Investing.com’s stocks of the week

Amid a completely empty macroeconomic calendar, the pound sterling has returned to levels recorded early last Friday, that is, before the publication of retail sales data. That was an expected move because since the outcome of the FOMC meeting had been announced, the currency immediately went down.

As a result, the pound sterling became excessively oversold. The market was simply correcting the imbalance. Anyway, the Fed’s decisions that triggered a fall in the pound sterling did not change. Plans to raise the interest rate will be weighing on the pound and other currencies for a long time.

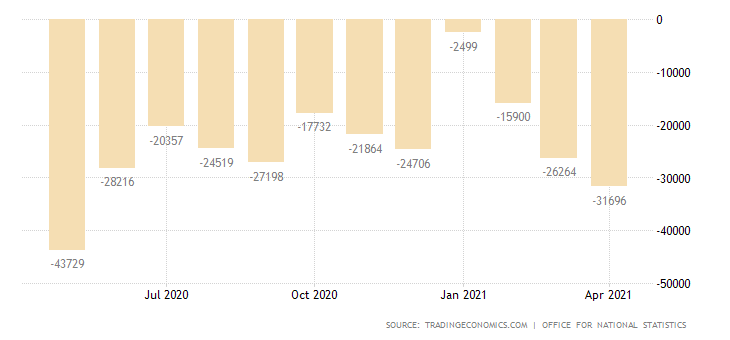

That is why the trend that developed in the second half of the previous week is expected to resume. At the same time, the empty macroeconomic calendar is likely to boost the pound. In particular, public sector net borrowing in the United Kingdom is estimated to drop by £28.4 billion, Which is an extremely positive factor in this case.

Public Sector Net Borrowing (United Kingdom):

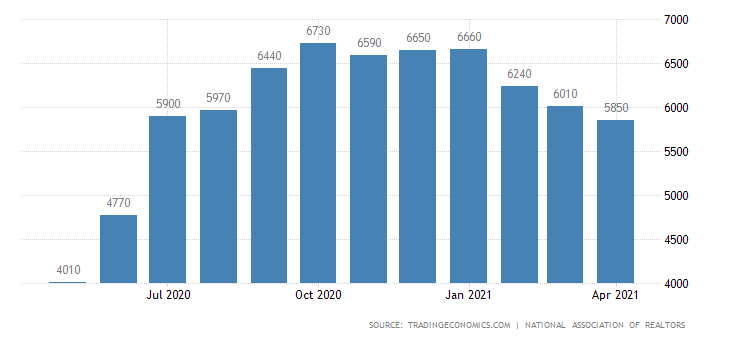

In addition, existing home sales in the United States are projected to fall by 1.0%, reflecting a decrease in consumer confidence. In this light, the pound sterling is likely to increase slightly as, at any rate, the decisions announced at the end of the FOMC meeting are of the greatest importance. There should be solid reasons so as market sentiment can change.

Existing Home Sales (United States):

Yesterday, GBP/USD recovered losses sustained during a fall on June 18. In terms of technical analysis, we can observe a correction in the market due to an oversold pound sterling.

Market dynamics during the period June 16-21 has extremely high values, which is confirmed by speculative interest among traders and the structure of candlesticks.

Given the current location of the quote, the price has reached the high as of June 18 and the number of long positions has decreased afterwards.

Analysing the daily time frame, traders may notice an inertial decline that may well put the upward cycle as of April 12–May 18 at risk.

Under the circumstances, traders should expect the downward trend to continue. In fact, sellers could have benefited from the recent correction. If the price fails to consolidate above 1.3950, the quote is likely to go down to the recent pivot point of 1.3785.

In terms of complex indicator analysis, technical indicators are still sending a sell signal despite the corrective move.

InstaForex Group