As many traders will know by now the pound is looking very good on the charts as it goes from strength to strength. Yesterday’s Manufacturing PMI came as no surprise to many, however, it was much stronger than anyone expected at 57.5, which is a solid expansion in the economy (anything above 50 is expansion). With all these strong fundamental moves many are looking for options on the charts and the GBP/USD certainly looks like a good candidate.

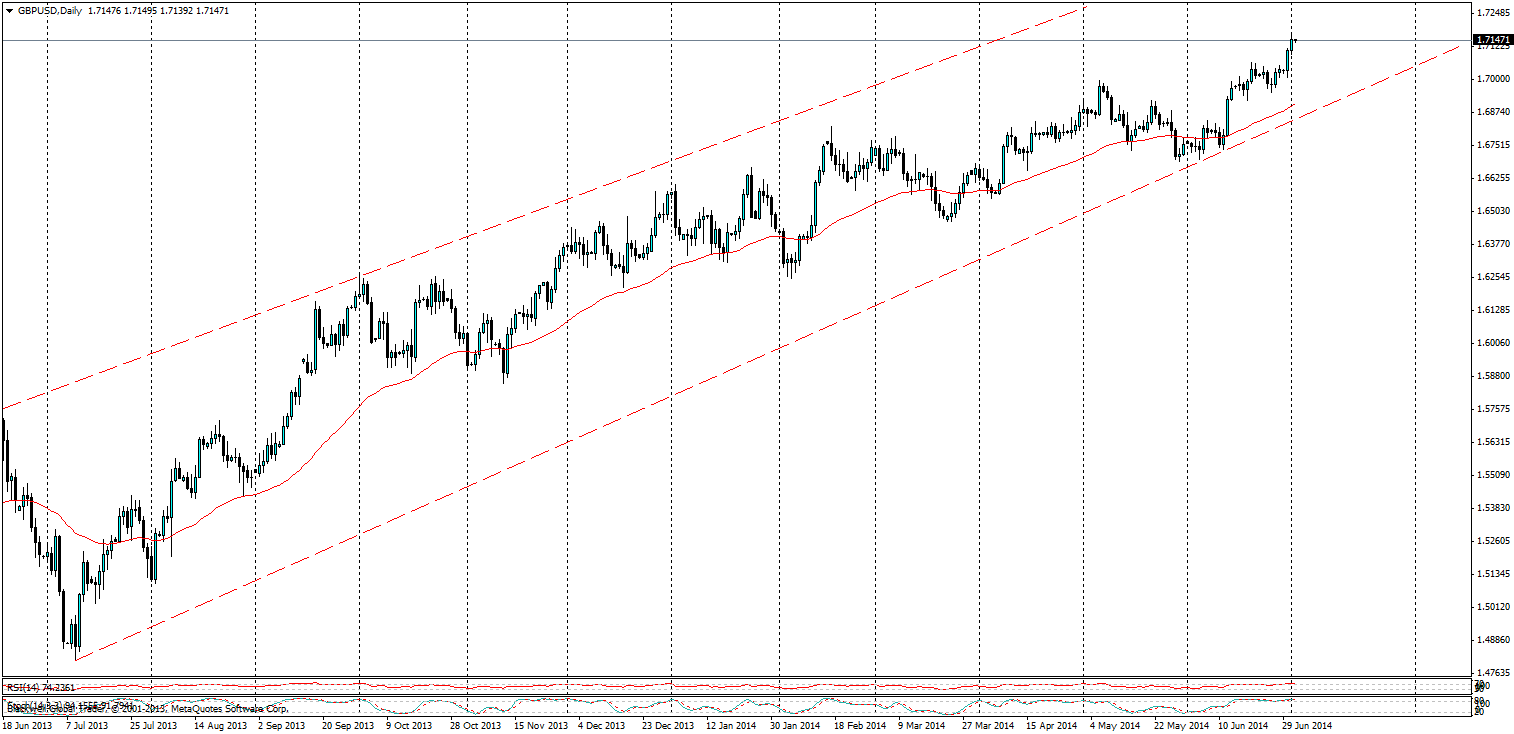

Source: Blackwell Trader (GBPUSD, D1)

A strong upward channel has formed, nevertheless, this pair is not looking so great in terms of an entry point – most traders need a point to enter the market rather than just slapping down a trade and hoping/waiting. Currently there is really no reference point to enter, however, if you were looking for a solid point of resistance it would most likely be found around 1.7492 or alternatively 1.7500 the psychological level.

Either way there is still two strong economic data releases for the pound. Construction PMI data is due out and so is Services PMI; both of which are going to have some impact. So far the Manufacturing PMI was strong and this bodes well for the economy as a whole, but Services is important when you look at the economy and the services sector dominates 75% of your economy overall.

So moves ahead for the pound and on the GBP/USD you could get caught either way as it can take big swings in either direction. So while I am an advocate of the GBP/USD, I think the GBP/JPY is actually a better trading opportunity overall.

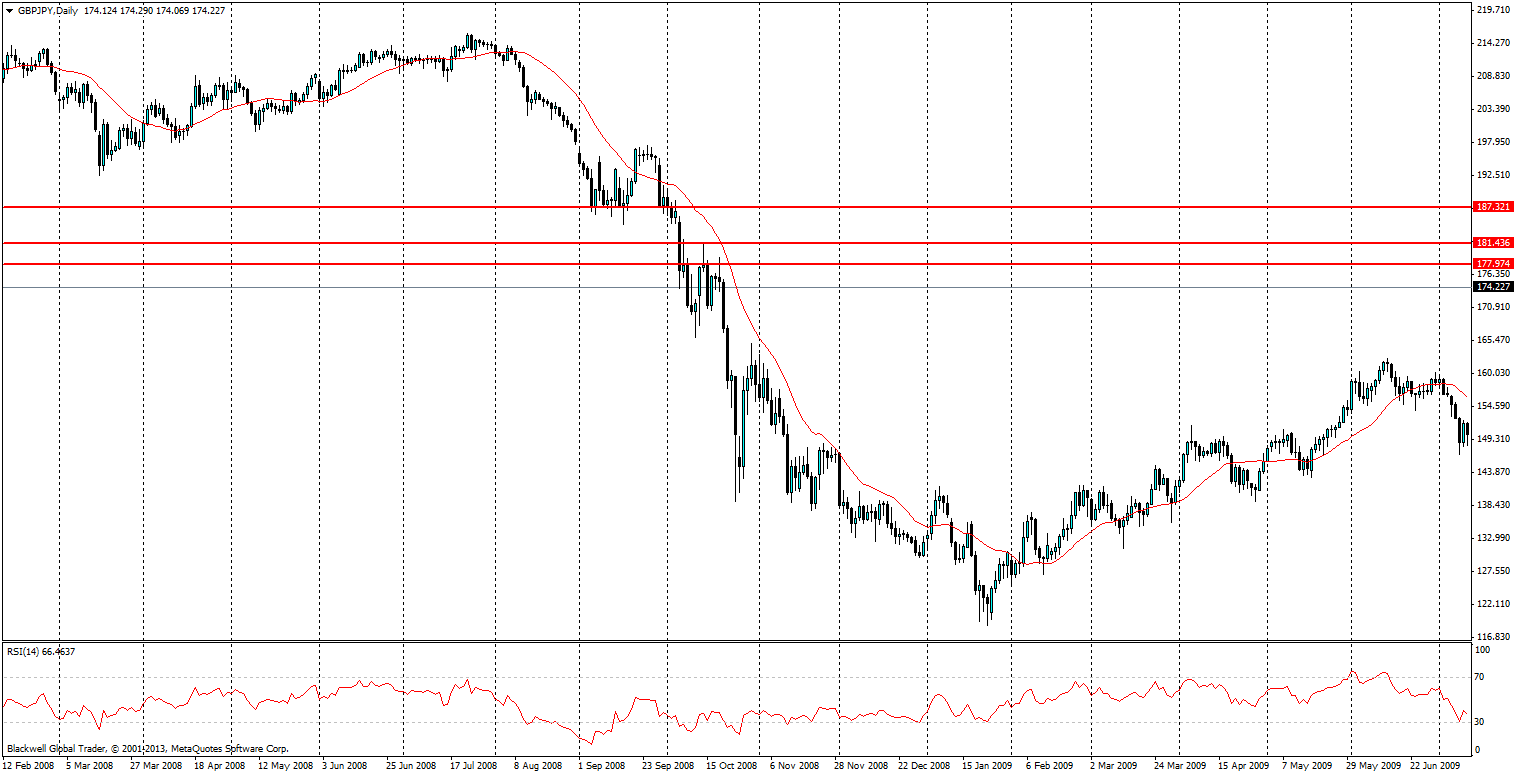

Source: Blackwell Trader (GBP/JPY, D1)

Currently the GBP/JPY is looking a strong candidate for a long play. I say this as the channel extends very far back and has been solid for some time now; despite the period of consolidation recently.

Source: Blackwell Trader (GBP/JPY, D1)

As can be seen on the chart at min zoom the channel has been extending strongly for some time now with a combination of a weak Yen and a strong pound, leading to a massive rise and there is still more room in there for higher movements.

Source: Blackwell Trader (GBPJPY, D1)

Current possible resistance levels can be found in 2008: these are 177.974, 181.436 and 187.321. These are likely to be strong as the GBP/JPY rises, but markets may push even higher back to pre-recession highs in the 200 range.

Either way, the GBP/JPY is presently a better opportunity than then GBPUSD. In the event of weaker economic data the trend line is very close and is likely to hold and push higher in a few days again. While on the GBPUSD we are currently in the middle and have no clear entry point, so it could swing backwards very harshly. For many the GBP/USD might be the trade they are set on, but for now I would strongly suggest taking a look at the GBP/JPY which has ample opportunities to take advantage of.