NZD: Unemployment drops to 5.4% and employment increases 0.8% q/q to far outweigh the -0.3% in Global Dairy prices.

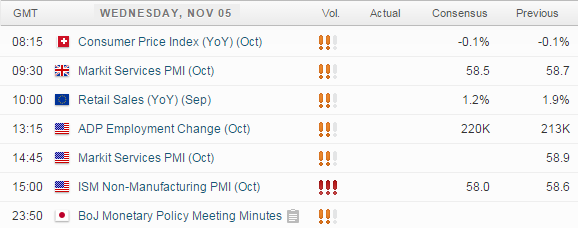

UP NEXT:

TECHNICAL ANALYSIS:

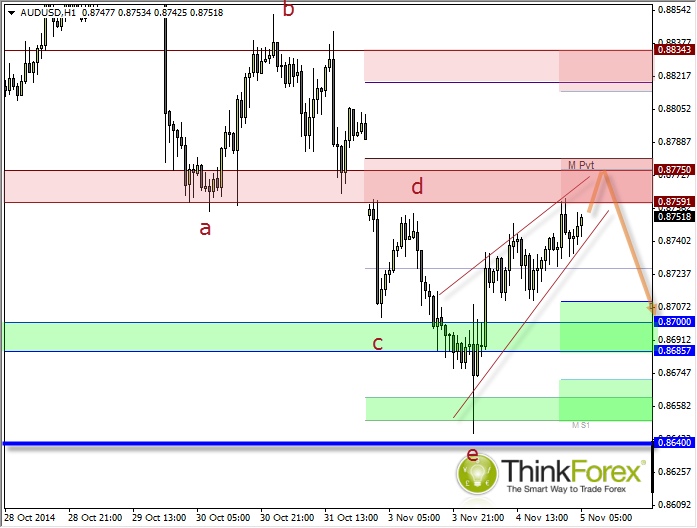

AUD/USD: Stalls below Monday's Gap

The pair has meandered up towards yesterday's bullish target and stalled just below the week's opening Gap. With price coiling up it suggests a Bearish Wedge is forming which would target the 0.864 lows but due to the zones of support then closer targets around 0.868 and 0.8370 may be a better approach.

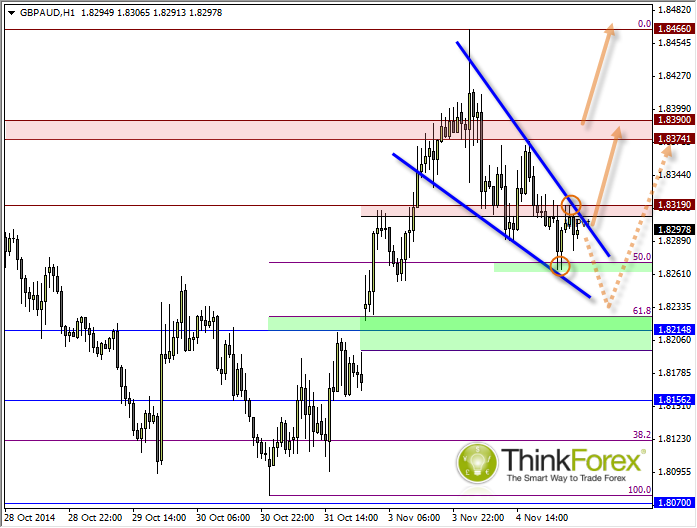

GBP/AUD: Potential Bullish Wedge above Monday's Gap

The original breakaway gap highlighted on Monday continues to hold and suggest continued gains are on the cards. After an impressive bullish continuation on Monday the pair has lost steam and now forms a potential bullish wedge.

Take note of the Bullish Piercing Line / Tweezer Bottom (circled) to suggest a swing low, above the previous swing low and opening gap on Monday.

We can consider a buy-stop above the 1.8320 high to catch a breakout, or seek a buy-limit further down to achieve a higher reward/risk ratio.

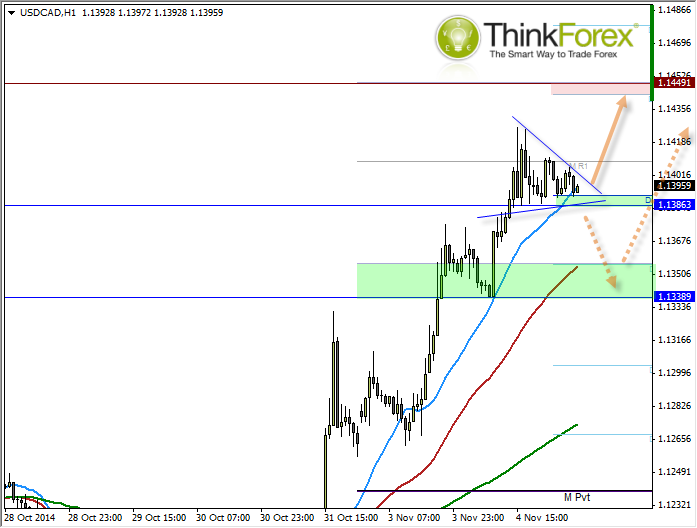

USD/CAD: Potential bull flag forming above Daily Pivot

Trends is clearly up so bullish setups are favoured. A slight word of caution is the reversal candles appearing on H4 but this does not necessarily mean a reversal is on the cards. It could just mean sideways trading prior to another leg up.