Market Brief

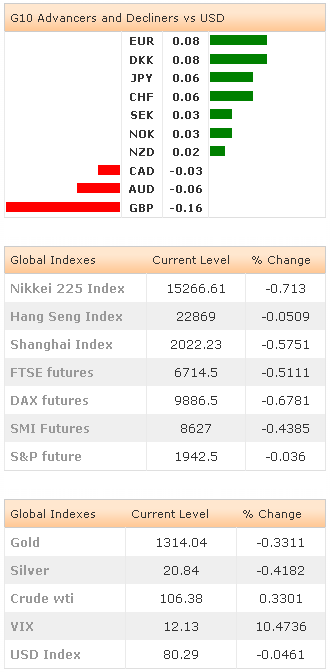

The FX markets traded in tight ranges with light position adjustments through the Asian session. USD/JPY and JPY crosses did little in Tokyo. USD/JPY eased to 101.86/102.00 range after hitting 102.17 in New York yesterday. The good US data pushed the US yields shortly upwards. The unexpected and significant increase in US new home sales (18.6% in May vs. 1.4% exp. & 6.4% last) shortly boosted the EUR/USD demand. The consumer confidence index showed improvement in June. Today, the focus shifts to US 1Q GDP, consumption and price index (third release). The expectations are soft following deterioration due to difficult winter conditions US went through. USD performance is mixed today.

In China, the consumer sentiment deteriorated in June according to survey realized by Westpack-MNI. Yuan extended losses versus USD for the third consecutive day, USD/CNY advanced to 6.2371. Hang Seng and Shanghai’s Composite retreated by 0.05% and 0.58% (at the time of writing). Chinese industrial profits data is due on Friday.

AUD/USD extends weakness to 0.9354 on position adjustment from the longs. The support zone is eyed at 0.9324/49 (50 & 21-dma), resistance is building at 0.9380/0.9400. A daily close below 0.9375 should confirm the short-term bearish reversal. AUD/NZD hovers around its 100-dma. Trend and momentum indicators are solidly negative. Key short-term support is seen at 1.0751 (Fib 76.4% on Oct’13 – Jan’14 drop). Option related offers stand at 1.0750/75 zone for today expiry.

The Cable extended weakness to 1.6961 as Asian players sold the BoE ambiguity at their turn. No technical levels have been damaged so far. Offers trail below 1.7000; option expiries at 1.6950/75 are likely to keep the upside limited. The next support stands at 1.6923, buying interest is seen at 1.6853/70 zone (50 & 21-dma). EUR/GBP finally consolidates recovery above 0.80000. Deeper correction should profit to the upside if the 0.80000 support holds. Offers are seen pre-0.80500/584 (optionality / 21-dma).

The volatilities continue fading in EUR/USD. Light bids continue defending the downside above the 21-dma (1.3594), the upside attempts remain limited at 1.3644/72 area (2-week high / 200-dma). A breakout on either side is needed for clear direction. EUR/GBP remains offered below its 200-dma (139.03), light stops are eyed above.

In Brazil, the real consolidates gains vs. USD at June highs; USD/BRL is offered pre-50-dma (2.2297). Low volatilities and cheap liquidities are still favorable for carry strategies.

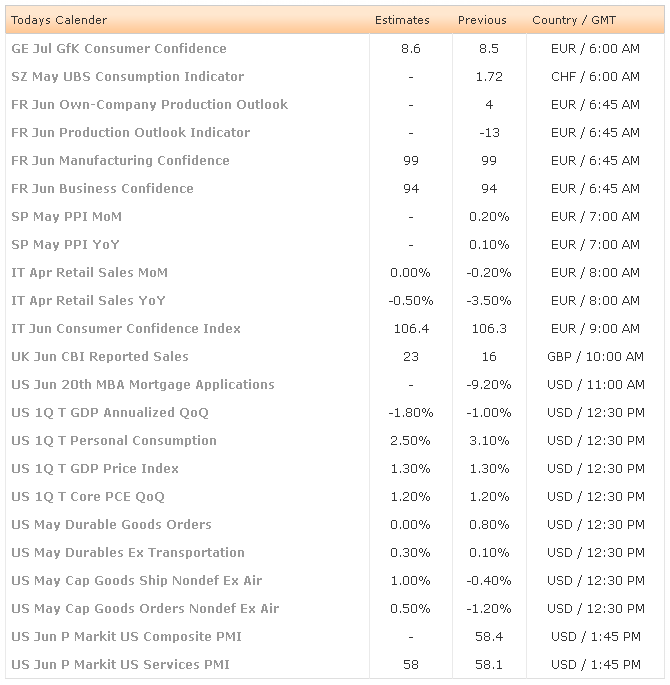

Today’s economic calendar consists of GfK Consumer Confidence in Germany in July, UBS’ Consumption Indicator in Switzerland in May, French June Manufacturing and Business Confidence and Production Outlook Indicator, Spanish May PPI m/m & y/y, Italian April Retail sales m/m & y/y and June Consumer Confidence Index, UK June CBI Reported Sales, US June 20th MBA Mortgage Applications, US 1Q ( Third) GDP Annualized q/q, Personal Consumption, GDP Price Index, Core PCE q/q, US May Durable Goods Orders and US June (Prelim) Services and Composite PMI.

Currency Tech

EUR/USD

R 2: 1.3677

R 1: 1.3644

CURRENT: 1.3609

S 1: 1.3594

S 2: 1.3565

GBP/USD

R 2: 1.7063

R 1: 1.6985

CURRENT: 1.6956

S 1: 1.6923

S 2: 1.6870

USD/JPY

R 2: 102.80

R 1: 102.20

CURRENT: 101.91

S 1: 101.69

S 2: 100.76

USD/CHF

R 2: 0.9037

R 1: 0.8975

CURRENT: 0.8934

S 1: 0.8911

S 2: 0.8882