GBP/CHF has recently completed the well-formed Triangle chart pattern identified on the daily charts. We rate the overall Quality of this chart pattern at the 6 bar level as a result of the low Initial Trend (measured at the one bar level), near-maximum Uniformity (9 bars) and substantial Clarity (8 bars). Higher Uniformity of this Triangle reflects the even distribution of the connecting points of the upper and the lower trendlines of this chart pattern. The completion of this Triangle continues the long-term predominant downtrend visible on the daily and the weekly GBP/CHF charts.

Both of the connecting points of the upper resistance trendline of this Triangle (points A and B on the chart below) formed when the pair reversed sharply down from the strong resistance at the round price level 1.5000 (former major support which reversed powerful downtrend at the start of 2009, as is shown on the second chart below). The latest sharp downward reversal from 1.5000 (at point B) led to the strong Breakout (whose strength is measured at the maximum 10 bar level) of the lower support trendline. The pair is expected to fall further toward the Forecast Price 1.4696.

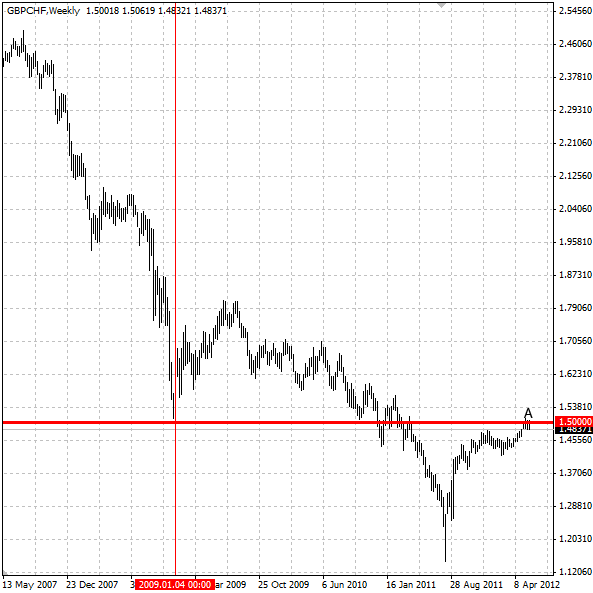

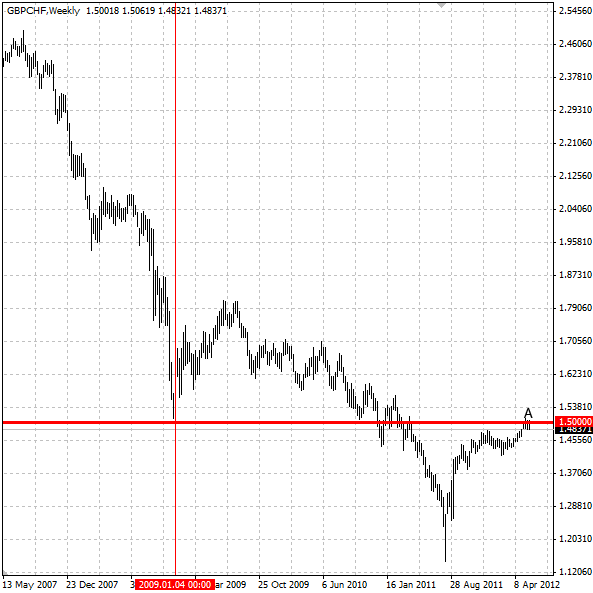

The following weekly GBP/CHF chart shows previous price action close to 1.5000:

GBP/CHF" title="GBP/CHF" width="593" height="593" />

GBP/CHF" title="GBP/CHF" width="593" height="593" />

Both of the connecting points of the upper resistance trendline of this Triangle (points A and B on the chart below) formed when the pair reversed sharply down from the strong resistance at the round price level 1.5000 (former major support which reversed powerful downtrend at the start of 2009, as is shown on the second chart below). The latest sharp downward reversal from 1.5000 (at point B) led to the strong Breakout (whose strength is measured at the maximum 10 bar level) of the lower support trendline. The pair is expected to fall further toward the Forecast Price 1.4696.

The following weekly GBP/CHF chart shows previous price action close to 1.5000:

GBP/CHF" title="GBP/CHF" width="593" height="593" />

GBP/CHF" title="GBP/CHF" width="593" height="593" />