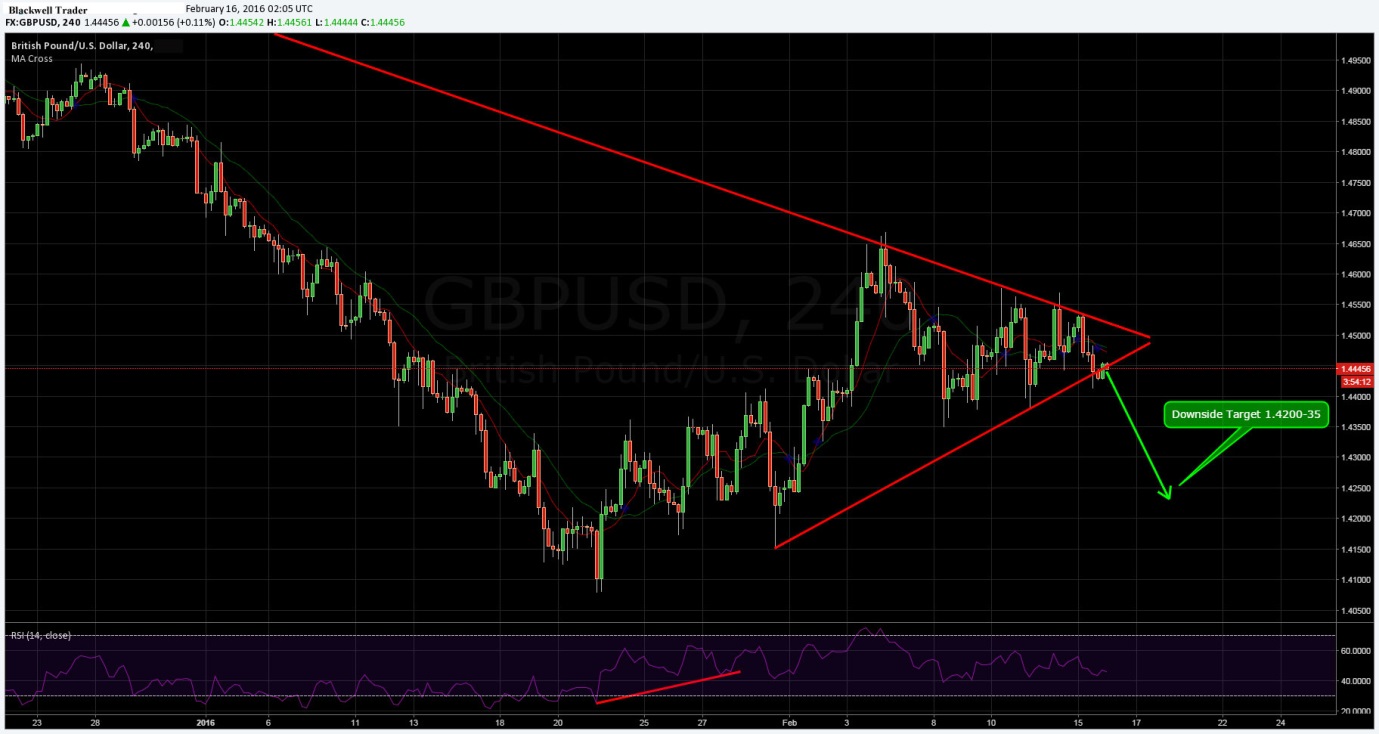

The past few days have seen the cable grappling with both sliding UK economic data as well as a resurgent US dollar. Subsequently, the pair is now challenging the bottom of the wedge pattern that has been constraining much of its moves. However, the question remains; will the pair move to breakout of the wedge and through the key 1.44 handle, or falter and return to status quo?

The cable’s technical indicators have largely been a mixed bag over the past week as price action remained constrained by a wedge pattern. However, the pair appears to have just breached the wedge on the downside and a potential short play could be in the wind.

The 4-hour chart provides the context for a short push as price action has penetrated through the bottom of the wedge, signalling the potential for a sharp pullback. In addition, lower highs are now becoming dominant, further adding to the bearish momentum and our overall bias. RSI is also trending lower, within neutral territory, whilst price has broken below the 100-Day moving average.

In fact, the daily chart is also demonstrating some downside potential as the medium term bear trend remains in place despite numerous tests of the upside. Supporting the contention for further short selling, Friday saw a clear Doji appear on the daily chart that is likely indicative of the current setup occurring in other time frames.

Ultimately, there are some very strong signals that demonstrate the cable is preparing for a sharp pull back towards the 1.42 region. Subsequently, look for a confirmed break of the current wedge pattern with entries around the 1.4435 level and targets down towards the 1.42 handle. However, be wary of the upcoming UK Core Retail Sales and Unemployment figures, due soon, as a strong result could spoil the party.