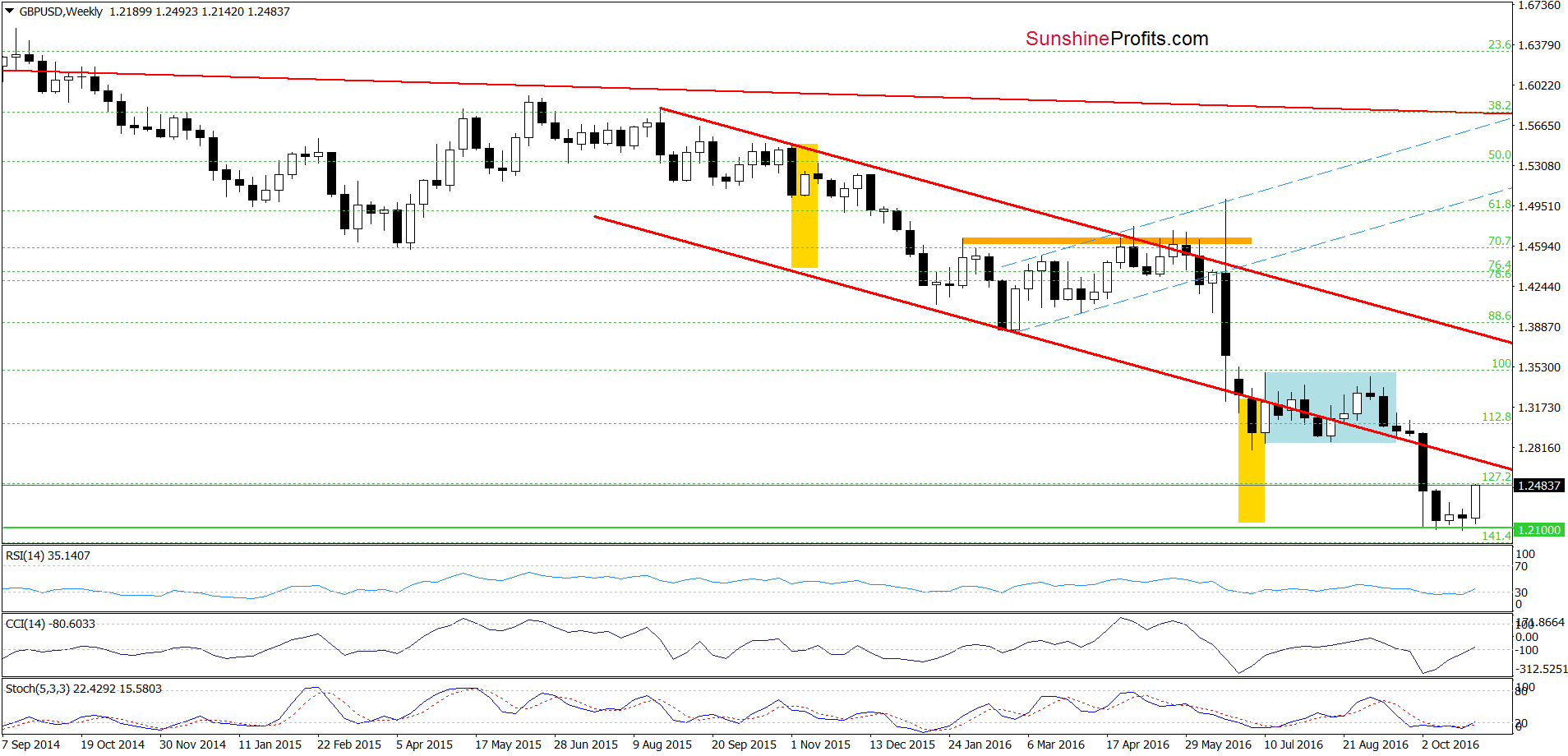

Earlier today, GBP/USD extended gains and climbed above important resistance levels after news that the British government lost the Brexit case in the high court. Additionally, the Bank of England kept monetary policy on hold, which resulted in a rally above 1.2400. How high could the exchange rate go in the coming days?

In our opinion, the following forex trading positions are justified:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7769; initial downside target at 0.7542)

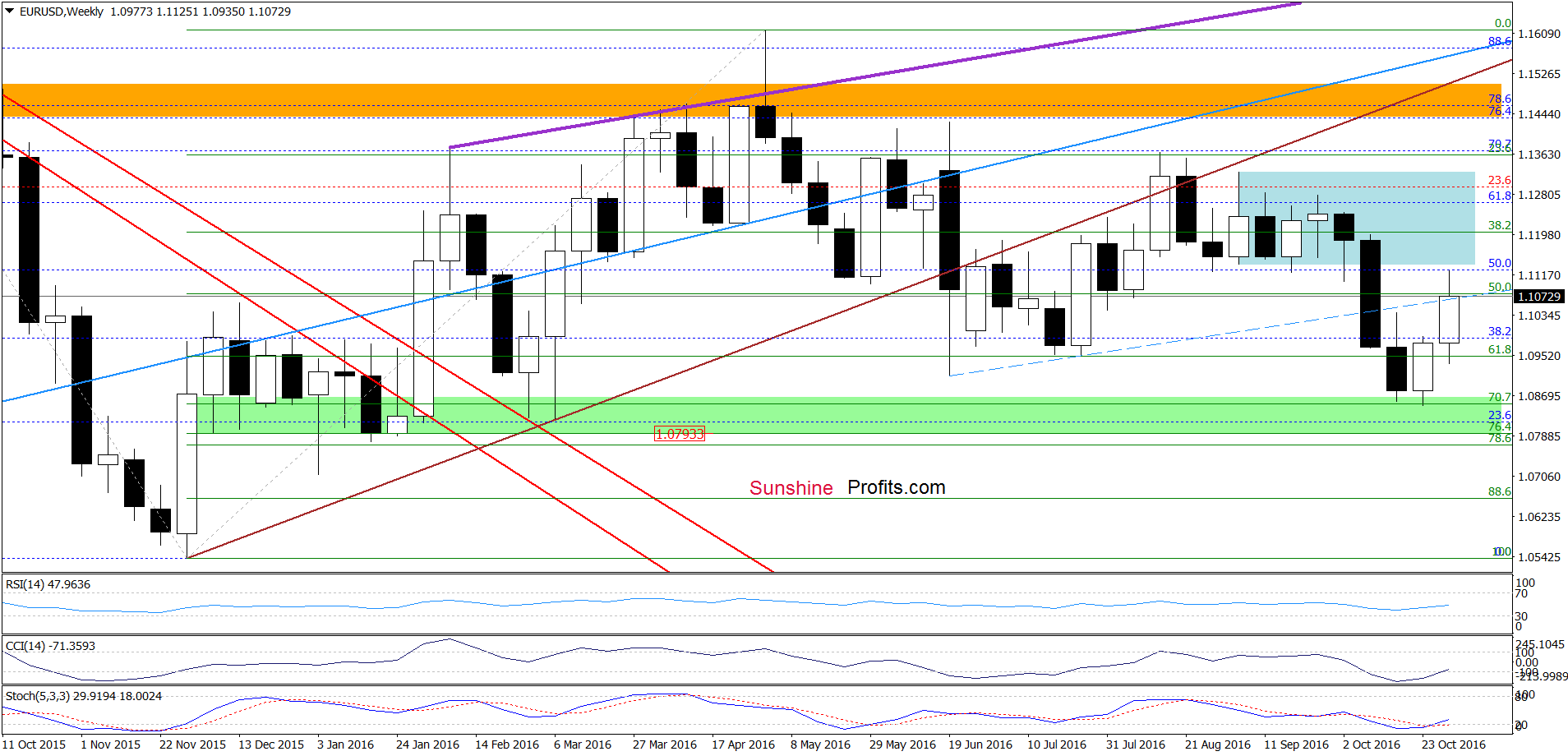

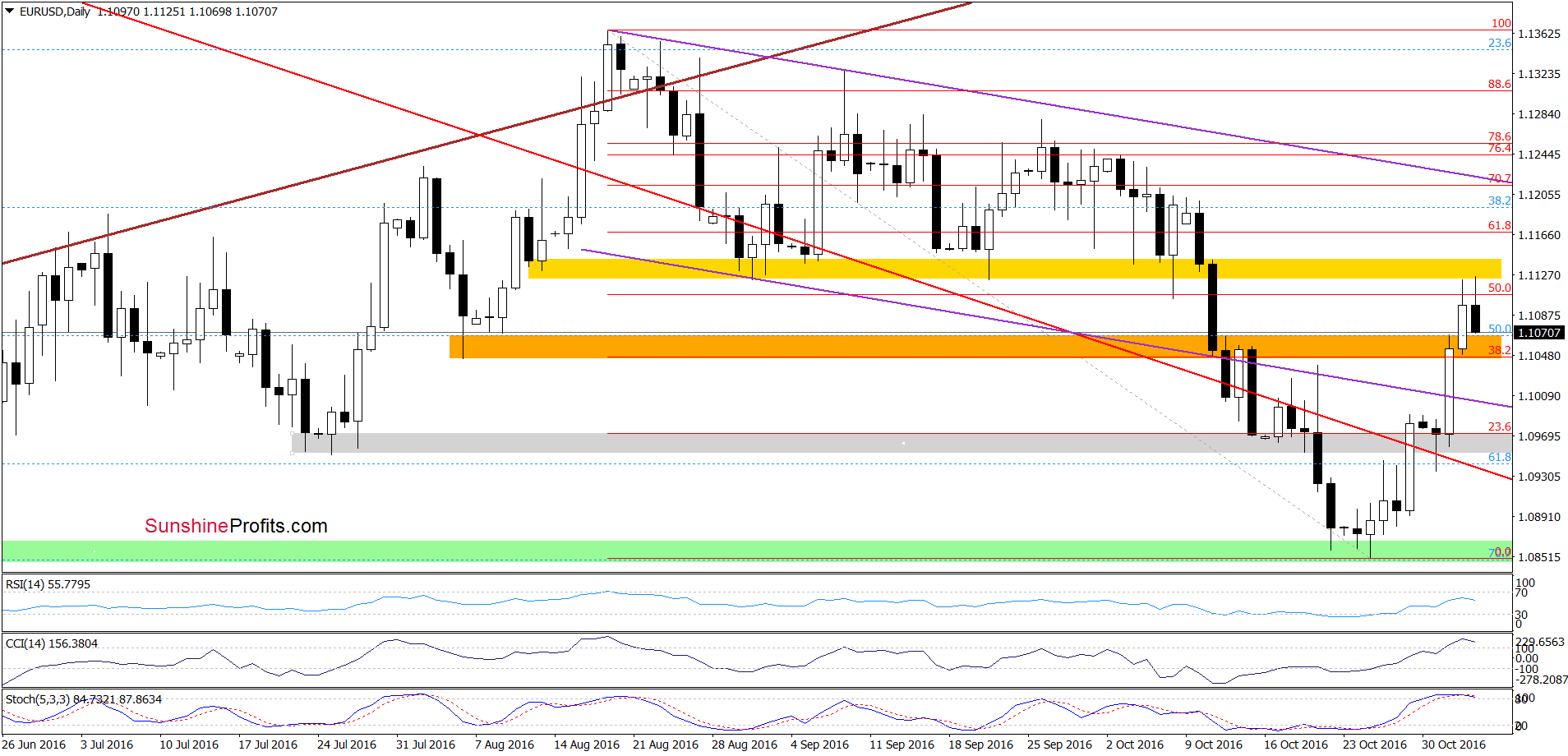

Looking at the weekly chart, we see that the proximity to the lower border of the blue consolidation encouraged currency bears to act, which resulted in a pullback that took EUR/USD to the previously-broken blue dashed line, which serves now as a support.

How did this price action affect the very short-term picture? Let’s check.

Yesterday, we wrote the following:

(…) EUR/USD broke above the orange resistance zone (…), which triggered further improvement earlier today. With this move the pair approached the next Fibonacci retracement, which in combination with the current position of daily indicators (the CCI and the Stochastic Oscillator are overbought) suggests that the space for gains may be limited (…) even if EUR/USD moves higher from current levels, it seems that the yellow resistance zone will stop (or at least pause) further rally.

From today’s point of view, we see that the situation developed in line with our assumptions and EUR/USD reversed and declined after an increase to the yellow resistance zone. Taking this fact into account and combining it with the current position of daily indicators (the CCI and the Stochastic Oscillator are very close to generating sell signals), we think that further deterioration is just around the corner. Therefore, if the exchange rate drops under the orange zone, we’ll consider opening short positions.

- Very short-term outlook: mixed with bearish bias

- Short-term outlook: mixed

- MT outlook: mixed

- LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, if the exchange rate drops under the orange zone, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

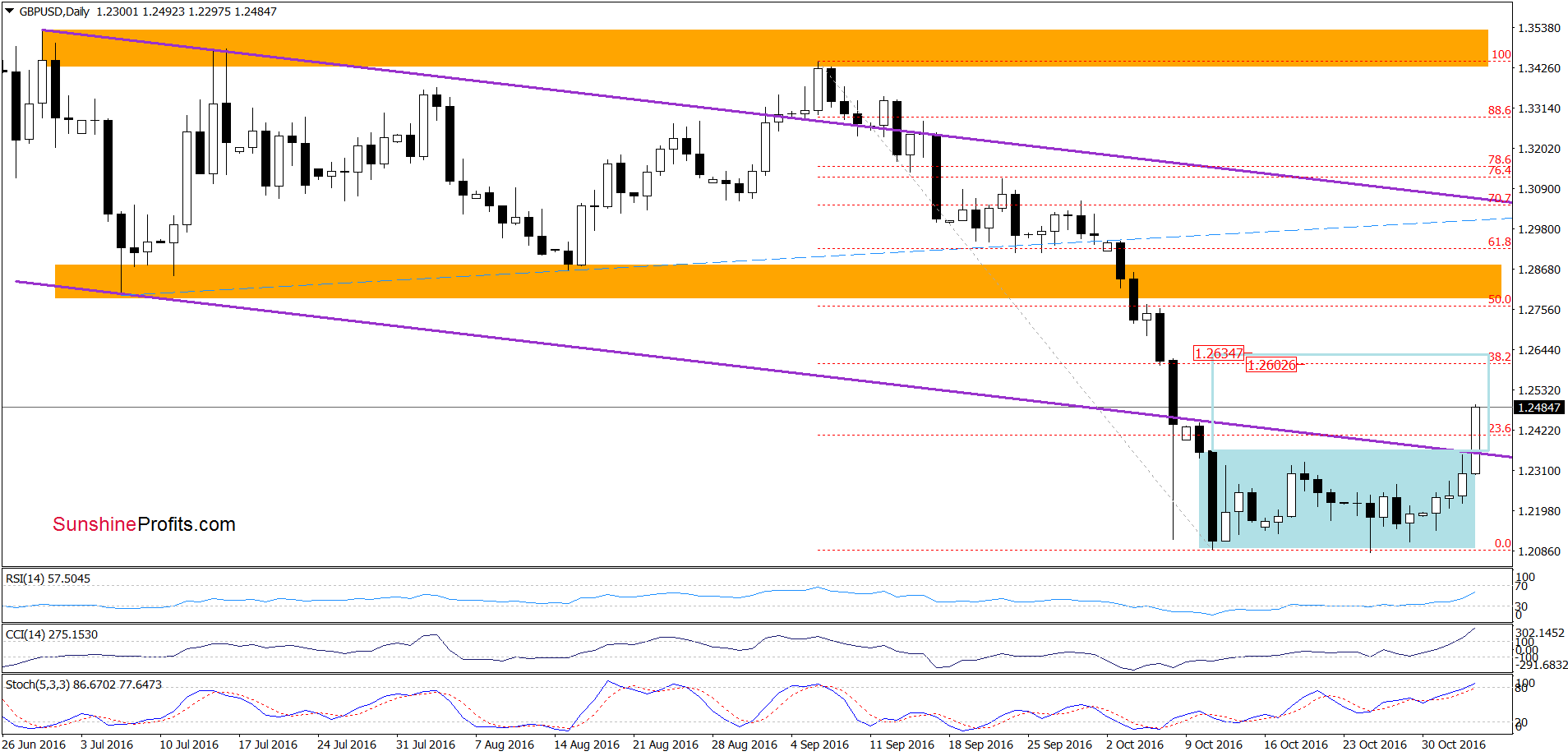

The first thing that catches the eye on the daily chart is a breakout above the lower border of the purple trend channel and the upper line of the blue consolidation. This means that what we wrote yesterday is up-to-date also today:

(…) what could happen if currency bulls manage to push GBP/USD above the purple resistance line and the upper border of the blue consolidation? In our opinion, such positive event could trigger an upward move to around 1.2602, where the 38.2% Fibonacci retracement (based on the Sep-Oct downward move) is. Additionally, slightly above this level (around 1.2634) the size of the upswing would correspond to the height of the formation, which could encourage currency bears to act.

- Very short-term outlook: bullish

- Short-term outlook: mixed

- MT outlook: mixed

- LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

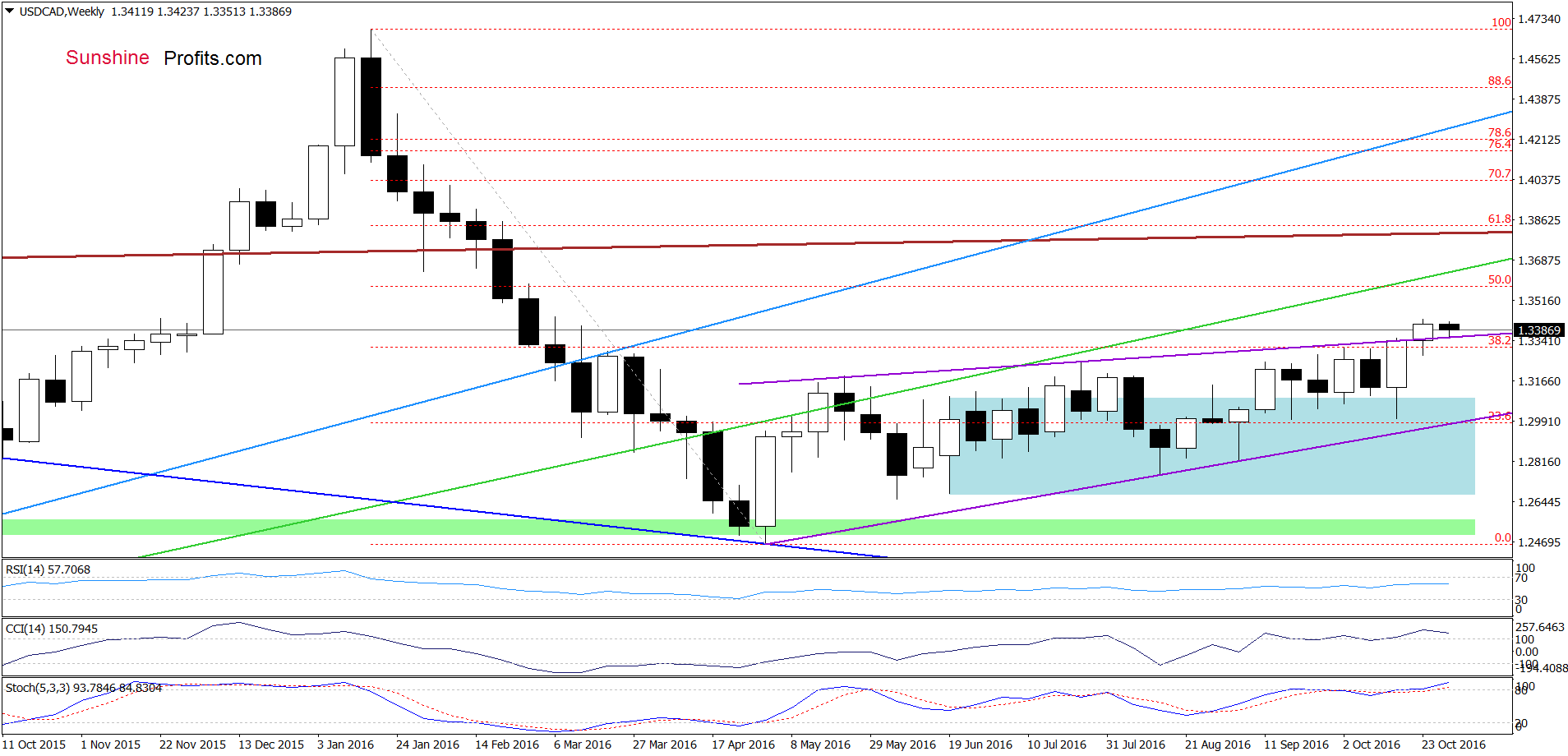

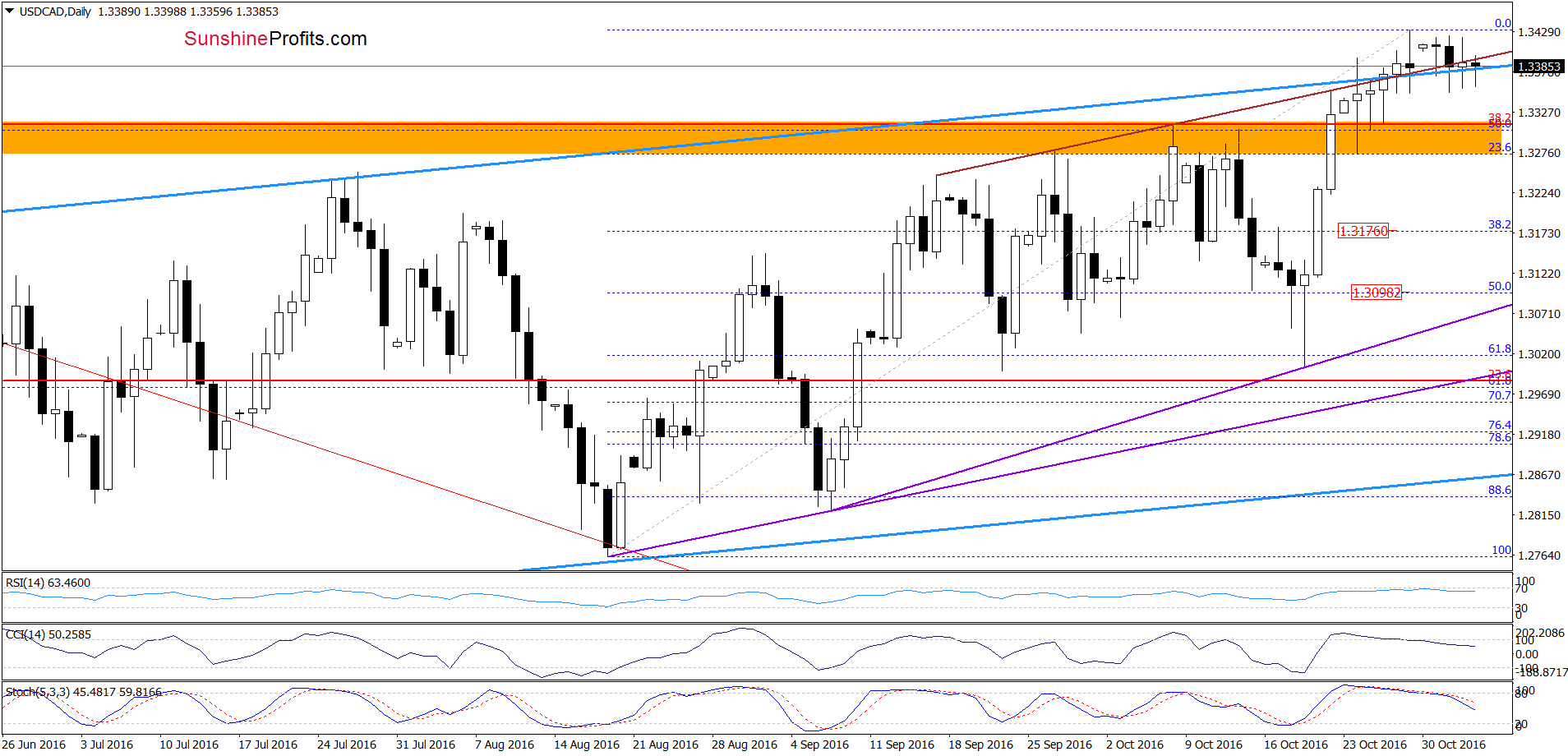

On the weekly chart, we see that the overall situation hasn’t changed much as USD/CAD remains above the previously-broken upper border of the purlpe rising wedge. Nevertheless, the current levels of the CCI and Stochastic Oscillator suggest that reversal may be just around the corner.

Having said the above, let’s check the very short-term picture.

Looking at the daily chart, we see that USD/CAD slipped under the upper border of the violet rising wedge, but the upper line of the blue rising trend channel continues to keep declines in check (at least at the moment of writing these words), which means that our previous commentary on this currency pair remains up-to-date:

(…) the current position of the indicators (they all generated sell signals) favors currency bears and lower values of the exchange rate. Therefore if we see a daily closure below the upper border of the violet rising wedge and the upper line of the blue rising trend channel we’ll consider re-opening short positions. At this point it is also worth noting that if the pair declines from current levels, the initial downside target would be around 1.3153, where the 38.2% Fibonacci retracement (based on the mid-Aug – Oct upward move) is.

- Very short-term outlook: mixed with bearish bias

- Short-term outlook: mixed with bearish bias

- MT outlook: mixed

- LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. Nevertheless, if we see a daily closure below both above-mentioned lines, we’ll consider re-opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

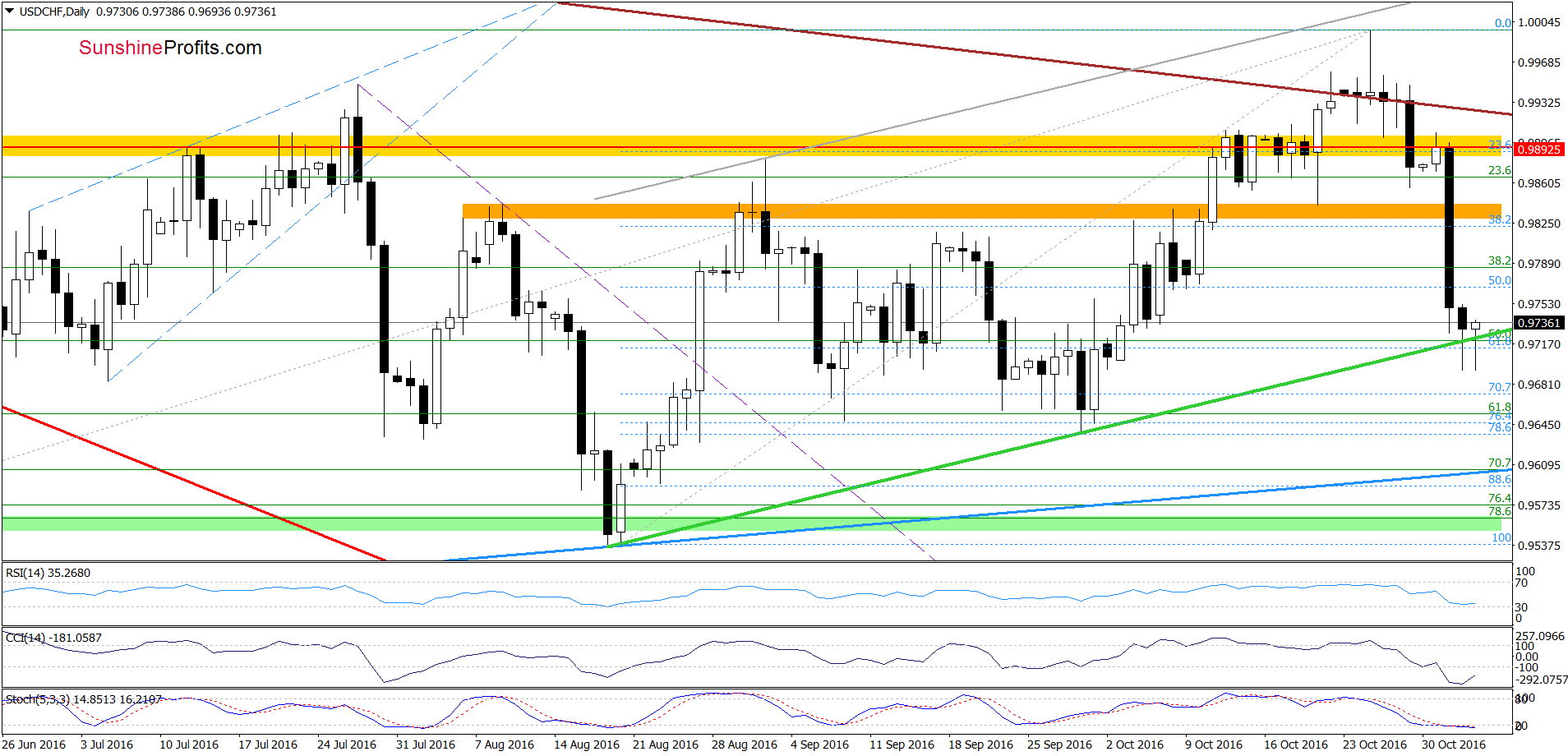

The situation in the medium term hasn’t changed much as USD/CHF remains in the blue consolidation under the key resistance zone (created by the long-term red declining resistance line based on the Nov and Feb highs, the green rising line based on the May and Aug 2015 lows and May and Jul highs). Today, we’ll focus on the very short-term changes.

Quoting our previous commentary on this currency pair:

(…) the pair approached the support zone created by the green support line based on the previous lows, the 50% Fibonacci retracement based on the Aug-Oct rally and the 61.8% retracement based on the May-Oct upward move. Additionally, the current position of the indicators increases the probability of reversal.

On the daily chat, we see that although USD/CHF slipped under the above-mentioned support zone, this deterioration was very temporary and currency bulls pushed the exchange rate higher (as we had expected), invalidating earlier breakdowns (this means that decision to close short positions and take profits off the table was good). Such positive event in combination with the current position of the indicators (they are very close to generating buy signals) suggests that further improvement is just around the corner. Therefore, if the exchange rate closes today’s session above the green line, we’ll consider opening long positions.

- Very short-term outlook: mixed with bullish bias

- Short-term outlook: mixed

- MT outlook: mixed

- LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, if the exchange rate closes today’s session above the green line, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.