GBP/JPY: Technical Analysis Points To Long Position

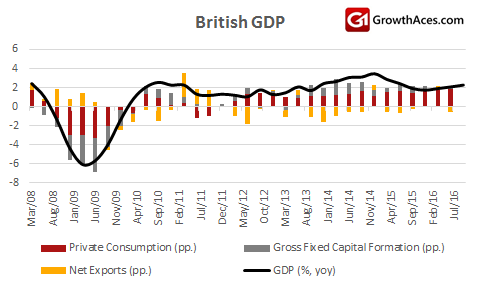

- Britain's economy barely slowed in the third quarter despite the Brexit vote shock, further diminishing the chance of a fresh interest rate cut by the Bank of England next week.

- British GDP expanded by 0.5% in the July-September period, less rapid than the unusually strong growth of 0.7% seen in the second quarter but comfortably above a median forecast of 0.3%. Compared with the third quarter of last year, growth picked up to 2.3%, the strongest pace in more than a year.

- The Office for National Statistics said on Thursday that the country’s dominant services sector provided all the growth for the economy in the third quarter, growing by 0.8% from the April-June period. Industrial production, including manufacturing, and construction both contracted, down 0.4% and 1.4% respectively. The fall in construction was the biggest since the third quarter of 2012.

- The Bank of England said as recently as September that the preliminary ONS reading would probably show growth in the third quarter of only 0.2%. The central bank is due to decide next week whether to cut interest rates further below their all-time low of 0.25%, something it hinted at last month. But its governor, Mark Carney, suggested on Tuesday that he was concerned about the sharp fall in the value of the pound and how that will push up inflation, further dampening already low expectations of a rate cut on November 3.

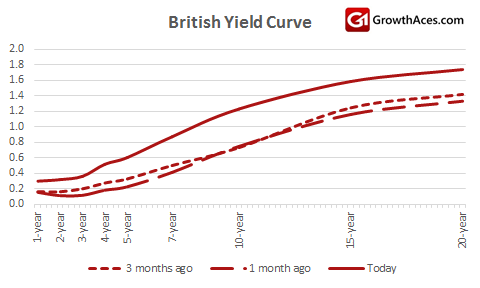

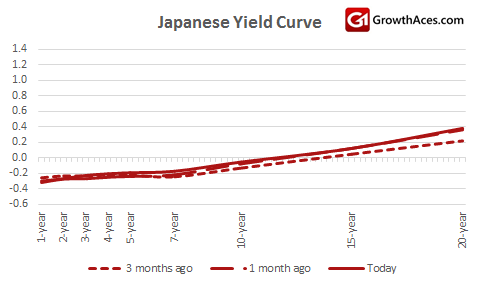

- The Bank of Japan is likely to keep its monetary policy steady for a while and to stick to its pledge to guide 10-Year government bond yields around zero percent. As we can see on the charts below, British yield curve went up in recent days, while Japanese yield curve stays anchored at low levels.

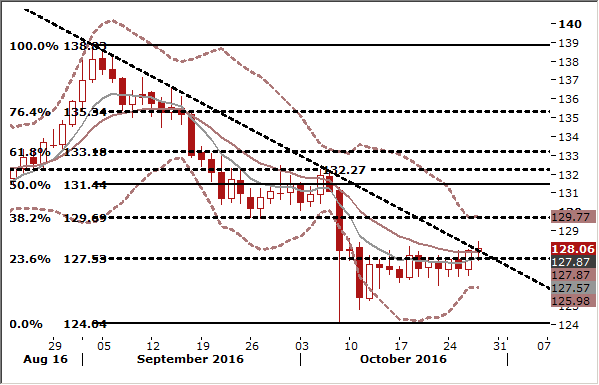

- We are looking to buy the GBP/JPY, as 7-day ema is positively aligned and is going to break above the 14-day ema in the coming sessions. We have placed our GBP/JPY bid at 127.65. Our target will be near October highs, at 132.00.

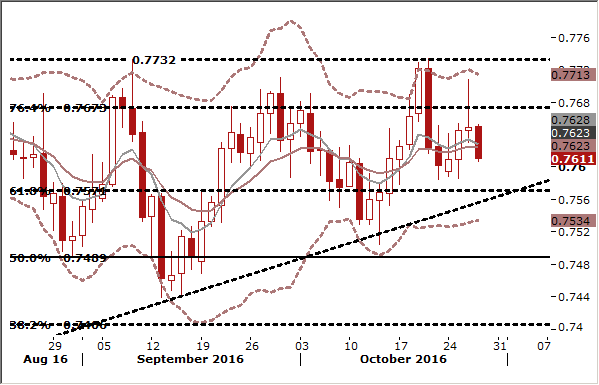

AUD/USD Still Cannot Break Above The 0.7700 Resistance

- The AUD/USD ticked lower on Thursday as a two-day rally fizzled out in the face of stubborn chart resistance above 0.7700. The AUD/USD briefly jumped above this barrier on Wednesday after steady inflation figures only reinforced expectations the Reserve Bank of Australia would skip a chance to cut rates at its policy meeting next Tuesday. However, the Aussie was quick to fall back, marking the fifth time since September that it has failed to hold a beachhead at 0.7700.

- Earlier, official data showed a 3.5% rise in export prices while import prices fell 1%. The ratio of the two, considered a proxy for the terms of trade, posted the biggest increase in almost five years.

- The fundamental analysis suggests the AUD/USD should be ready to break above the 0.7700 ceiling, but we will need probably one more attempt. Our trading strategy will be to buy the AUD/USD on dips.