GBP/JPY Daily Outlook

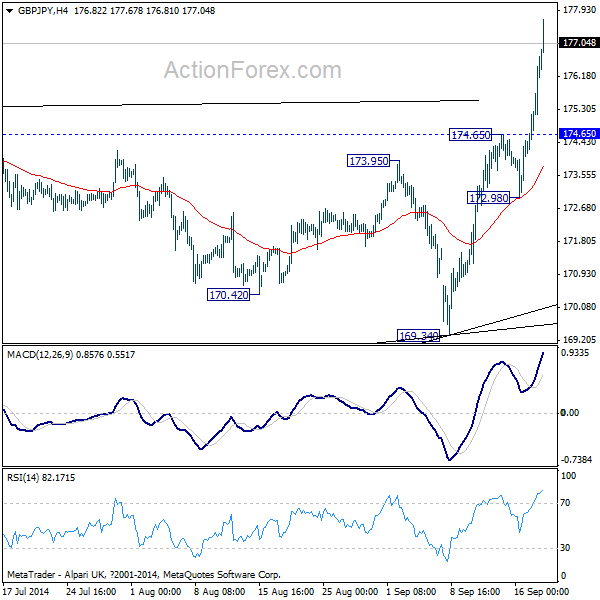

Daily Pivots: (S1) 174.85; (P) 175.65; (R1) 177.16;

GBP/JPY surged to as high as 177.67 so far and took out 175.36 key resistance decisively. The development confirmed resumption of larger up trend. Intraday bias remains on the upside and further rise should be seen to next long term fibonacci level at 183.96. On the downside, break of 174.65 is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

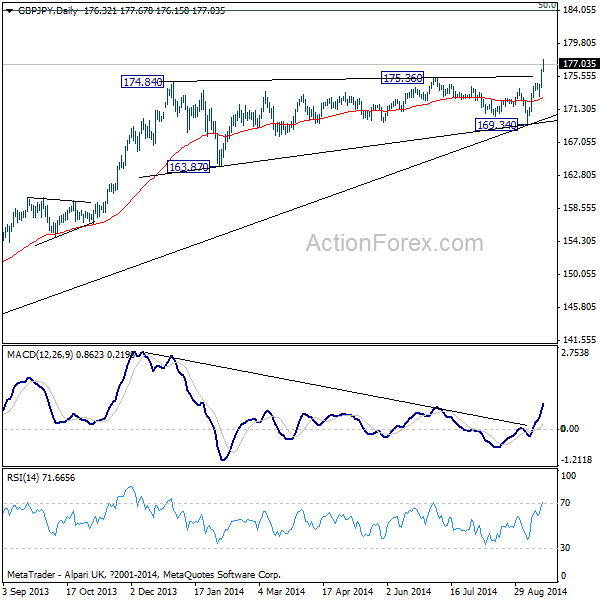

In the bigger picture, the strong break of 175.36 confirmed larger up trend from 116.83 low has resumed. Current rise would now extend to 50% retracement retracement of 251.09 to 116.83 at 183.96. Medium term momentum as seen in weekly MACD isn't too convincing. Thus, we'd expect some strong resistance from 183.96 to finally bring reversal, unless upside acceleration is seen. Meanwhile, outlook will stay bullish as long as 169.34 support holds, in case of deeper pull back.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 138.88; (P) 139.26; (R1) 139.75;

The break of 139.27 resistance confirmed near term reversal. That is, the consolidation pattern from 145.68 has completed with three waves down to 135.72 just ahead of 135.50 key support. Intraday bias remains on the upside for resting 143.78/145.68 resistance zone. On the downside, break of 138.46 support is needed to indicate near term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, there is no clear sign of trend reversal in EUR/JPY in spite of the loss of upside momentum as seen in bearish divergence condition in weekly MACD. The cross held on to 135.50 key support level, as well as the 55 weeks EMA. Hence, the up trend from 94.11 long term bottom is still in favor to continue. Break of 145.68 will target 76.4% retracement of 169.96 to 94.11 at 152.59. Though, break of 135.50 will confirm reversal and target 124.95 support.