The “Draghi rally” following Thursday’s initial disappointment continued yesterday with GBP/EUR falling to a one-month low and EUR/USD pressuring the 1.24s. This has been driven by falling yields on European periphery debt and in particular the short-term debt of Spain.

We look at the shorter-term money because it gives us a picture of how Madrid, if at all, is able to borrow in the money markets. This measure has fallen by over 0.5% since Mario Draghi finished speaking on Friday and now sits below 3.5%. Put this against a 7% level a fortnight ago and you can see that this is a significant improvement. Similar if less dramatic falls have been seen in Italian and Portuguese debt as well, reflecting the market belief that the ECB will come in and buy these debts in due time.

Aussie dollar has remained strong for the past fortnight despite market tensions and is close to a 5 month high at current levels thanks to an inactive RBA overnight. The Reserve Bank of Australia held rates at 3.5% overnight and signalled to the market that although there is obvious room for looser monetary policy, there is no reason to move anything yet. Inflation is towards the top end of the range in Australia and fresh taxes have seen this increase but the RBA is happy that “core” prices are at comfortable levels.

As with all central bank communications now, the emphasis was on what Europe could possibly do to the world economy. The RBA summed it up nicely by saying that Europe “will remain a potential source of adverse shocks for some time”. These shocks can be positive as well as negative of course.

The Bank of England would love to have an economy that warrants an interest rate of 3.5% but it is not to be. The recent run of poor data from the UK has many origins (poor weather, the Jubilee, the Olympics) and today’s Industrial and Manufacturing Production number is unlikely to break that trend. Last week’s manufacturing PMI was stinking and drops of over 3% month on month are forecast. The impact is unlikely to be too crippling however; save for the newspaper howls.

Today’s Italian GDP figure (10am) will be the main focus in Europe alongside German factory orders (11am). Germany has been dragged into the mire in the past few months and this is likely to continue through the summer.

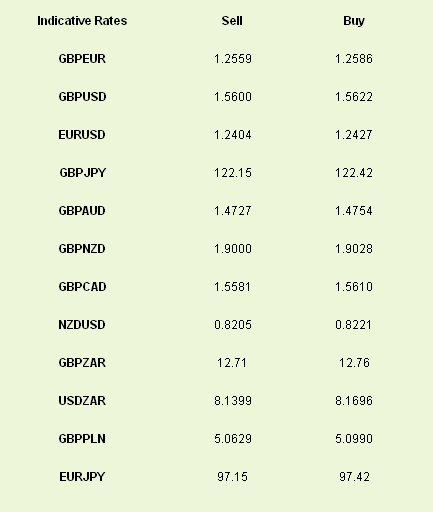

Latest exchange rates at time of writing

We look at the shorter-term money because it gives us a picture of how Madrid, if at all, is able to borrow in the money markets. This measure has fallen by over 0.5% since Mario Draghi finished speaking on Friday and now sits below 3.5%. Put this against a 7% level a fortnight ago and you can see that this is a significant improvement. Similar if less dramatic falls have been seen in Italian and Portuguese debt as well, reflecting the market belief that the ECB will come in and buy these debts in due time.

Aussie dollar has remained strong for the past fortnight despite market tensions and is close to a 5 month high at current levels thanks to an inactive RBA overnight. The Reserve Bank of Australia held rates at 3.5% overnight and signalled to the market that although there is obvious room for looser monetary policy, there is no reason to move anything yet. Inflation is towards the top end of the range in Australia and fresh taxes have seen this increase but the RBA is happy that “core” prices are at comfortable levels.

As with all central bank communications now, the emphasis was on what Europe could possibly do to the world economy. The RBA summed it up nicely by saying that Europe “will remain a potential source of adverse shocks for some time”. These shocks can be positive as well as negative of course.

The Bank of England would love to have an economy that warrants an interest rate of 3.5% but it is not to be. The recent run of poor data from the UK has many origins (poor weather, the Jubilee, the Olympics) and today’s Industrial and Manufacturing Production number is unlikely to break that trend. Last week’s manufacturing PMI was stinking and drops of over 3% month on month are forecast. The impact is unlikely to be too crippling however; save for the newspaper howls.

Today’s Italian GDP figure (10am) will be the main focus in Europe alongside German factory orders (11am). Germany has been dragged into the mire in the past few months and this is likely to continue through the summer.

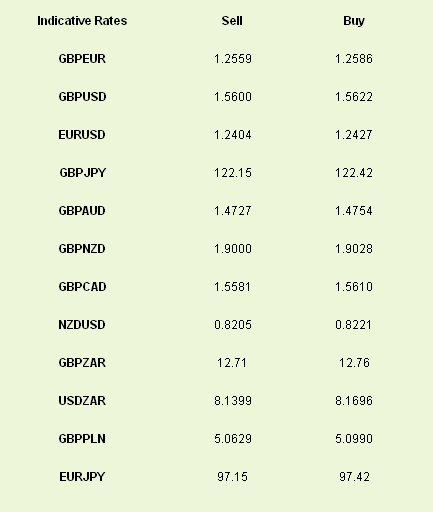

Latest exchange rates at time of writing