Talking Points:

- GBP/JPY Technical Strategy: Flat

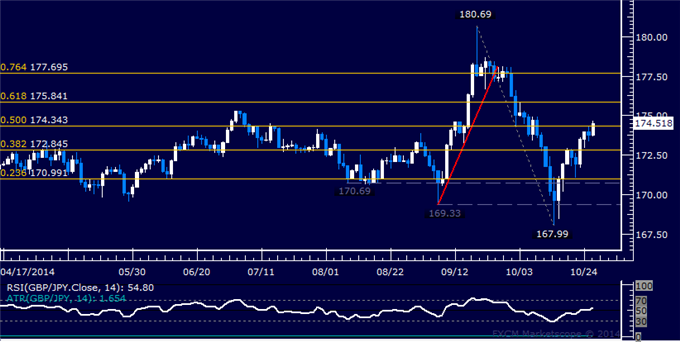

- Support: 174.34, 172.85, 170.69

- Resistance: 175.84, 177.70, 180.69

The British Pound is aiming above the 175.00 figure against the Japanese Yen after clearing another technical threshold. Near-term resistance is at now at 175.84, the 61.8% Fibonacci retracement, with a break above that on a daily closing basis exposing the 76.4% level at 177.70. Alternatively, a turn below the 50% Fib at 174.34 clears the way for a challenge of the 38.2% retracement at 175.85.

While entering long seems compelling from a purely technical perspective, we will tactically opt to pass on the trade. GBP/JPY is highly sensitive to risk sentiment trends, with prices showing strong correlations to the benchmark 10-year US Treasury yield and the MSCI World Stock Index (0.65 and 0.64 respectively on 20-day percent-change studies). With that in mind, we prefer not to initiate exposure ahead of the upcoming FOMC policy announcement.