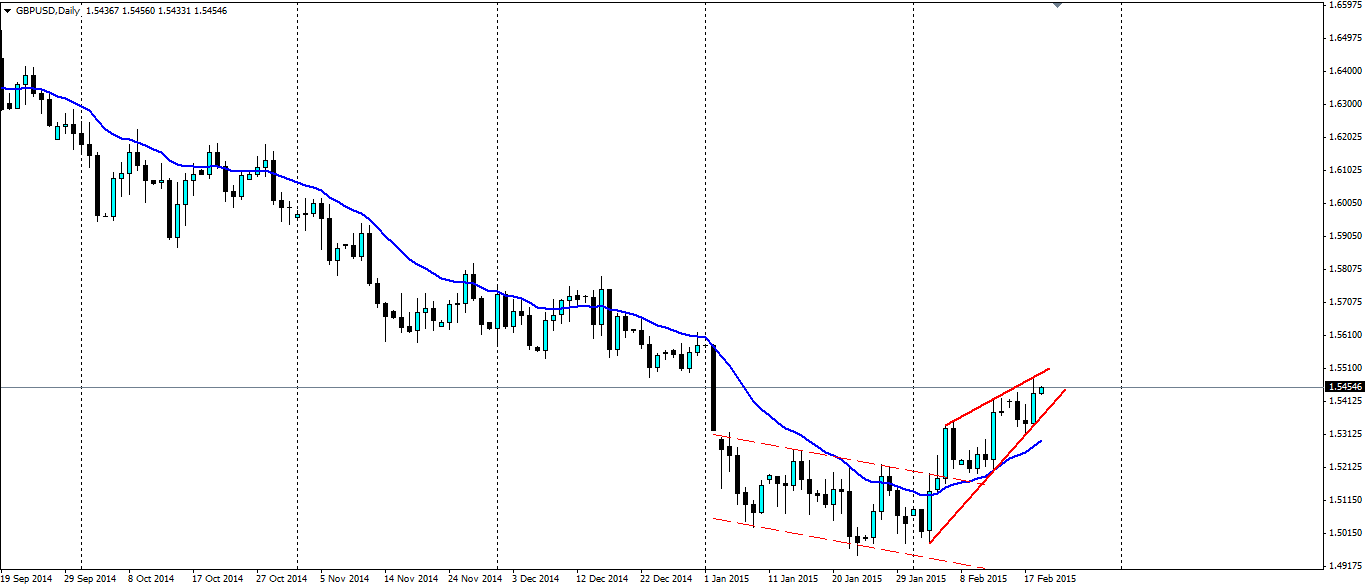

The pound has found plenty of support recently after some positive news and a faltering US dollar. But a rising wedge could signal a bearish breakout that could see a continuation of the overall bearish trend.

The latest news out of the UK shows the unemployment rate falling from 5.8% to 5.7% and the claimant count falling by -35k. This is a good result for the UK economy and something the Bank of England will find solace in especially after the talk of reducing interest rates. A weak inflation rate, thanks to falling energy prices, has let the BoE to entertain the idea of reducing interest rates, but this is unlikely to materialise given the strength in the UK economy.

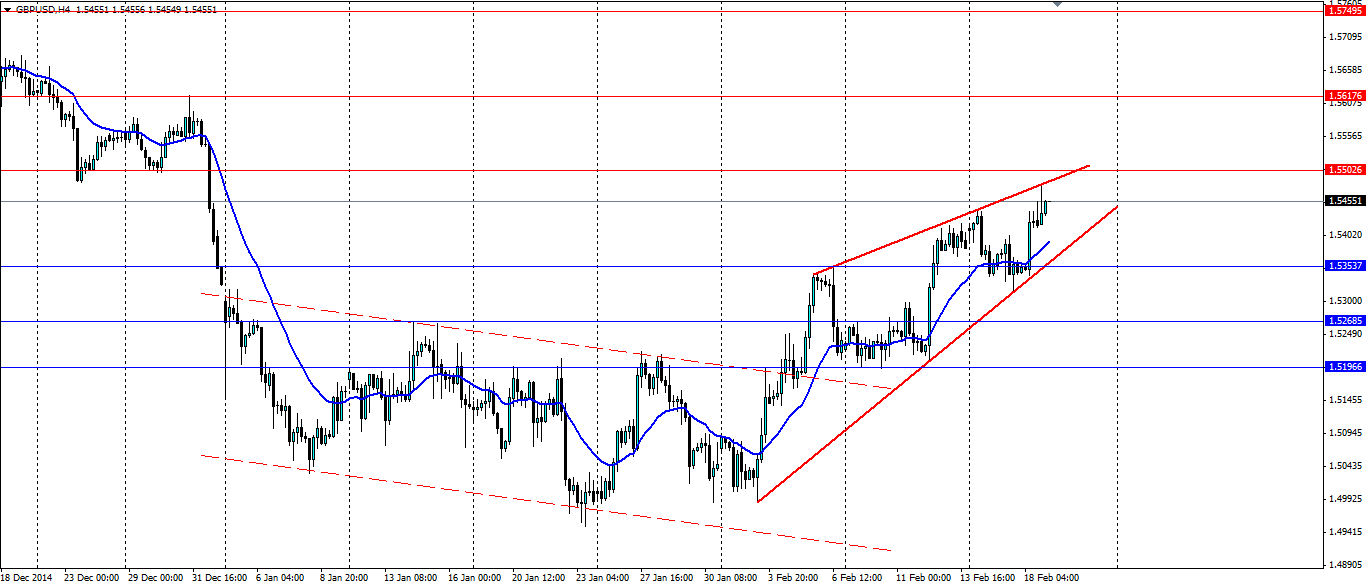

As a result, we have seen a bullish breakout of the downward sloping channel. That breakout is now consolidating to for a rising wedge pattern which generally is a bearish continuation pattern. The result is that we could see breakout lower of the wedge.

If we do see a continuation of the bearish trend, a breakout will look for support at 1.5353, 1.5268 and 1.5196. On the other hand if we see the positive news force the pound higher, look for resistance to be found at 1.5502, 1.5617 and 1.5749.