The next 24 hours or so could be pretty significant for sterling with Theresa May now entering extra time when it comes to finding a Brexit resolution. Another fudge from the PM could help set GBP/USD on a path towards 1.36 this summer - and 1.40-1.45 by year-end.

While prime minister Theresa May faces an impossible Brexit trinity, a cheap pound trading at a discount to short-term economic fundamentals means that it’s still a good value play. Signs of a Brexit resolution would see some of this value realised – and we look for sterling to navigate towards levels consistent with a ‘neutral’ Brexit by year-end (GBP/USD: 1.45 and EUR/GBP: 0.85).

As for the immediate future, reports that pro-Brexit cabinet ministers will 'behave' over the coming months is a minor win for the currency. However, for Brexit risks to fully dissipate, the response from EU officials to the UK government’s Brexit plan is what truly matters for GBP markets. If Brussels feel they can work with Downing Street’s Brexit vision, then we could see a sizable relief rally in the pound – as FX investors turn their attention towards the prospects of an August Bank of England rate hike.

PM May’s ‘Impossible Brexit Trinity’ has left GBP wandering aimlessly for now

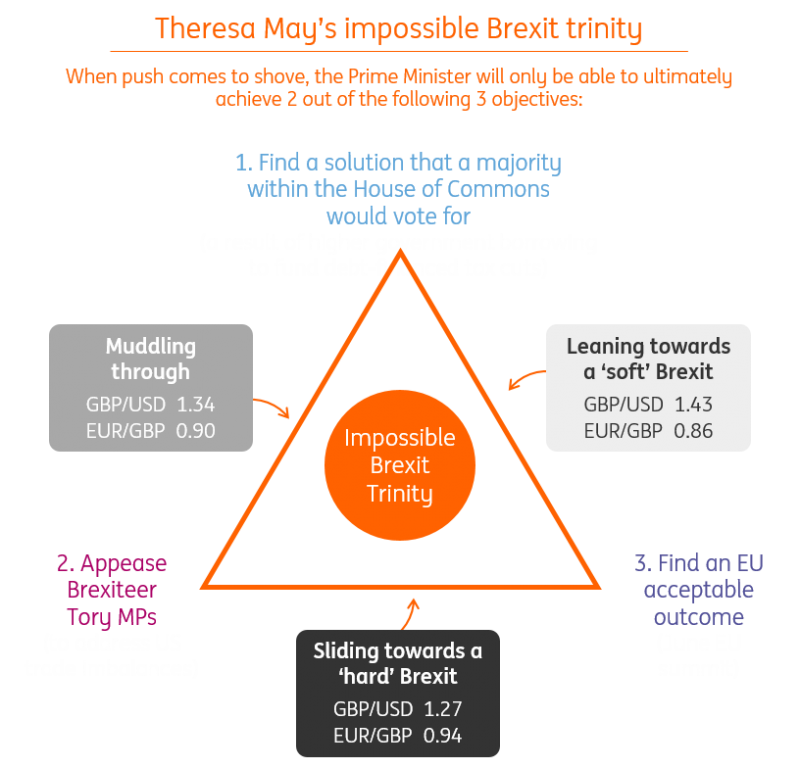

Theresa May’s predicament can be characterized as an 'impossible Brexit trinity' – with the PM trying to achieve three simultaneous objectives:

(1) Appease Brexiteer MPs within her party;

(2) Find a solution that a majority of MPs in the House of Commons would back; and

(3) Find an outcome that is politically suitable for all EU members to accept.

If push comes to shove, Mrs May will only be able to choose two out of these three objectives – with GBP’s broader trajectory a function of the PM’s choice as outlined below.

But a cheap GBP is ready for a sizable move higher if Brexit (and trade war) risks ease

All the noise out of the BoE suggests they are ready to hike again in August – with UK macro data having been relatively upbeat of late. But there are two big elephants in the room – a ‘no deal’ Brexit and a global trade war. Given that neither of these risks can be ignored, GBP is currently trading at a discount relative to where it should be if this were a pure BoE policy story.

If the PM does steer towards a ‘soft’ Brexit – one that keeps the UK in a single market for goods and mirrors the current customs union arrangement – then the tailwind of reduced Brexit risks, a BoE in tightening mode and neutral FX positioning would see GBP moving sharply higher. We still dare to dream that GBP/USD moves into the 1.40 territory by year-end.

Worst-case scenario? 'No deal' Brexit risks matter more than domestic political noise

What matters for financial markets is the type of Brexit delivered - not necessarily who delivers it from the UK side of things. In theory, GBP would be able to handle resignations from pro-Brexit ministers - as long as this doesn't result in any question marks over the PM's leadership.

If pro-Brexit ministers choose not to 'behave' as reports suggest, then GBP could easily fall back towards 1.30 as markets begin to price out expectations of an August Bank of England rate hike - on the assumption that an election is more probable over the coming months.

But GBP's worst outcome is if not only Theresa May's leadership is challenged - and rising tail risks of a UK general election this year - but if Brussels finds the UK government's Brexit plan as 'unworkable'. The latter would see heightened risks of a Brexit 'no deal' - and prolonged economic uncertainty - which is GBP's kryptonite.

In this worst-case scenario, we see GBP/USD sliding down to 1.25-1.27 - and EUR/GBP heading north towards 0.92-0.94.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer please click here.