On Wednesday, the pressure in the financial markets slightly decreased after Bloomberg reports that China and the U.S. are edged closer to their positions on trade and can avoid a new wave of escalation. The message is not very trustworthy, as it cites unnamed sources. However, for lack of other information, the markets regained some of the recent losses.

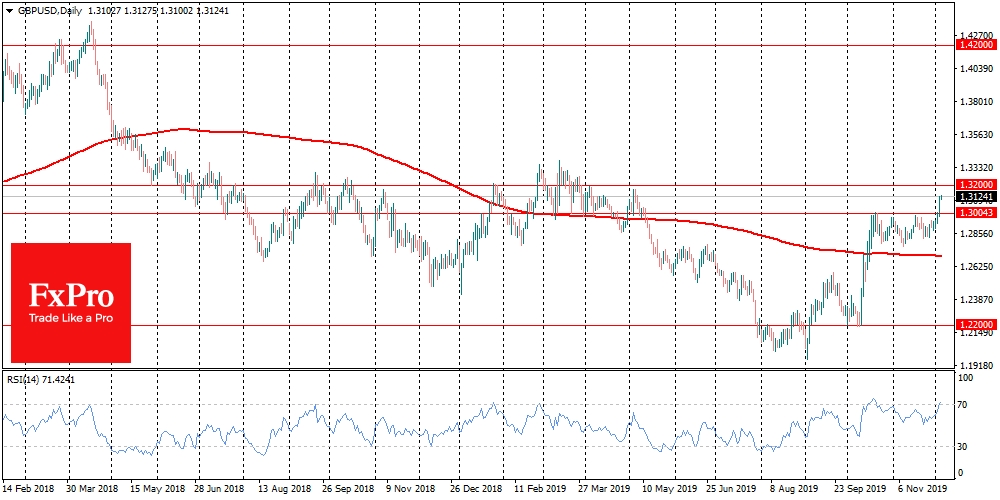

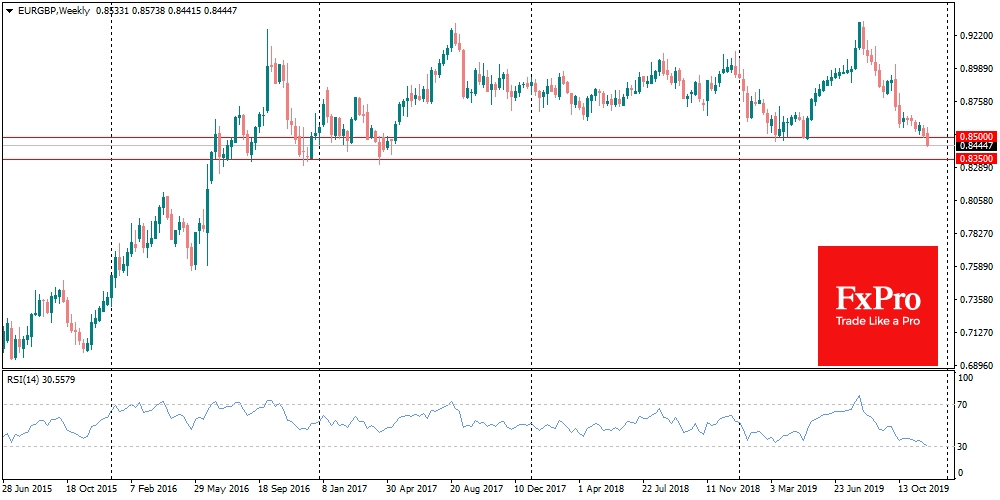

Most importantly, this news has allowed market participants to distract themselves from the theme of eternal trade wars, which has benefited the British currency. GBP/USD jumped to $1.31 on Wednesday, its highest level since May, while EURGBP declined to 0.8450, its lowest point since May 2017. The pound rose sharply following the polls, which indicated growing expectations that Boris Johnson's party would strengthen its position significantly during the elections next week.

The reaction of the markets looks ironic at first sight, as in August the pound declined to multi-year lows on the news about Johnson's coming to power. Recall that GBPUSD was then close to more than 30-year lows, and EUR/GBP exceeded 0.93, reaching 10-year highs.

Over the past months, the British pound grew by about 10% to the dollar and the euro as the strengthening of Johnson's position perceived as good news. There is not much surprising here, as in less than five months he managed to move significantly closer to breaking the legislative impasse. The confident victory of the Conservative party headed by him promises a fast passage of Brexit initiatives and further reduction of uncertainty, which will be welcomed by the markets.

In the course of yesterday's breakthrough, the British pound came out of the traded ranges both against the dollar and the euro, which opens up the way for further growth in the coming days on the triggering of stop-orders. As for tech analysis, GBP/USD has no significant obstacles to increase up to levels above 1.32, above which the pair has been experiencing difficulties with growth since September last year.

EUR/GBP made an even more significant step, and is close to the oversold level on the weekly charts, but may well continue to decline by inertia down to the local lows of 2017 at 0.8350.

The FxPro Analyst Team