The GBP/AUD pair has been one that we have been paying a lot of attention to lately. With the British Pound, we have a currency that has been struggling, and the Aussie Dollar hasn’t been much better. Granted, the AUD has been gaining a bit – but still remains a bit soft, and the gold markets aren’t necessarily strong at this point. I know that the gold markets rallied, but in the end – we are still very much in a downtrend.

Because of this, I feel that the pair rolling over must have more to do with the Aussie than anything else. Perhaps it is a statement on the outlook of Asian growth. Maybe its gold. One thing I learned a long time ago is to avoid arguing with the market. In the end – the WHY doesn’t matter as much as the WHAT. If you remember that, you should do well in the end.

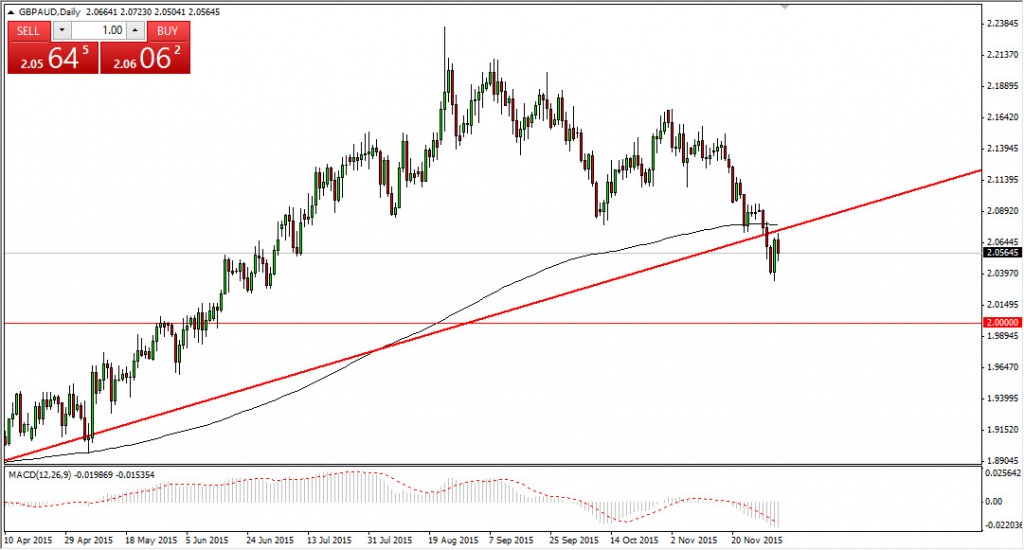

The pair has been selling off lately, but the most significant move was when we broke below the trend line. This trend line was very supportive for months, but finally gave way to selling pressure. The 200 day exponential moving average was broken below as well, and this in and of itself can be thought of as a longer-term trend signal. The market has bounced a bit, and finally retested the bottom of the broken trend line, and found resistance. With this, I am a seller as the market continues to look weak.

I think that you will be best served by “triangulating” the markets. By this, I mean that you need to pay attention to the AUD/USD pair, the GBP/USD pair, and of course this chart. The XXX/USD pairs are a great way to gauge the strength of a currency, so if you have a clear winnner in the AUD/USD and GBP/USD pairs, then it makes sense that the currency will be stronger than the other one. Lately, we have seen a bounce in the AUD/USD pair, and a selloff in the GBP/USD pair. This makes the breakdown in the GBP/AUD pair a no-brainer, and one that Adrian and I are taking very seriously. We are sellers of rallies, and anticipate that this pair will visit the 2.00 level soon.