GBP/USD has started the week with gains. In the North American session, the pair is trading at the 1.2470. On the release front, British housing and industrial data climbed higher in February. Rightmove HPI posted a strong gain of 2.0%, its strongest gain since February 2016. CBI Industrial Expectations jumped to 8 points, easily beating the forecast of 5 points. The indicator is pointing to optimism over industrial orders, following two years of declines. On the release front, US markets are closed for Presidents’ Day, so we expect light trading and limited movement from GBP/USD in the North American session. On Tuesday, BoE Governor Mark Carney testifies before Parliament’s Treasury Committee on the central bank’s inflation report.

The BoE released its quarterly inflation report on February 2, when the central bank also held the benchmark rate at 0.25%. At that time, BoE Governor Mark Carney said that the BoE expected inflation to reach its target of 2 percent in February. However, Carney added that it had lowered its forecast for inflation in 2019, due to a stronger pound and an increase in markets bets on higher interest rates. Carney will be grilled on the BoE inflation forecast, as well as his views on Brexit and the current political climate. Carney has long warned about the dangers of Brexit on the economy, and is likely to include the new Trump administration as a significant element of uncertainty for the British economy.

With Fed Chair Janet Yellen’s giving the US economy a thumbs-up last week, the markets are keen to review the Fed policy minutes, which will be released on Wednesday. Testifying before Congress last week, Yellen noted that inflation is moving towards the Fed’s 2 percent target, the labor market remains red-hot and consumer spending is strong. Yellen strongly hinted that a rate hike was imminent, leaving the markets to speculate if the Fed prefers to make a move in March or June. If the US economy stays on track in 2017, analysts expect two or three rate hikes of a quarter-point. At the same time, the Fed wants to take into account the economic stance of the new administration, but this remains an elusive goal. Donald Trump continues to have difficulty filling in key cabinet positions and the media continues to probe connections between Trump officials and Russia. Trump has fired back by bitterly attacking the media, and lost in the mayhem is a clear and coherent economic policy. Although Trump has been in office for just over a month, the perception of a muddled and disoriented White House is creating uncertainty in the markets, and is, as Trump would say, “bad for business”.

GBP/USD Fundamentals

Sunday (February 19)

- 19:01 British Rightmove HPI. Actual 2.0%

Monday (February 20)

- 6:00 British CBI Industrial Order Expectations. Estimate 5. Actual 8

Tuesday (February 21)

- 5:00 Inflation Report Hearings

*All release times are GMT

*Key events are in bold

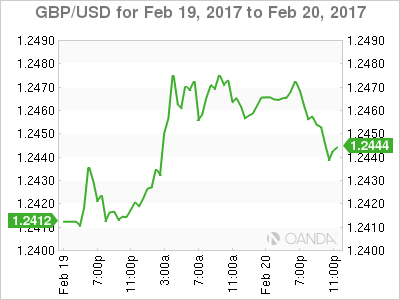

GBP/USD for Monday, February 20, 2017

GBP/USD February 20 at 9:50 EST

Open: 1.2428 High: 1.2483 Low: 1.2407 Close: 1.2472

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2272 | 1.2351 | 1.2471 | 1.2579 | 1.2674 | 1.2775 |

- GBP/USD was flat in the Asian session. The pair posted moderate gains in the European session and is steady in North American trade

- 1.2471 is under strong pressure in support

- 1.2579 is the next line of resistance

Further levels in both directions:

- Below: 1.2471, 1.2351, 1.2272 and 1.2143

- Above: 1.2579, 1.2674 and 1.2775

- Current range: 1.2471 to 1.2579

OANDA’s Open Positions Ratio

In the Monday session, GBP/USD ratio is showing long positions with a majority (57%). This is indicative of trader bias towards GBP/USD continuing to move upwards.