Talking Points

-No clear broad based GBP has emerged in the past two weeks

-A ‘Yes’ victory is not priced in, just increased volatility

-Sell GBP on a ‘Yes’ victory, sell the GBP against the EUR and NZD in a ‘No’ victory

There has been a lot of speculation and polling conducted to provide predictions about the result of this Thursday’s Scottish referendum vote. This article will lay out some strategies to trade through what is anticipated to be a highly volatile week.

First of all, when I view the charts of GBP and its cross rates, I was surprised to see how steady it has been, even over the past couple of weeks.

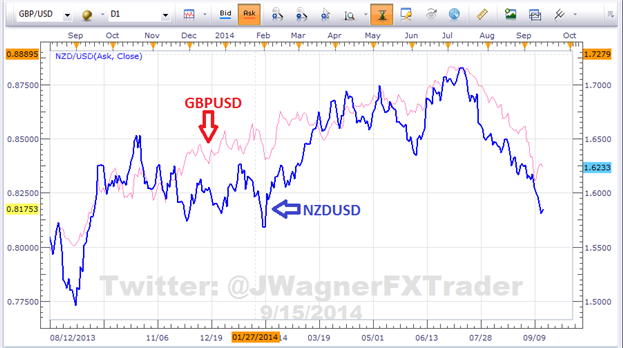

Forex Strategy: GBP/USD vs NZD/USD Correlation

(Created using FXCM’s Marketscope 2.0 charts)

For example, if you compare the GBP/USD versus the NZD/USD, you will find they have correlated well over the past several months.

Even though the ‘Yes’ votes have closed the gap in recent polling, the GBP hasn’t really sold off in a broad based rout. The sell-off has generally been contained against the USD.

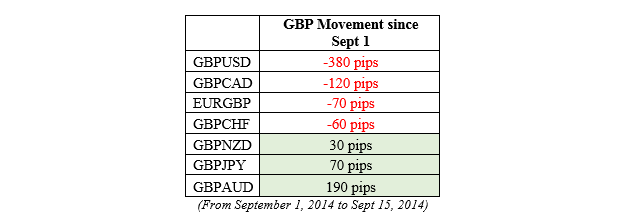

To illustrate further, I calculated the difference in price now versus September 1, 2014. In early September, a ‘Yes’ vote wasn’t seriously considered as a probable outcome. It wasn’t until the next week did the ‘Yes’ polling begin to show a shot of winning the vote.

Anyway, using September 1, 2014 as the reference point, price action in the GBP exchange rates have varied widely with no clear cut trend. Nearly half of the currencies have outperformed against Sterling and against the NZD, JPY and AUD, Sterling has actually outperformed!

My point is this, it may have seemed like a broad based round of GBP weakness, but the charts indicate otherwise. Therefore, let’s analyze the two outcomes for the vote.

YES wins

I believe this is the biggest surprise that has not been priced into the GBP. There is a lot of uncertainty that comes with an associated YES victory. Therefore, we will likely see broad based GBP weakness. Since the FOMC would have met already on Wednesday and assuming that Fed Chairwoman Janet Yellen continues towards a sooner than expected rate hike, then the GBP/USD would be a good candidate to sell. Otherwise, I would look to the GBP/AUD as a secondary option as a few of the AUD charts are showing bullish undertones.

NO wins

This appears to be the more probable outcome. Therefore, I would not be surprised to see a GBP rally that could be broad based and temporary. We will use the rally as a means to sell Sterling, but we will sell a strategic cross pair.

One choice to sell would be the GBP/NZD cross rate near the 2.03 – 2.05 zone. At this point, the GBP would be at its richest point relative to the value of the NZD since 2012. Therefore, the rally would be overdone and at risk of a pull back.

Secondarily, the EUR/GBP has an interesting technical set up. We wrote about the bullish bat pattern that would offer a buy point in the pair near .7870. This risk on this trade is clear as the pattern becomes invalid on trade through .7740.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.