The GBP plunged after yet another spin in UK politics, which worsens the state of uncertainty around a no-deal Brexit following the decision by UK Prime Minister Boris Johnson to use his powers in order to suspend parliament from Sept 12 for 5 weeks after getting the approval by Her Majesty the Queen.

Quick Take

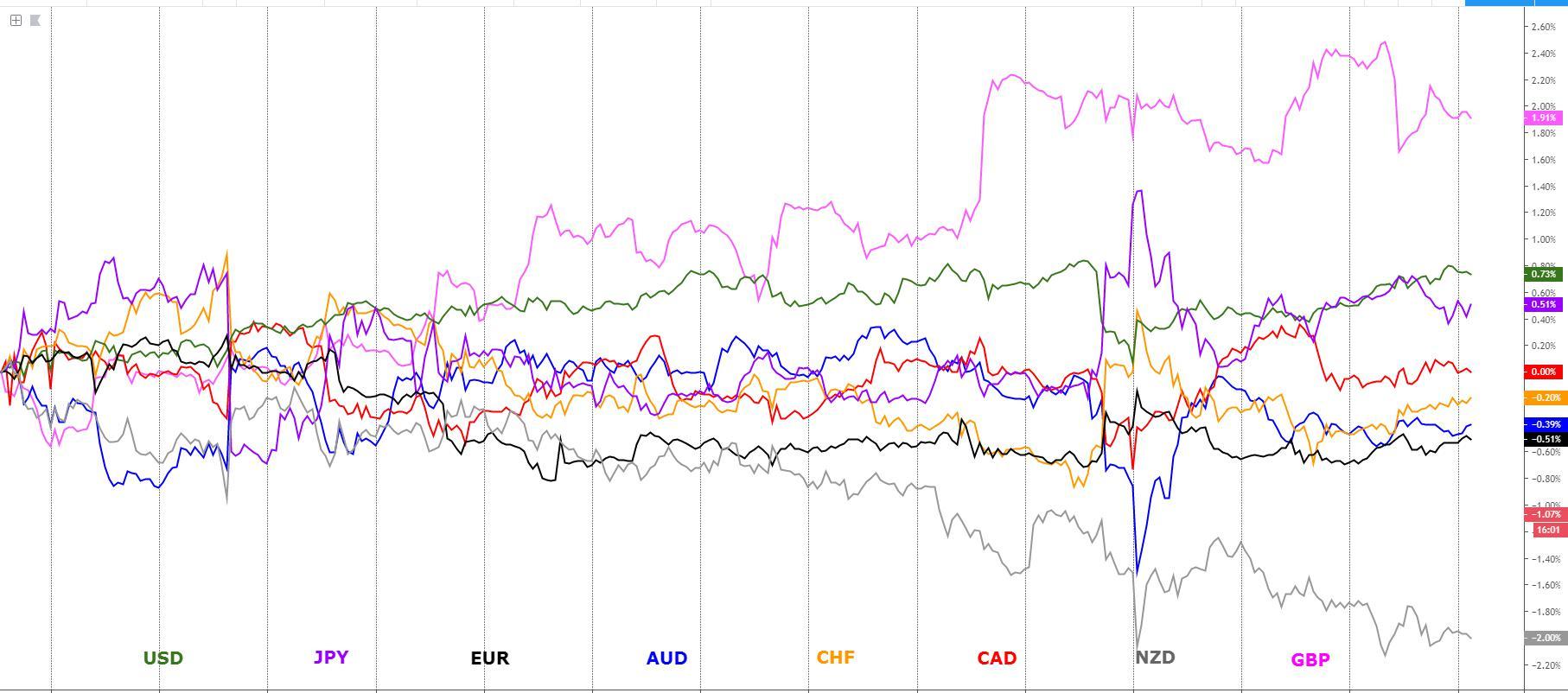

The Sterling was the main mover, this time hammered lower, after a bold move by UK PM Johnson to prorogue (suspend) the British Parliament after it returns from recess for five weeks until Oct 14th, essentially leaving very little room for MPs to block any potential no-deal scenario ahead of the Oct 31 Brexit deadline. The Speaker of the Commons Bercow described the move by Johnson as a “constitutional outrage", quite a symbolic expression to tell you how heated the proceedings are in UK politics ahead of what's expected to be an incredibly turbulent time for volatility to hit the GBP from Sept onwards. Amid the angst around Brexit and China's trade, risk dynamics remain poor, which has undoubtedly contributed to keeping the bid tone in funding currencies, especially on the EUR after Italian Prime Minister Conte will finally be given the mandate to form a new government in Italy, which makes the prospects of a snap election dissipate a tad for now. The selloff in Italian yields relaxed the selling pressure on the Euro. A currency that attracted most of the demand on Wed was the US Dollar Index, on the verge of breaking a key resistance. Lastly, the hight-beta currency complex the likes of the AUD, NZD, CAD remain with a bearish outlook overall, with the NZD the worst performer after another terrible business confidence reading out this Thursday morning in NZ.

The indices show the performance of a particular currency vs G8 FX. An educational article about how to build your own currency meter can be found in the Global Prime's Research section.

Narratives In Financial Markets

* The Information is gathered after scanning top publications including the FT, WSJ, Reuters, Bloomberg, ForexLive, Institutional Bank Research reports.

GBP plummets on 'constitutional' crisis: The GBP plunged after yet another spin in UK politics, which worsens the state of uncertainty around a no-deal Brexit following the decision by UK Prime Minister Boris Johnson to use his powers to suspend parliament from Sept 12 for 5 weeks after getting the approval by Her Majesty the Queen. This makes the window for parliament to oppose a no-deal Brexit incredibly tight as MPs will return on October 14th, while the Brexit deadline happens to be Oct 31st. The Speaker of the Commons Bercow described the move by Johnson as a “constitutional outrage.”

Johnson's threat of no-deal keeps getting real: Johnson is aiming for a deal with the EU but needs to up his threatening game of a no-deal as a bargaining chip. What this means is that parliament will come back from recess on Sept 3rd only to go back on recess 6 days later on Sept 9. Looks like he has two choices. Either the EU bends and eventually accepts to negotiate the backstop or if not, Johnson may call a general election, but if that were to occur, the Conservatives would most likely be split over Brexit, Labour not that popular which may lead to the Lib-Dems as having the upper hand.

Chances of no-deal Brexit on the rise: The betting markets have updated the quotes to now assign a no-deal Brexit at around 45%, while an exit with or without a deal at 52%. However, by reading a vast number of bank research reports, it looks as though a general election still remains the central scenario for the market. One must brace for the increase in volatility due to the risk headlines in the period ahead. We are definitely in for a lively period of erratic gyrations in the GBP, which makes trading the currency a dangerous proposal.

Risk dynamics remain shaky: The fluid situation in UK politics has been largely contained to a GBP affair, with the moves in risk-sensitive assets confined in relatively small ranges after a day where no major news outside the British island failed to be stimulatory enough to inspire significant price movements. That said, the risk dynamics remain on shaky ground as pointed in yesterday’s note, with the bearish trends in the S&P 500 and the US bond yields still prevalent, the yen and usd indices in bullish territory (negative sign for the global economy), gold holding at multi-year high, while the vol index (VIX) trades just below the 20.00 mark, an elevated level that hints levels of unrest remain high.

Trump keeps attacking the Federal Reserve day after day: On Wednesday, Trump tweeted: “Our Federal Reserve cannot “mentally” keep up with the competition - other countries. At the G-7 in France, all of the other Leaders were giddy about how low their Interest Costs have gone. Germany is actually “getting paid” to borrow money - ZERO INTEREST PLUS! No Clue Fed!” What I pointed out in yesterday’s note is crucial to understand. “There is a growing school of thought that President Trump’s latest strategy, ever since the Fed cut rates by less than he expected back in July (has coincided with the ramp-up in criticism), is aimed at leveraging his ability to engineer volatility as an economic policy tool to get the Fed to act more dovish on interest rates in order to weaken the dollar and provide the economy with renewed impetus heading into the 2020 elections.”

Mnuchin not overly optimistic on China talks: US Treasury Secretary Mnuchin, directly involved in leading the negotiations with China on trade, spoke in an interview with Bloomberg, said that the resumption of trade meetings will happen but perhaps not so soon. Mnuchn said he “expects Chinese negotiators to visit Washington, but wouldn't say whether a previously planned September meeting would take place”, adding that “we continue to have conversations. We're planning for them to come.” Mnuchin touched on the USD, noting that the Treasury does not intend to intervene on the USD for now, which means they don’t close the door to that possibility. Watch this space.

SNB ready to intervene on the CHF when needed: One of the reasons weighing on the ability of the CHF to keep up as a ‘risk-off’ play with the mighty JPY is the fear of continuous intervention by the Swiss National Bank. Its Governing Board Member Andrea Maechler, in comments on Wednesday, said that “right now we still have plenty of room for forex intervention.” Meanwhile, when it comes to the JPY, there is a growing realization that the bar for the BOJ/MOF to intervene in Japan has been raised as any artificial manipulation of the rate may lead to an immediate increase in trade tensions with the US.

Encouraging news out of Italian politics: Italian Prime Minister Giuseppe Conte will finally be given the mandate to form a new government and avoid a snap election, according to Bloomberg. Conte and the 5-Star Movement managed to pull it off by agreeing to form a coalition with the PD. Uncertainty remains high as what ahead in terms of forming a coalition and cabinet is quite a challenge, but there is no doubt that the prospects have improved judging by the collapse of the Italian 10-year yields.

PBOC readies launch of cryptocurrency: The People’s Bank of China is close to release its own cryptocurrency, according to various reports. "The PBOC plans to distribute its cryptocurrency through at least seven institutions in the initial stage, including Chinese tech giants Alibaba and Tencent, China's largest payments card issuer China UnionPay, and four Chinese state-owned banks." Despite the news, the crypto space has suffered a major slump overnight, with Bitcoin breaking below 10k usd.

Recent Economic Indicators & Events Ahead

Source: Forexfactory

A Dive Into The Charts

The indices show the performance of a particular currency vs G8 FX. An educational article about how to build your own currency meter can be found in the Global Prime's Research section.

The EUR index is looking fundamentally (on Italy’s political news) as well as from a risk dynamic standpoint (see ‘risk line’ in orange) as an interesting long play even if the chart still does not vindicate shifting the stance to bullish from a daily perspective. The currency is trapped in range-bound action for the last 2 weeks, which makes playing the edges where turnarounds are most likely to occur the most sensible strategy until a resolution of the non-directional period.

The GBP index is the only currency detached from risk dynamics as it trades extremely susceptible to the risk headlines around the no-deal Brexit prospects. On the chart, we can clearly see how the sharp pullback from Wed found buyers at the retest of the baseline. The index still remains in positive territory and is still way too premature to gain short exposure. The GBP is about to become a very tough currency to navigate and trade in coming weeks.

The USD index is on the verge of breaking into new trend highs, currently testing a level of resistance even if the close at the highs of the day by NY does suggest that pressure is building up to see a breakout into higher auction levels across the G8 FX space. The risk line (in orange), which indicates the level of ‘risk off’ in the market trades at elevated levels, indicating that the market will keep seeking out protection by amassing US Dollars. The correlation between the risk line and the USD index remains very high since early August.

The CAD index trades in no man’s land, away from the areas drawing the most interest to gain long/short exposure. The last test of resistance was rejected given the wholesale value that existed to add shorts as the ‘risk-on line’ (in orange) stood very depressed. I personally would continue to hold an overall neutral to bearish stance in the index given the discrepancies that still exist between the pricing of the CAD and the gloomy risk dynamics ahead.

The JPY index continues to face the prospects of further buying pressure as the rationale here is that the Japanese currency is yet to catch up to the elevated levels of risk aversion in the market, mainly driven by lower bond yields, as clearly depicted by the ‘risk-off’ line, which accounts for the S&P 500 and the US 30Y bond yields in equal weight. Notice how strong the correlation is between the risk line and the Yen index? It suggests that the current valuation of the Yen remains at cheap levels judging by where we stand on the risk front.

The CHF index has faked its downward break of the baseline, and as noted in yesterday’s note, since the price was heading straight into an area of reference (support) at a time when the ‘risk-off’ line was very elevated, it’s led to buyers regrouping to push the currency back up above the baseline with a marginal increase in aggregate tick volume. As in the case of the JPY, the risk remains skewed towards the upside on the CHF as more catch up seems to be in store.

The AUD index is unlikely to attract much buying interest based on the current risk profile in the market (see ‘risk on’ orange line at very low levels). Technically, the index is also displaying bearish tendencies as it trades below the daily baseline (13ema). The higher the Aussie goes from here, the more the interest it will attract by sellers to engage at better prices. Note, today’s AUD outlook will also depend on the Capex release, which may influence the sentiment.

The NZD index continues to trade on the back foot, with no respite being found from its constant bleeding lower, regardless of the fact that RBNZ Governor Orr has implied that the bar to cut further rates after the 50bp cut shocker earlier this month has now been raised. The market is unquestionably jumping on the bearish bandwagon in what’s become the best trend to trade in currencies within the G8 FX space that I monitor during the month of August.

Important Footnotes

- Risk model: The fact that financial markets have become so intertwined and dynamic makes it essential to stay constantly in tune with market conditions and adapt to new environments. This prop model will assist you to gauge the context that you are trading so that you can significantly reduce the downside risks. To understand the principles applied in the assessment of this model, refer to the tutorial How to Unpack Risk Sentiment Profiles

- Cycles: Markets evolve in cycles followed by a period of distribution and/or accumulation. To understand the principles applied in the assessment of cycles, refer to the tutorial How To Read Market Structures In Forex

- POC: It refers to the point of control. It represents the areas of most interest by trading volume and should act as walls of bids/offers that may result in price reversals. The volume profile analysis tracks trading activity over a specified time period at specified price levels. The study reveals the constant evolution of the market auction process. If you wish to find out more about the importance of the POC, refer to the tutorial How to Read Volume Profile Structures

- Tick Volume: Price updates activity provides great insights into the actual buy or sell-side commitment to be engaged into a specific directional movement. Studies validate that price updates (tick volume) are highly correlated to actual traded volume, with the correlation being very high, when looking at hourly data. If you wish to find out more about the importance tick volume, refer to the tutorial on Why Is Tick Volume Important To Monitor?

- Horizontal Support/Resistance: Unlike levels of dynamic support or resistance or more subjective measurements such as fibonacci retracements, pivot points, trendlines, or other forms of reactive areas, the horizontal lines of support and resistance are universal concepts used by the majority of market participants. It, therefore, makes the areas the most widely followed and relevant to monitor. The Ultimate Guide To Identify Areas Of High Interest In Any Market

- Trendlines: Besides the horizontal lines, trendlines are helpful as a visual representation of the trend. The trendlines are drawn respecting a series of rules that determine the validation of a new cycle being created. Therefore, these trendline drawn in the chart hinge to a certain interpretation of market structures.

- Correlations: Each forex pair has a series of highly correlated assets to assess valuations. This type of study is called inter-market analysis and it involves scoping out anomalies in the ever-evolving global interconnectivity between equities, bonds, currencies, and commodities. If you would like to understand more about this concept, refer to the tutorial How Divergence In Correlated Assets Can Help You Add An Edge.

- Fundamentals: It’s important to highlight that the daily market outlook provided in this report is subject to the impact of the fundamental news. Any unexpected news may cause the price to behave erratically in the short term.

- Projection Targets: The usefulness of the 100% projection resides in the symmetry and harmonic relationships of market cycles. By drawing a 100% projection, you can anticipate the area in the chart where some type of pause and potential reversals in price is likely to occur, due to 1. The side in control of the cycle takes profits 2. Counter-trend positions are added by contrarian players 3. These are price points where limit orders are set by market-makers. You can find out more by reading the tutorial on The Magical 100% Fibonacci Projection