Investing.com’s stocks of the week

A refreshingly simple price-action setup may be establishing on the GBP/AUD, which if successful, should see it break to 3-month highs.

SUMMARY:

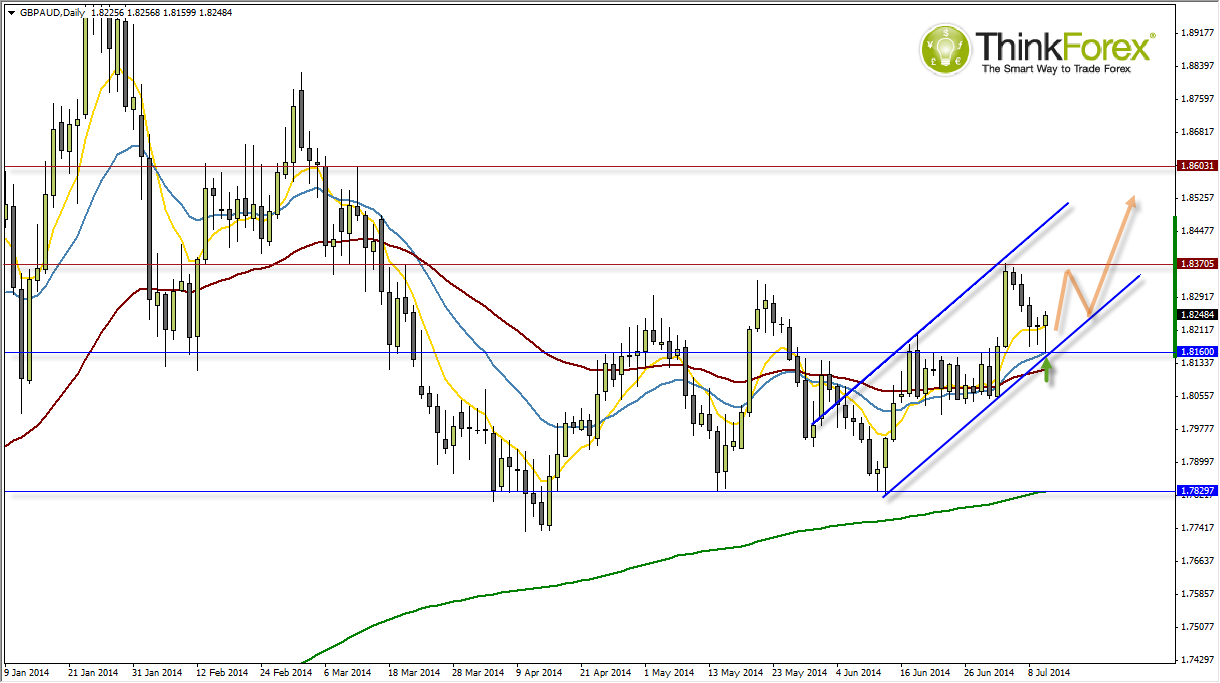

- Bullish channel and respect of 1.816 favours gains towards 1.837 (and eventually a breakout)

- Today's close (if bearish but above 1.816) may provide a better price to buy the dip

- A break below 1.816 would invalidate the analysis and see me stand aside, as we are back within range

While today's candle is yet to become complete the low of the day has already rejected 1.816 supports to suggest the potential for a bullish hammer in the making. This level also houses the 21-day eMA and a lower bullish channel. The below-expectations Chinese data today helped the GBP/AUD reject this level and with GBP rate statement out tonight there is potential for further gains here too (assuming BoE are more Hawkish of course).

In the event of a Dovish night then we should see the GBP/AUD recycle back towards 1.816 support, but I doubt we will break this tonight. This would leave us with a potential Inverted Hammer or Doji above support (and the opportunity to buy at a more favourable price).

While I suspect that 1.837 is a likely resistance, I am also anticipating this to break to new highs and out of the current trading range.