Talking Points

- Triangle Pattern on GBP/NZD Daily Chart

- Key Support Zone for Initiating New Longs

- A Potential Entry Signal Flashing Right Now

Most triangle patterns involve trading breakouts. However, the other trade that is possible under these circumstances is trading bounces within the triangle, and that is the opportunity being offered in GBP/NZD today.

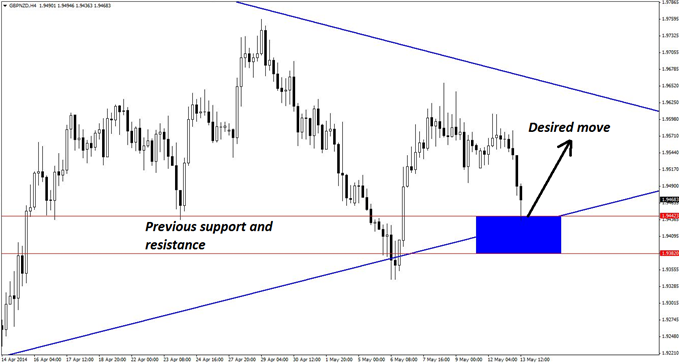

Although the bias on the below daily chart is slightly toward the downside, the rising line of support has been tested multiple times, and thus, traders would expect to see a bounce on the lower time frames that just might continue to the upside.

However, because the trade is occurring within a triangle, it is wiser to be defensive and to use multiple positions so that the trade can be scaled out of at the first sign of trouble. Afterall, trading in sideways markets always comes with such heightened volatility.

The four-hour chart below readily provides a zone of support based on previous support and resistance coinciding with the rising trend line from the higher time frame. The final support zone has been estimated as 1.9382-1.9442, which is a zone 60 pips deep.

The potential reward to the topside within the triangle is approximately 200 pips or more, which affords a very attractive overall risk profile of 3:1.

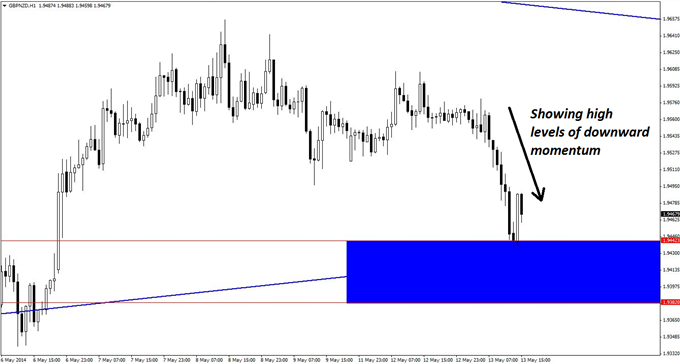

Regardless, the trade is to be taken using the lower time frames in order to provide an optimal risk-controlled opportunity. For this, the hourly chart below is used.

At this level of magnification, a good amount of momentum has been visible recently, but it has been countered by a large and significant bullish engulfing candlestick coming out of the support zone. As price has pulled back down slightly, aggressive traders may choose to enter at this point at a better price close to 1.9468, which would be perfectly legitimate and acceptable.

More conservative traders may wait and see if price will give a lower low in the next few hours, and would consider bullish reversal divergence, pin bars, and/or further bullish engulfing patterns as viable entry signals from there.

Candidly, the author is more than satisfied with the current bullish engulfing pattern. Even if the trade stops out, it will do so on small risk. As always, however, two or three attempts can be made in order to capture the move if and when it happens.

By Kaye Lee, private fund trader and head trader consultant, StraightTalkTrading.com.