Forex News and Events

How will BoE handle "Brexit" (by Peter Rosenstreich)

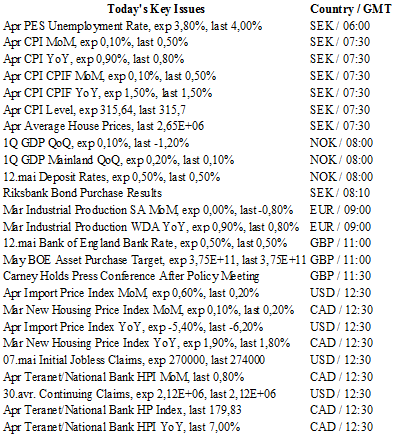

GBP traders will be extremely busy today focused on BoE rate decision, MPC meeting minutes; BoE press conference and the quarterly inflation report. We expect no change in the bank rate or asset purchases in a unanimous vote of 9-0. As for the tone of the minutes, we suspect it will remain dovish with no material shift expected ahead of the EU referendum. Concerning the press conference, questions will be geared towards the BoE view on “Brexit”. Carney will be undoubtedly prepared for this and will tread cautiously over every neutral, unbiased response. This minefield should generate GBP volatility but nothing lasting, barring Carney going rouge.

The focus of the inflation report will be the extent of the BoE adjustment of forecasts and contingency plans after the “Brexit” vote. We expect that any mention of the event will be limited due to the Bank’s effort to appear neutral. Yet, it will be difficult for BoE‘s Carney to stay balanced as his prior views suggest that “Brexit” poses a massive economic risk to the UK. Current BoE forecasts simply gaze over the vote without actually pricing in either scenario. Yet, regardless of the outcome we suspect extreme economic reaction, which is expected to render current BoE forecasts obsolete. Given the binary aspect of the vote it is unlikely that the BoE symmetrical risk in growth and inflation forecasts will provide much insight. Outside of the politically correct BoE, it is commonly viewed that Brexit will produce a significant growth shock to the UK economy, which is not being accounted for in current forecasts. In order to stay impartial there is chatter that the BoE might provide two forecasts (“remain” and “leave” projections) to handle the event. GBP/USD false breakout above 1.4700 is running into resistance at the 1.4800 supply area, indicating a reversal in the bullish momentum. We anticipate a bearish correction to 1.4298. EUR/GBP is consolidated around the 0.7900 handle, yet bullish trend gives scope for extension to 0.8000.

Russia: rising gold helping to take some heat off the ruble (by Yann Quelenn)

The ruble is now at its highest level against the dollar (less than 65 ruble for one dollar). The rebound in commodities prices has given some relief to the eastern country for which revenues should clearly increase in the near term. The recent rebound, which is slowing inflation - currently running at 7.2 y/y, is also strengthening the domestic currency against the dollar, which is a positive given that most oil exports are denominated in USD. However, we should remained vigilent for further turmoil on the oil market, or any Fed rate hike, which would re-expose Russia to a strong devaluation and add upsides pressures to inflation again.

It is clear to see why one of Russia’s main policy objectives is to remove the dollar from its international exchanges as the currency threatens its price stability. Consequently, Russian Central Bank head, Elvira Nabiullina, has made it clear that one of her primary objectives will be to increase gold and FX reserves up to $500 million. For the time being, holdings amount to $390.1 billion and while gold prices are also on the rise, we do not doubt that this $500 billion target is attainable by mid-2017. The increase in gold is definitely helping the central bank to take some pressure off the ruble. We are still bearish on the USD/RUB and 64 represents our short-term target.

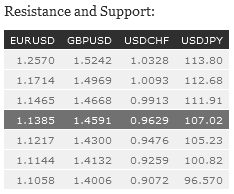

The Risk Today

Peter Rosenstreich

EUR/USD is still trading without massive volatility and is pushing slightly higher. Stronger support can be found at 1.1217 (24/0452016 low). Hourly resistance is located at 1.1479 (06/05/2016 high) and stronger resistance lies at 1.1616 (12/04/2016 high). Expected to show further weakness.In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located at 1.1640 (11/11/2005 low). The current technical appreciation implies a gradual increase.

GBP/USD keeps on bouncing on support implied by the lower bound of the uptrend channel. Hourly support is given at 1.4300 (21/04/2016 low) while hourly resistance can be found at 1.4543 (06/05/2016 high). Stronger resistance is located at 1.4770 (03//2016 high). A break of the uptrend channel is necessary to confirm deeper selling pressures. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is back to bullish after recent consolidation phase. Hourly resistance can be found at 109.38 (10/05/2016 high) and stronger resistance is given at 111.88 (28/04/2016 high). Hourly support lies at 106.25 (04/05/2016 low). Expected to show further buying pressures. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF is trading without strong momentum. Hourly resistance can be found at 0.9797 (22/04/2016 high) while a break of hourly support is located at 0.9652 (06/05/2016 low) would confirm deeper selling pressures. Indeed the medium-term momentum is bearish. Expected to show further consolidation. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.