preliminary Business Investment. Estimate 1.7%. Actual -0.4%.

- 8:30 British Index of Services. Estimate 0.7%. Actual 0.6%.

- 10:05 US FOMC Member James Bullard Speaks.

- 12:30 US Unemployment Claims. Estimate 347K. Actual 340K.

- 13:00 US Flash Manufacturing PMI. Estimate 51.6 points. Actual 51.9 points.

- 13:00 US HPI. Estimate 0.9%. Actual 1.3%.

- 14:00 US New Home Sales. Estimate 429K. Actual 454K.

- 14:30 US Natural Gas Storage. Estimate 90B.