The Pound versus the Aussie dollar has been following some technical patterns lately which can provide us with an opportunity to short the pair as it looks to bounce off a Fibonacci line and head down to its recent lows.

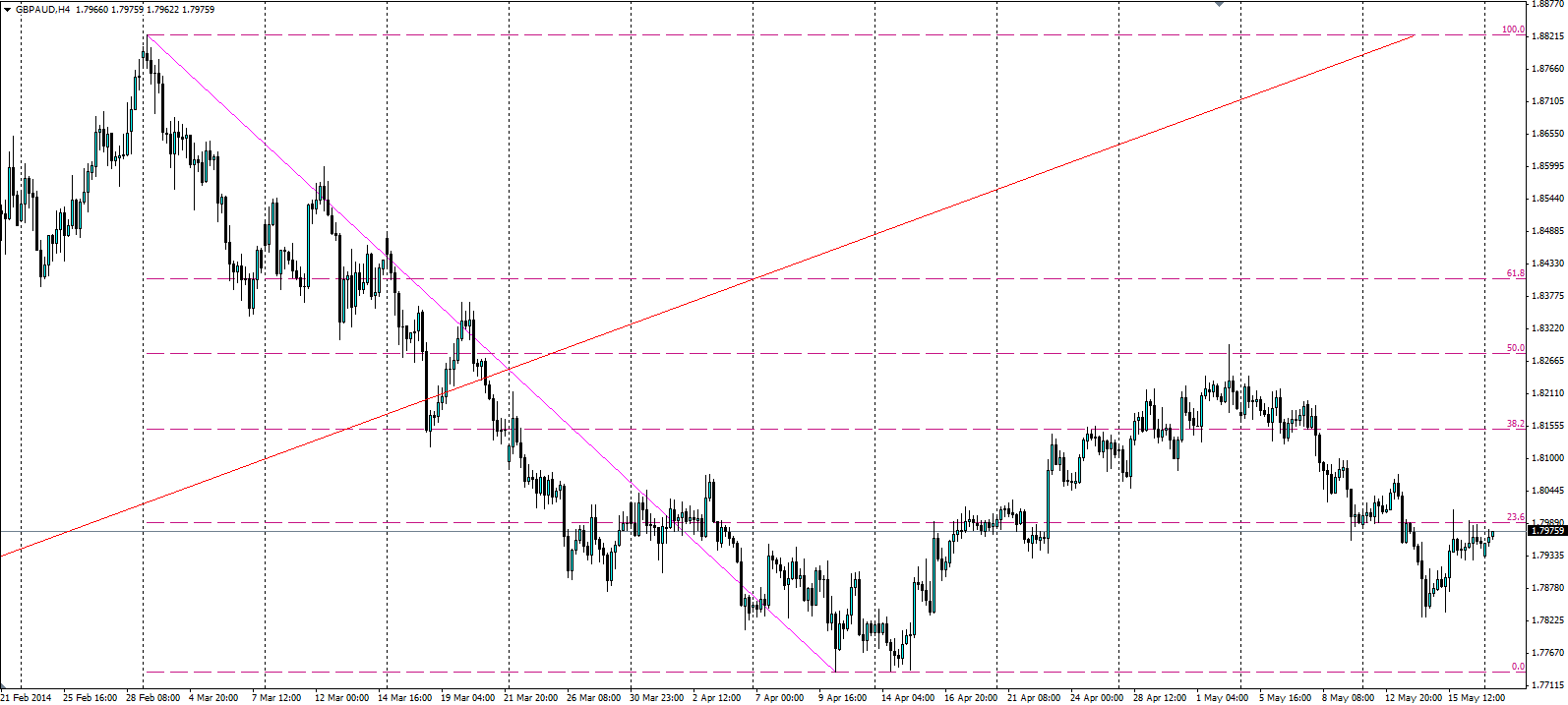

The downward movement through March is where we will draw our Fibonacci line and it becomes apparent just how much this pair relies on these lines for support and resistance levels. From the bottom, it was a quick retracement up to the 23.6% line which provided resistance until that was broken. Then again, it was a quick movement up to the 38.2% Fibonacci line as the below H4 chart shows.

Source: Blackwell Trader

The testing of the 50.0% Fibonacci line provides us with a very clear bearish rejection and the price has since made its way down below the 23.6% line again. However, the short term bearish trend looks to have just broken and signs point to a breakout of the 23.6% line.

Looking at the fundamentals, the Pound certainly looks the stronger of the two and recent positive economic data backs this up. The GDP estimate for this year was upgraded to 3.0% and early forecasts of CPI figures due out this week show the market expecting a 0.1% rise in inflation to 1.7%. The PPI and retail sales should also provide indications of economic health for the UK which has been looking solid lately.

The Aussie on the other hand has very little news out this week after the government released a very unpopular budget last week. The market seemed to take it well as it looks to reduce government spending in favour of a business tax cut to boost growth. Consumer confidence and inflation expectations should provide a little bit of direction, but in the absence of big news, all eyes will be on the UK data.

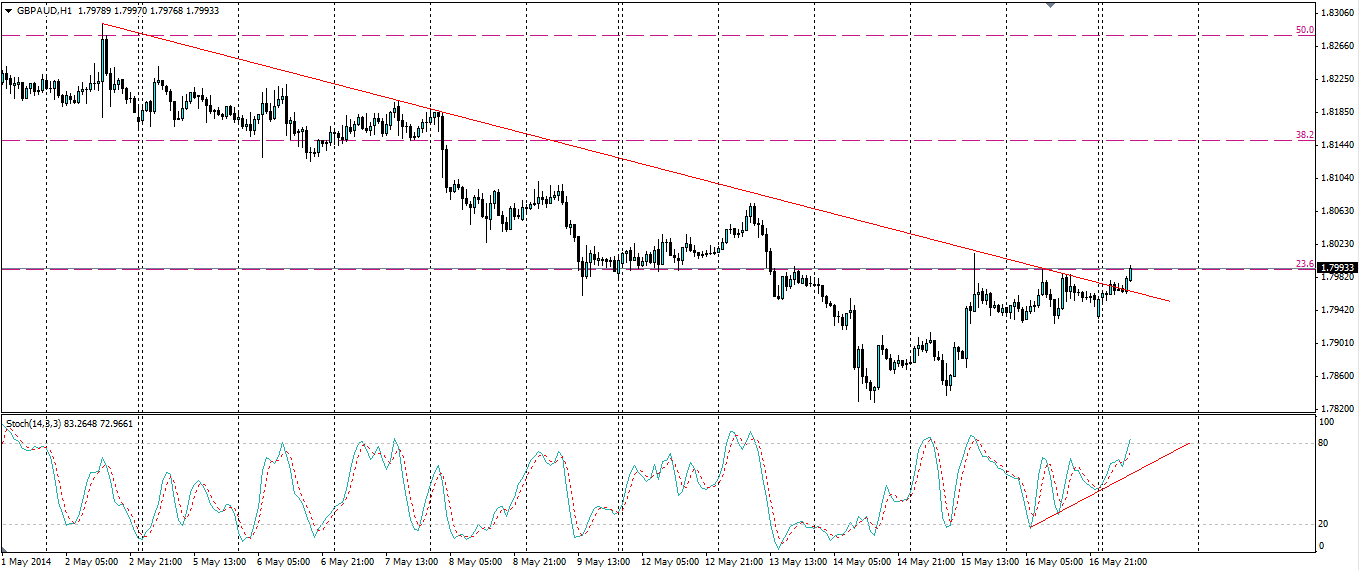

We can also look at the Stochastic Oscillator on the H1 chart to see a very clear bullish signal. The Oscillator has been posting higher lows and is currently showing the momentum to be with the bulls as the price looks to test the 23.6% line.

Source: Blackwell Trader

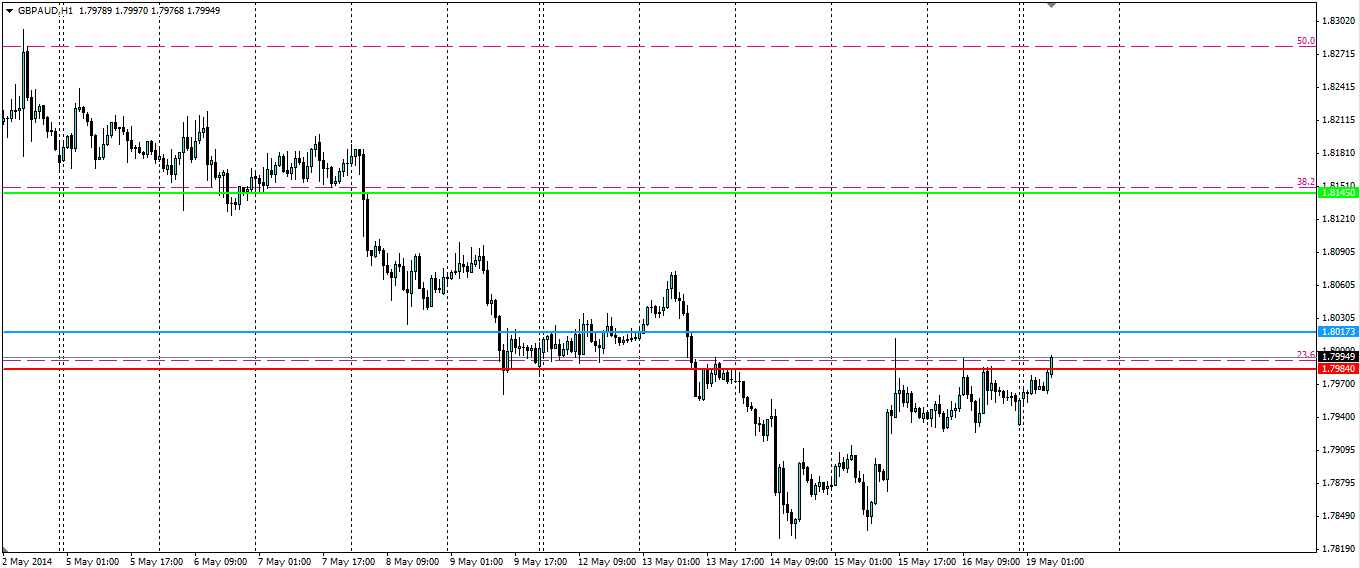

The logical strategy to play this setupis to long the pair on the breakout and, given the fundamental strength of the Pound with the upcoming economic news,should materialise. A stop buy should be set slightly above the resistance at 1.8017 and the first target should be the 38.2% Fibonacci line with the possibility it could test the 50.0% line again. A stop loss should be back below the line at the 1.7984 level.

Source: Blackwell Trader

The Fibonacci lines give us a clear indication of the support and resistance levels this pair likes to bounce off and that gives us targets for entry and exit points. The current intra-day indicators point to a bullish breakout of the 23.6% Fibonacci line, which could prove lucrative.