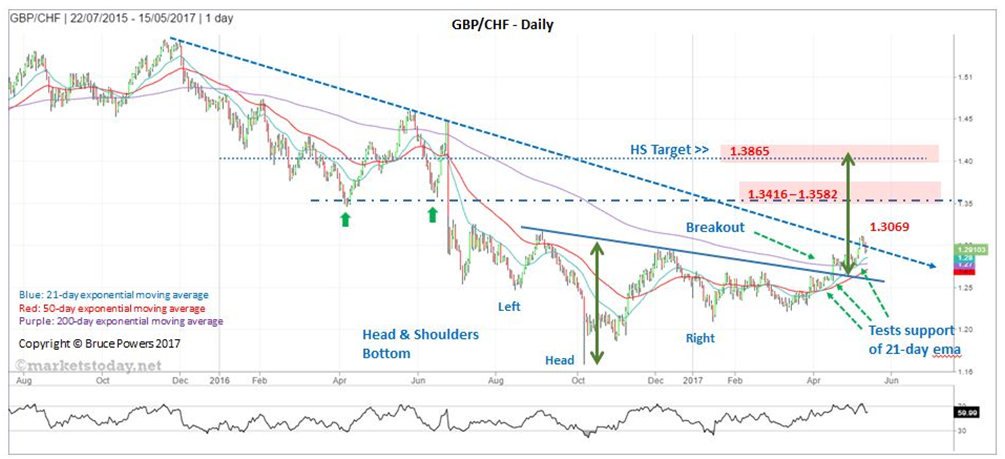

The larger pattern in the GBP/CHF remains bullish given the following:

- Decisive breakout of Head and Shoulders Bottom and also breakout above the 200-day exponential moving average (ema) occurred four weeks ago. (Note: Pattern is not perfect with right shoulder noticeably lower than left. But valid nonetheless given reaction of price following breakout above neckline and 200-day ema.)

- Subsequently, the GBP/CHF continues higher following breakout and last week breaks out above the long-term downtrend line and closes above it on a daily basis. Even though the pair has closed back below the trend line the move above the line indicates this pair probably wants to go higher.

- 21-day ema crosses above 200-day ema two weeks ago

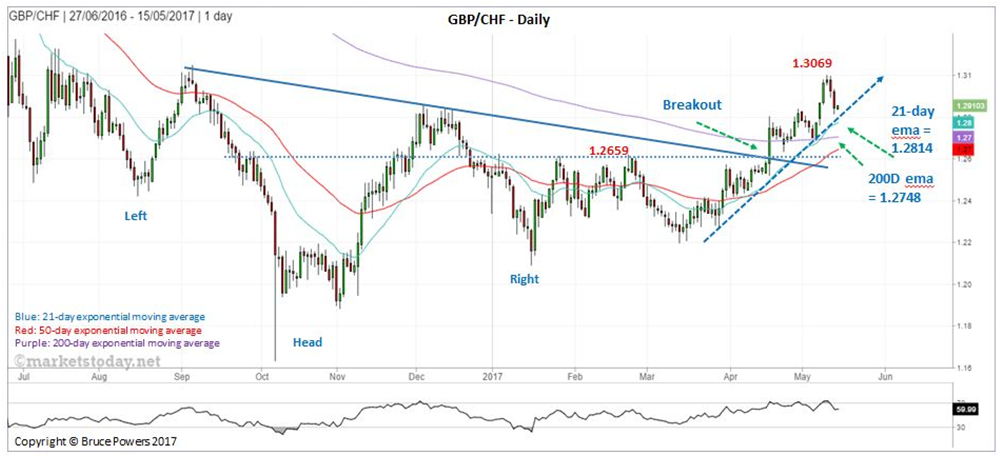

- During minor retracements price was rejected around 21-day ema support several times over the past six weeks and it held. This makes the 21-day ema a moving average to watch for support again in the future.

- The 200-day ema was tested once as support during recent pullback and it held. Support may be seen again around the 200-day ema during pull backs.

Given the above the odds favor an eventual continuation of the uptrend that began off the mid-March 1.2215 bottom. In the short-term this pair is overbought and starting to pull back. However, support of 21-day ema is close by at 1.2814. The probability that we’ll see signs of support around the 21-day ema is higher than normal given that the uptrend line represents the same price support area. On the below chart the uptrend line is covering the 21-day ema.

Regardless, if price continues lower the 200-day ema should halt further declines. The 200-day ema is now at 1.2748.

Watch price behavior around the 21-day ema for signs of reversal on the intraday charts. If the 21-day fails to hold the decent then next watch for support around the 200-day ema.

Upside potential is there given that the target from the Head and Shoulders Pattern is around 1.3865. This is a long-term target and it could take some time to meet this objective if it is to be reached.

In the meantime, lower down, the next main target area is around a price zone from approximately 1.3416 to 1.3582. That resistance zone provides plenty of upside as it’s over 500 pips above last week’s close of 1.2895.(www.marketstoday.net)