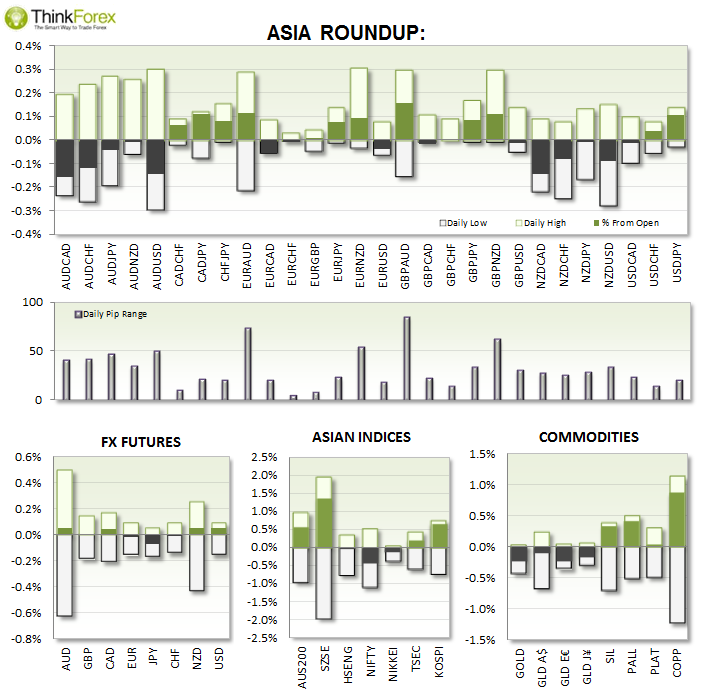

AUD: The Aussie saw a shortly lived rally following a narrowed Trade deficit and stonger than expected Retail sales. Within 2 hours the pair had reversed and printed yet another 4-year low.

UP NEXT:

TECHNICAL ANALYSIS:

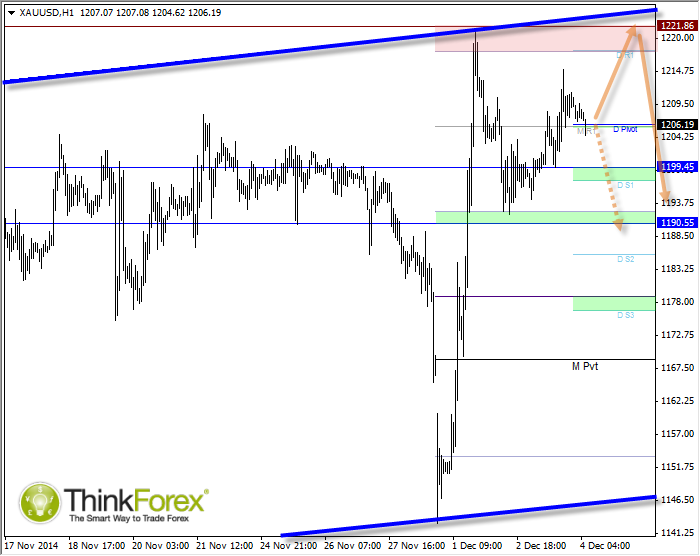

Gold: Expecting $1220 to hold as resistance

Gold, whilst spiky yet directional at the same time recently, does remain within a broad and slightly bullish channel. $1220 houses several technical levels which I expect to hold if tested again. Intraday price action suggests we may have another crack at this level too, so we can consider bullish setups above the Daily pivot for this move.

The downside I would prefer to wait for a break below $1190 before becoming committed to bearish setups. Besides, we also have $1200 to break through fist which I would expect to cause a reaction at least.

With ECB talking tonight and US data then Gold should get some moves on the way.

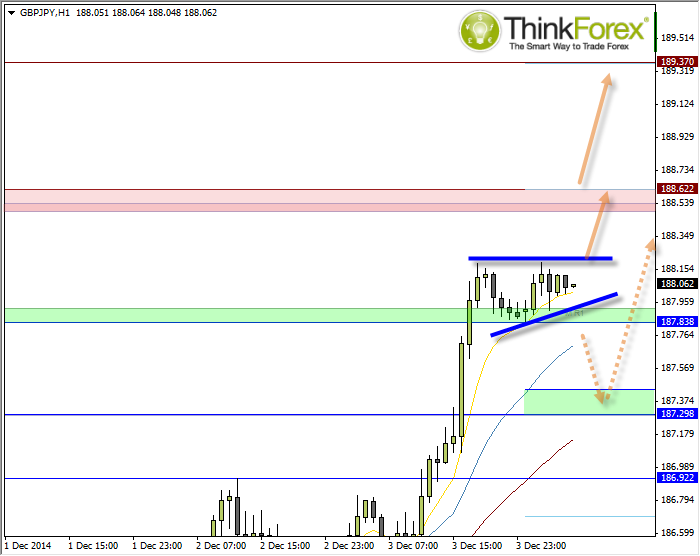

GBP/JPY: Remains bullish and expecting new highs

The bullish move unfolded quicker than expected, but was a pleasant surprise at least. Price rests above 187.8 support and forming a potential bullish triangle but we may also trade sideways leading up to the BoE tonight.

JPY crosses tend to work well for breakout trading so a buy-stop above the congestion may be a good option.

If we see a downside break then we could consider bullish setups above 187.30.

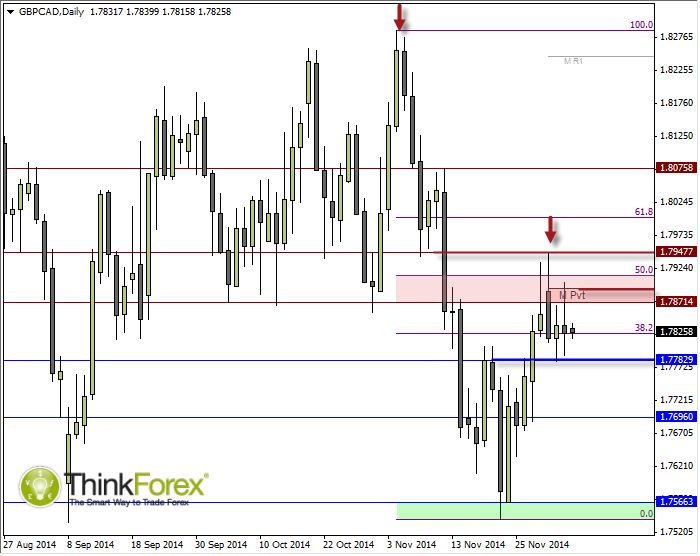

GBP/CAD: Break below 1.778 confirms bears back in control

This trade idea hasn't taken off quite yet but we may be approaching. We certainly have the catalysts on hand with BoE and CAD manufacturing data.

A break below 1.778 would suit sell-stop orders. Alternatively we can sell at market to assume a bearish move, or set sell-limits within one of the many sell-zone to catch any up spikes.

A break above 1.795 invalidates the analysis.