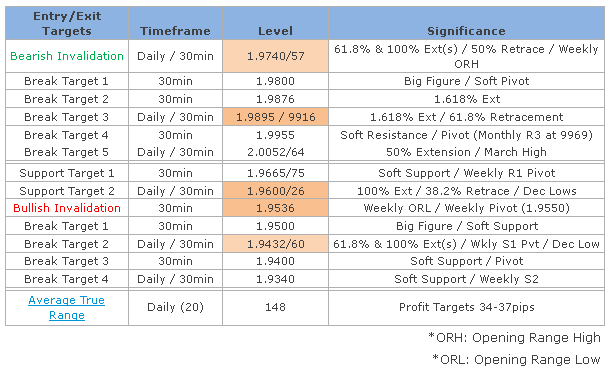

- GBP/NZD breakout in question- scalp bias constructive above 1.96

- Weekly opening range break to validate

- Major event risk on tap from New Zealand and UK into the April close

- GBP/NZD Makes outside-day push through 1.9598-1.9626 resistance range

- Daily RSI trigger breach- bullish

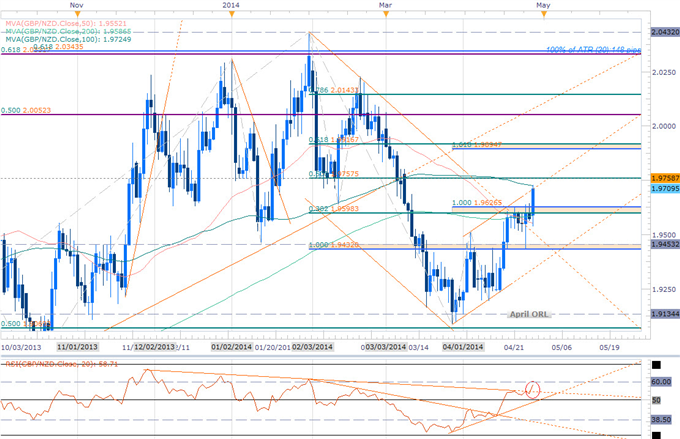

- Topside targets at channel resistance, 1.9757, 1.9895/1.9916

- Break sub 1.96 turns neutral- break below weekly ORL turns bearish

- Broader outlook constructive above 1.9432/53- bullish invalidation

- Look for RSI 60-breach for acceleration / support triggers pending

- Event Risk Ahead: New Zealand Trade Balance Data tonight, UK 1Q GDP tomorrow

Technical Outlook

A clear RSI trigger and breach above the Asian opening range high immediately shifted our focus to the topside last night with a nice outside day taking us through the 1.9600/26 key resistance range. The pair remains within the confines of a well-defined ascending channel formation off last week’s low with channel support now converging on that same range.

While I am inclined to participate in this setup, it’s important to remain nimble as this may still be an end-of-month blow-off / exhaustion move here. Keep in mind that the monthly opening range clearly broke to the topside on April 16th and as such, a late-month high in the exchange rate is expected. With the last two days of April trade falling on key UK GDP data and the FOMC policy meeting on Wednesday (not to mention NFPs Friday), lighten exposure heading into the close of the month as we look to the May opening for further guidance.

Bottom line: While our immediate focus is lower against this 1.9740/57 resistance range, looking to buy dips while above 1.96 with only a move sub 1.9536 suggesting a more significant high may have been put in place here. The weekly opening range is now in view between 1.9536 ~ 1.9750 and a break should offer further conviction on our near-term bias heading into the May open.

It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session and hourly basis offering further clarity on intra-day biases.