Investing.com’s stocks of the week

Sterling markets had positioned for a weak GDP figure on Friday and a weak figure is what they got. I can’t understand the surprise however. PMI surveys from businesses in manufacturing, construction and services all averaged in contractionary territory through the last 3 months of the year, while current account figures last week emphasised a slowing of international trade. Consumer spending, or the lack thereof, can be summarised by the recent high-profile High St closures, with a low spending Christmas unable to prop up companies that have been forced to cut prices through the year to combat low demand.

That being said the pathetic nature of the UK recovery is clear. We haven’t grown in 3 years and the fact that a gas platform shut down, the lack of an Olympics or snow can see the difference between growth and contraction.

It is likely that this will be the final straw for our AAA credit rating and we expect a downgrade by at least one agency by the end of Q1. The impact of this is more political than anything however, and we emphasise that a downgrade will not prompt a “sterling crisis” or a crash in gilts. In fact we look at it as a positive as it alleviates one form of short-term uncertainty that has plagued GBP for the past few months.

Our GDP estimate for 2013 as a whole remains unchanged following this number at 0.6%.

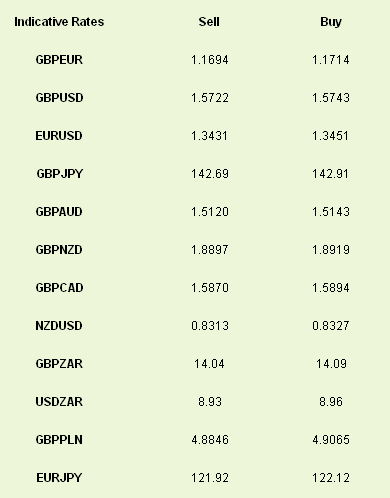

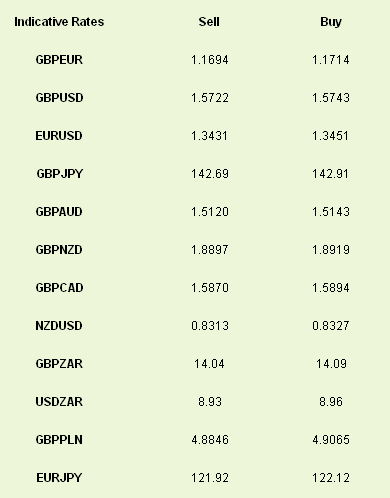

This, combined with more good news from Europe, has seen GBPEUR break into the 1.16s. This time the good news came after the announcement from the ECB that EUR137bn of the close to EUR1trn borrowed by European banks would be repaid in February. While this is good news it does lead to thoughts that, in the longer term, this could be a negative for European periphery debt as collateral used against the loans are sold following the rally that they have benefited from through the past 6 months.

Financial concerns are easing in the Eurozone but this must not be mistaken for an improvement in the crisis; a sovereign debt issue has merely been Draghi’d away and has now been replaced by a growth crisis. Problems from this will occur as the ECB remains vehemently anti-inflation and the euro strengthens on interest rate differentials.

That being said, the euro is not at particularly high levels against long-term averages but then again, it’s not like the Eurozone is enjoying economic productivity at long-term average levels either. Measures to bring the euro lower are not the kind of policy that central banks tend to apply to the growth crisis that the region finds itself in. If the sovereign crisis was still an issue then I don’t think that we would be talking about it.

Sterling has also been taken lower by comments from current Bank of Canada and future Bank of England Governor Mark Carney at the World Economic Forum in Davos about the role of further monetary policy in developed markets. Carney stated that policy is not “maxed out” and although he didn’t tie these thoughts to the UK economy, you have to think that he is preparing the ground for some form of policy shift.

The data calendar is quiet today but heats up later in the week with the latest Fed decision and Friday’s payrolls and global manufacturing PMI run.

That being said the pathetic nature of the UK recovery is clear. We haven’t grown in 3 years and the fact that a gas platform shut down, the lack of an Olympics or snow can see the difference between growth and contraction.

It is likely that this will be the final straw for our AAA credit rating and we expect a downgrade by at least one agency by the end of Q1. The impact of this is more political than anything however, and we emphasise that a downgrade will not prompt a “sterling crisis” or a crash in gilts. In fact we look at it as a positive as it alleviates one form of short-term uncertainty that has plagued GBP for the past few months.

Our GDP estimate for 2013 as a whole remains unchanged following this number at 0.6%.

This, combined with more good news from Europe, has seen GBPEUR break into the 1.16s. This time the good news came after the announcement from the ECB that EUR137bn of the close to EUR1trn borrowed by European banks would be repaid in February. While this is good news it does lead to thoughts that, in the longer term, this could be a negative for European periphery debt as collateral used against the loans are sold following the rally that they have benefited from through the past 6 months.

Financial concerns are easing in the Eurozone but this must not be mistaken for an improvement in the crisis; a sovereign debt issue has merely been Draghi’d away and has now been replaced by a growth crisis. Problems from this will occur as the ECB remains vehemently anti-inflation and the euro strengthens on interest rate differentials.

That being said, the euro is not at particularly high levels against long-term averages but then again, it’s not like the Eurozone is enjoying economic productivity at long-term average levels either. Measures to bring the euro lower are not the kind of policy that central banks tend to apply to the growth crisis that the region finds itself in. If the sovereign crisis was still an issue then I don’t think that we would be talking about it.

Sterling has also been taken lower by comments from current Bank of Canada and future Bank of England Governor Mark Carney at the World Economic Forum in Davos about the role of further monetary policy in developed markets. Carney stated that policy is not “maxed out” and although he didn’t tie these thoughts to the UK economy, you have to think that he is preparing the ground for some form of policy shift.

The data calendar is quiet today but heats up later in the week with the latest Fed decision and Friday’s payrolls and global manufacturing PMI run.