Forex News and Events

The UK inflation decelerated faster-than-expected in September, GBP-complex is heavily offered post-CPI. The Cable tests 2014-low levels as the soft inflation gives more flexibility to BoE before it starts the policy normalization. In Russia, the CBR lowered its target RUB-basket by 10 kopeks to temper RUB sell-off reinforced by weak oil prices. We see sharp shift in Russian rate forecasts in coming months. In US, the funds shift significantly toward the back-end of sovereign curve as uncertainties on Fed policy persists. The US -10 year yields retreat to 2.2255%.

UK inflation decelerates faster-than-expected

The UK inflation decelerates to 1.2% on year to September (vs. 1.4% exp. & 1.5% last), the core CPI eases to 1.5% y/y. As knee-jerk reaction, the GBP/USD legs down to 1.5959 (at the time of writing), EUR/GBP advances to 100-dma (0.79572). The soft inflation dynamics clearly give more time to BoE before the policy normalization as the BoE’s inflation target band stands at a distant 2-3%. Despite strong labor data expectations (due tomorrow), the GBP-complex will likely extend weakness. Option barriers in EUR/GBP are placed at 0.7950/70 for today expiry, if cleared will open the way to 0.8000/50 vanilla calls this week. GBP/USD should test 1.5855/1.5944 (Nov 2012 low / 2014 low), option related offers trail up to 1.6285 for today expiry, and more barriers are building at 1.6000-.

The ruble slide weighs on the CBR

USD/RUB extends gains at historical highs as the weakness in oil prices continue. The improvement in Russian current account is at risk given the slide in oil prices as additional challenge to RUB depreciation and the weak FDI due to geopolitical concerns. The Russian Central bank lowered the target RUB-basket floor (55% USD/RUB dollar & 45% EUR/RUB) by 10 kopeks to 45.35 to temper RUB sell-off. According to bank’s procedure, the CBR lets the RUB trade within 9-RUB-wide band and sells 350mn dollars above the limit to smooth depreciation before proceeding with 5 kopek shift in the band. Given the intense selling pressures, we doubt on the efficiency of FX interventions and even the brand new FX repo operations to become effective from end-Oct. The forward rate markets price in 200 bps hike in the coming three months.

Interest shifts to the back-end of US sovereign curve

The UST interest shifted towards the back-end of the sovereign curve in September. We see some correction in US sovereign curve since September 23rd; however the net positioning in 2-year contracts remains at the lowest levels since mid-2007.

Through September, the non-commercial (speculative) holdings shifted from the US 2-year notes to 10-year bonds. According to CFTC data, the net long future positions in 2-year notes squeezed in September from 54’025 (Sept 2nd) to -160’000 contracts (Sep 23rd). Despite the USD rally, the net positioning in 2-year notes remain negative on the latest CFTC release (Oct 7th), around -78,838 contracts. During the same period (Sep 2-23), the US 10-year futures increased from -82’658 to 8,844 contracts. The inflows in US 10-year notes pulled the long-term yield down to 2.2255% as of today, lowest levels in 2 years. In our view, this behavior is the result of a limited risk appetite in the market place and highlights concerns on a higher short-term volatility on Fed speculations. The OIS swap pricings reveal uncertainties about the timing of the first Fed fund rate hike. Is it time to delay Q2, 2015 expectations for the first Fed rate hike?

Today's Key Issues (time in GMT)

2014-10-14T09:30:00 USD Sep NFIB Small Business Optimism, exp 95.9, last 96.1

The Risk Today

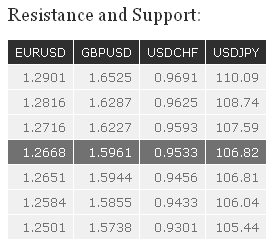

EUR/USD

EUR/USD is consolidating after its steep decline. Despite yesterday's break of the hourly resistance at 1.2716 (10/10/2014 high), prices have thus far failed to make any higher high. A resistance stands at 1.2816. Hourly supports can be found at 1.2651 (intraday low) and 1.2584 (07/10/2014 low). In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) opens the way for a decline towards the strong support at 1.2043 (24/07/2012 low). Intermediate supports are given by 1.2500 (psychological support) and 1.2466 (28/08/2012 low).

GBP/USD

GBP/USD seems to move within a horizontal range between the support at 1.5944 and the hourly resistance at 1.6227 (09/10/2014 high). Another resistance can be found at 1.6287. An hourly support lies at 1.6009 (10/10/2014 low). In the longer term, the collapse in prices after having reached 4-year highs has created a strong resistance at 1.7192, which is unlikely to be broken in the coming months. Despite the recent short-term bearish momentum, we favour a temporary rebound near the support at 1.5855 (12/11/2013 low). A resistance lies at 1.6525.

USD/JPY

USD/JPY has declined and is now challenging the support at 106.81 (see also the 38.2% retracement). Hourly resistances can be found at 107.59 (intraday high) and 108.18 (intraday high) and 108.74. Another support lies at 106.04. A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. Despite a probable medium-term consolidation phase after the successful test of the major resistance at 110.66 (15/08/2008 high, see also the 50% retracement from the 1998's top), a gradual move higher is eventually favoured. Another resistance can be found at 114.66 (27/12/2007 high).

USD/CHF

USD/CHF has thus far successfully tested its recent low at 0.9469. Hourly resistances stand at 0.9552 (intraday high) and 0.9593 (10/10/2014 high). Another support can be found at 0.9433 (18/09/2014 high). From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. As a result, the recent weakness is seen as a countertrend move. A key support can be found at 0.9301 (16/09/2014 low). A resistance now lies at 0.9691 (06/10/2014 high).