The pound-Canadian dollar is not a pair on many traders’ radars. But it is a volatile one and an old resistance line could provide an opportunity to grab some pips.

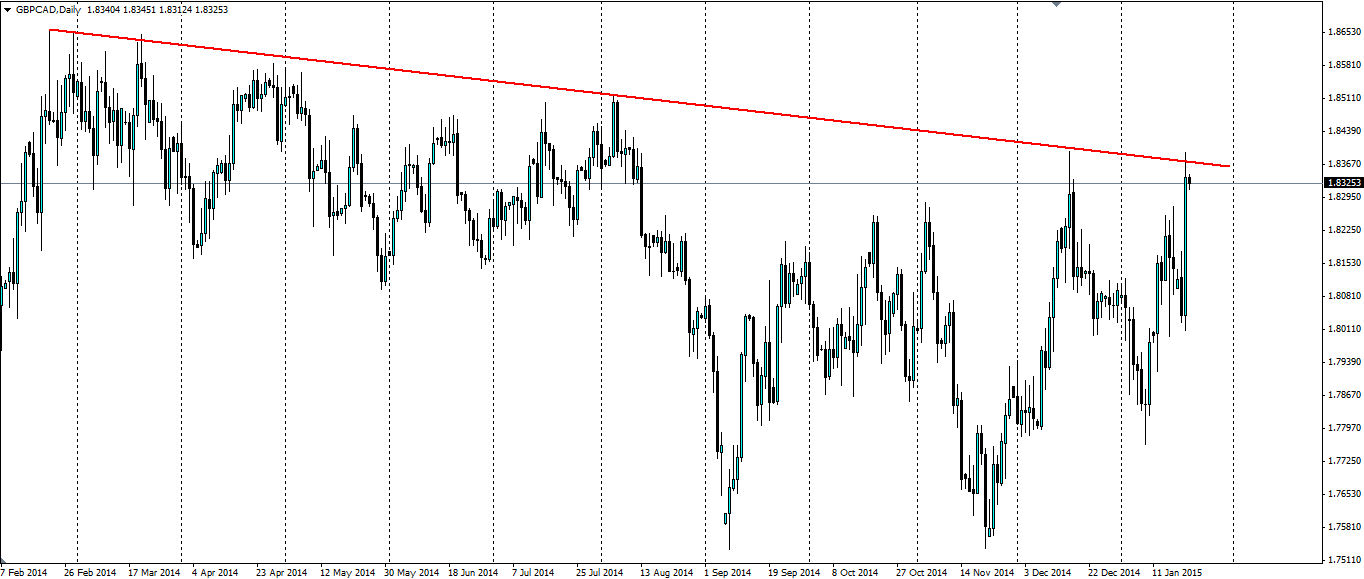

Source: Blackwell Trader

Firstly the GBP/CAD pair is an extremely volatile pair so anyone looking to trade should exercise proper caution and risk control. It is not unusual for this pair to swing large amounts. From 21st November to 15th December this pair gained 850 pips. Three weeks later it gave most of it back.

For the past year the pound-CAD pair has been struggling to get close to its previous highs. Each subsequent high has been lower, leading to a slight bearish bias to the resistance at the top. This has just come into play once again and the market has obliged and pulled back. Anyone who likes to trade the ABC waves will enjoy looking at the above chart.

There is some big news to watch out for due for both the pound and the Canadian dollar today. The pound will see the Monetary Policy Committee voting breakdown released at the same time as the Unemployment Rate (09:30 GMT). For the Canadian dollar, watch out for Wholesale Sales (at 13:30 GMT) and the Overnight Rate accompanied by the Bank of Canada Governor Stephen Poloz’s statement. All of these news events could significantly move the market.

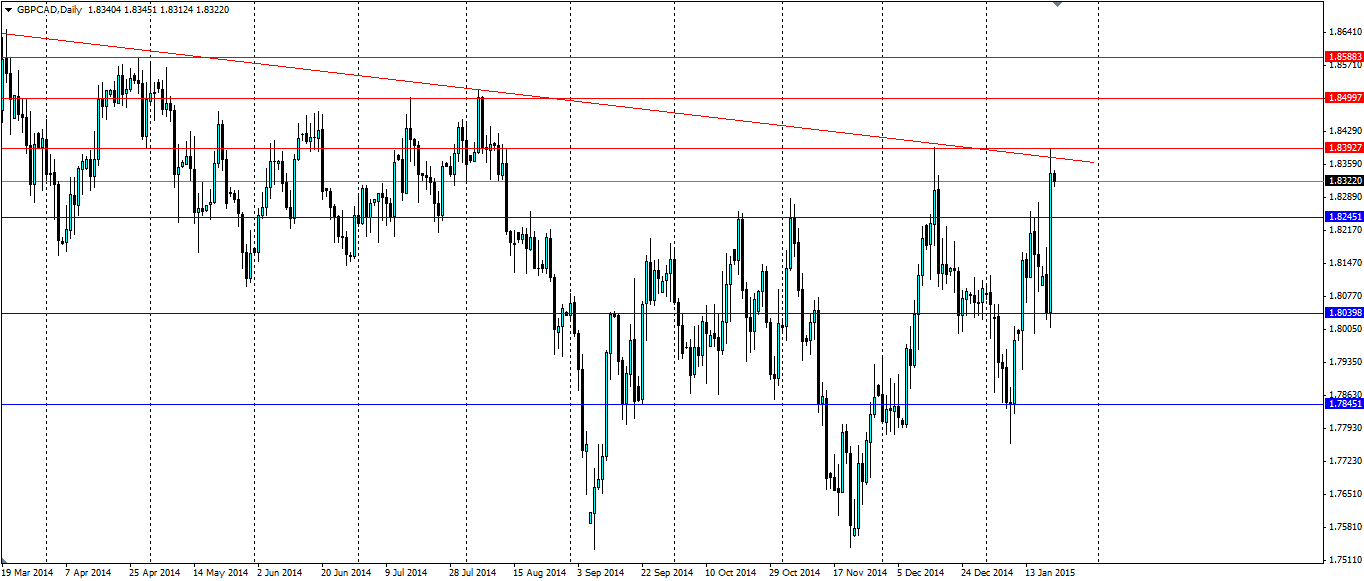

Source: Blackwell Trader

This pair also likes to play off some very clear levels of support and resistance. If the price rejects downwards, look for support to be found at 1.8245, 1.8039 and 1.7845. If we see an upside breakout through the resistance, look for further resistance to be found at 1.8392, 1.8499 and 1.8588.