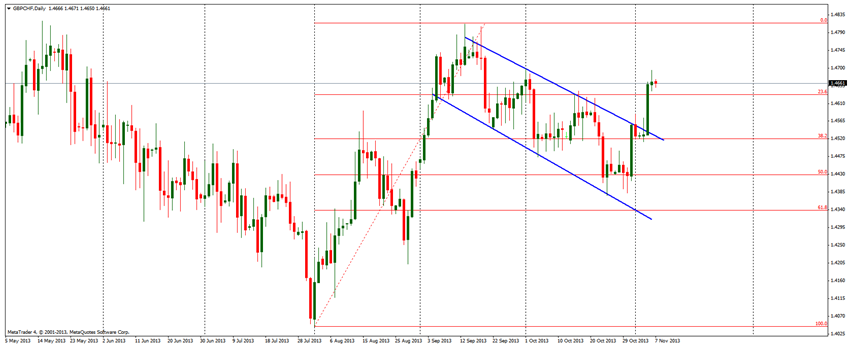

The GBP may seem overbought, but it constantly gets a very positive macroeconomic data that keeps pushing the currency pair even higher. From the second half of September, this pair was in the correction movement which can now be seen as a flag. Two days ago, buyers managed to break the upper line of the channel down, resulting to a price surge. The upswing was prepared above the 38.2 Fibonacci level, and broke the resistance at 23.6 Fibonacci which played an important role in the middle of October.

GBP/CHF Daily Chart" title="GBP/CHF Daily Chart" width="856" height="356">

GBP/CHF Daily Chart" title="GBP/CHF Daily Chart" width="856" height="356">

The GBP/CHF now has an open space for attacking the tops from the 13th of September, which is a very important resistance. Recent Fibonacci lines should play an important role as support levels in case the price drops. The sentiment stays positive for this pair.

Thursday will be important for this pair, as we have a Monetary Policy Committee Statement which will affect the GBP.