Investing.com’s stocks of the week

Most markets in North America a remaining calm as the Federal Reserve begins its two day meeting, which will end with a rate decision and policy statement tomorrow afternoon. US equities are up slightly while the major currencies experienced some activity upon the release of Durable Goods Orders which declined 1.3% on expectations of a 0.5% rise. The initial reaction was USD negative in virtually all the major pairs, but the Conference Board’s Consumer Confidence encouraged a retracement of that move by blowing out the consensus of 87 with a 94.5 print. In addition, the previous result was revised upward from 86 to 89, and according to the Conference Board’s Director of Economic Indicators, “With the holiday season around the corner this boost in confidence should be a welcome sign for retailers.”

Regardless of the US data releases today though, the market will be paying most of its attention to the potential scenarios when the Fed releases their conclusions. The most widely expected result is that they will completely taper away Quantitative Easing, but remind investors that interest rates will remain low for an extended period of time. Granted, there are other theories as well, including that they won’t taper everything, leaving only a small amount of QE to be tapered at their next meeting which also includes a press conference; but admittedly, that is a long shot. Therefore, tomorrow’s Fed event may be a lot more tame than many may like, which means we need to search elsewhere for action.

The action we seek may be in a potentially overlooked central bank meeting that is taking place only 2 hours after the Fed concludes their meeting, the Reserve Bank of New Zealand. The RBNZ has been the most aggressive central bank in the developed world having raised their interest rate four times in 2014 taking it from 2.5% to the current 3.5%. While they paused the hikes to assess the scene last month, it doesn’t mean they are stepping away from their hawkish pursuit despite their reservations about an overvalued NZD.

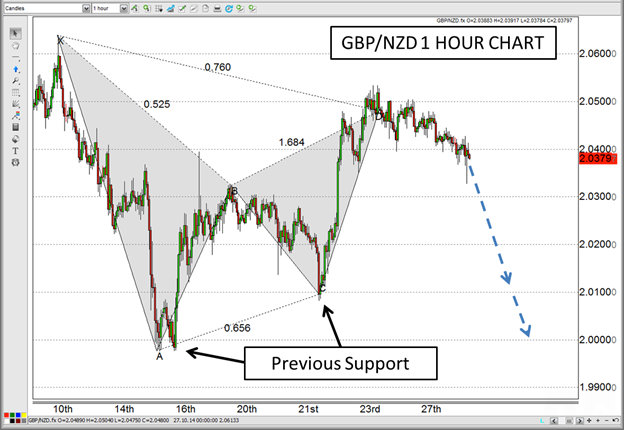

Since the September 10 meeting of the RBNZ, the NZD has depreciated significantly against virtually all other major currencies, and some of that loss of value could be replenished at this meeting. If the RBNZ is even remotely hawkish about the Kiwi economy, the NZD could be a popular play. One pair in particular that could see a lot of movement may be the GBP/NZD which moves a lot on a daily basis anyway and has recently completed a bearish Gartley Pattern. A hawkish RBNZ may open up the possibility of a return to previous support of 2.01 or even 2.00 for this pair.

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).