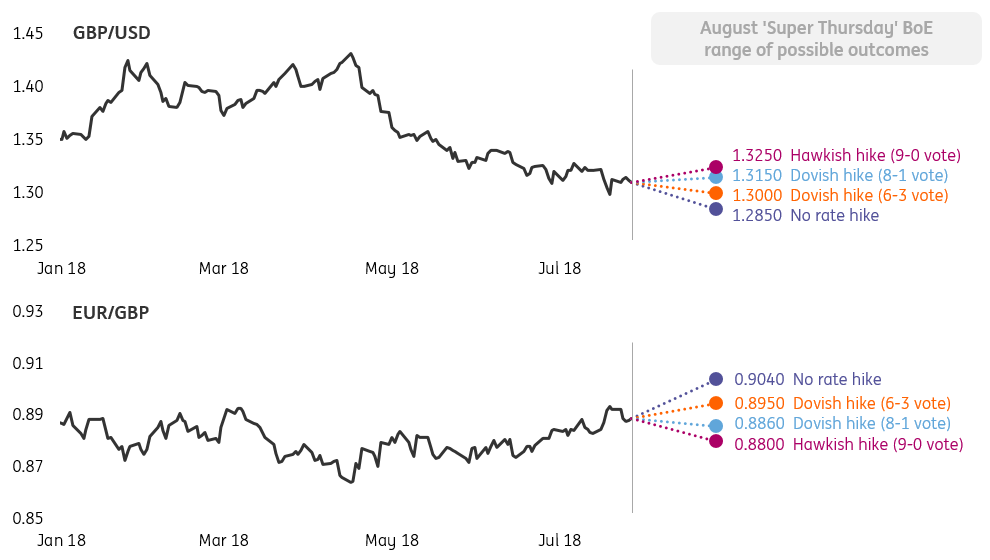

A pound under the political cosh is unlikely to find much love from a dovish 25bps BoE rate hike at the August 'Super Thursday' meeting. The tail risk of no rate hike this week would be the equivalent of pulling a rug from under GBP’s feet - with risks of GBP/USD falling to 1.28.

Key messages: Dovish BoE hike unlikely to spur much GBP upside

- A pound under the political cosh is unlikely to find much love from a dovish 25bps BoE rate hike this week. While we see the MPC delivering a 25bps rate hike at the ‘Super Thursday’ August BoE meeting, we think the potential for at least one, if not two dissenters (Cunliffe and Ramsden) – as well as cautious rhetoric by Governor Carney in the post-meeting press conference – is unlikely to engender much hawkish spirit in either UK rates or the pound this week, not least as both markets remain dominated by the risk of a no-deal Brexit.

- The Bank of England not hiking this week would be the equivalent of pulling a rug from under GBP’s feet – with GBP/USD falling to 1.2800/50 and EUR/GBP rallying to 0.90-0.91.

- However, the most likely market reaction following an expected 25bps BoE rate hike is a dovish one as the current political and broader economic environment renders any hawkish BoE assertions as incredible right now.

- While the UK rates market is underestimating the potential BoE rate hike path under a smooth Brexit scenario, we doubt investors will be broadly willing to bring forward their BoE policy tightening expectations given the obvious near-term political headwinds. However, we note GBP sentiment is particularly bearish – with positioning and options markets having already adjusted to the prospect of near-term GBP weakness. This may limit any GBP fallout from a dovish BoE rate hike this week.

- Hawkish BoE rhetoric alone is unlikely to elicit a steeper UK rate curve. At best, we see the curve staying where it is or bull flattening (longer-term UK rates moving slightly lower). This lends itself to a neutral to bearish GBP reaction in the short-term – with GBP/USD potentially falling back to 1.30 this week as the focus shifts to a tricky few months for Brexit politics.

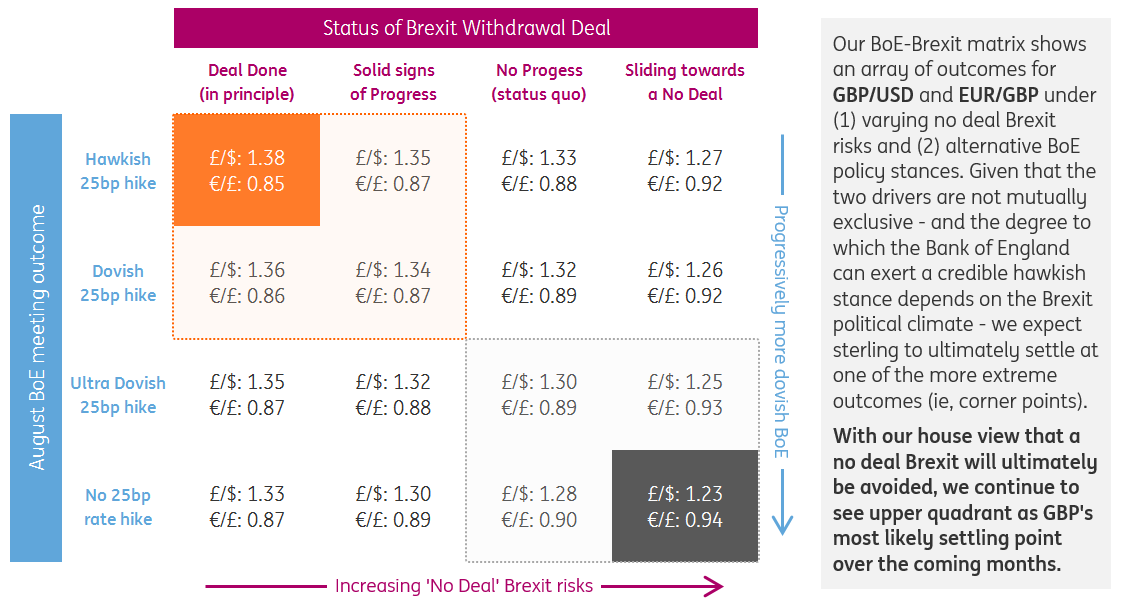

- Looking more broadly, our BoE-Brexit matrix shows an array of outcomes for GBP/USD and EUR/GBP under (1) varying no deal Brexit risks and (2) alternative BoE policy stances. With our house view that a no-deal Brexit will ultimately be avoided – we continue to see the potential for a significant relief rally in the pound on the basis of positive Brexit outcome (GBP/USD moving to 1.37-1.38 and EUR/GBP moving to 0.85-0.86). The catalyst for this re-pricing would be a concrete resolution on the Irish border 'backstop' dispute.

GBP scenarios for the August 'Super Thursday' BoE meeting

Our August Bank of England scenario analysis shows how the skew of potential outcomes (or risk-reward) favours a neutral to bearish GBP reaction following the event

- The Bank of England not hiking this week would be the equivalent of pulling a rug from under GBP’s feet. The most extreme bearish scenario would be the MPC not delivering the 25bps rate hike that is all but priced into markets (~85% priced into the OIS curve). We note that the prospect of BoE policy tightening is the only thing supporting the pound amid a myriad of political uncertainties (what we’ve previously described as ‘the Carney put’) – and taking away this support would be one heck of a blow. While we would expect the Bank to cushion the surprise of a rate hike disappointment with strong conditional guidance for a November rate hike, this would not be enough to see markets initially shifting to the idea that the Bank ‘will never hike again’. As such, we think the downside potential for the pound in a no rate hike scenario is GBP/USD falling to 1.2800-1.2850 – and EUR/GBP rallying to 0.90-0.91.

- The most likely market reaction following an expected 25bps BoE rate hike is a dovish one as the current political and broader economic environment renders any hawkish BoE assertions as incredible. BoE policy and Brexit politics are not mutually exclusive – and we are acutely aware of the fact that the BoE’s broader policy outlook is conditional on the assumption of a smooth Brexit adjustment. However, this is not a view that everyone in the market currently shares – especially given all the noise surrounding a no-deal Brexit. Hawkish BoE rhetoric alone is unlikely to elicit a steeper UK rate curve – and at best, we see the curve staying where it is or bull flattening (longer-term UK rates moving slightly lower). This lends itself to a neutral to bearish GBP reaction.

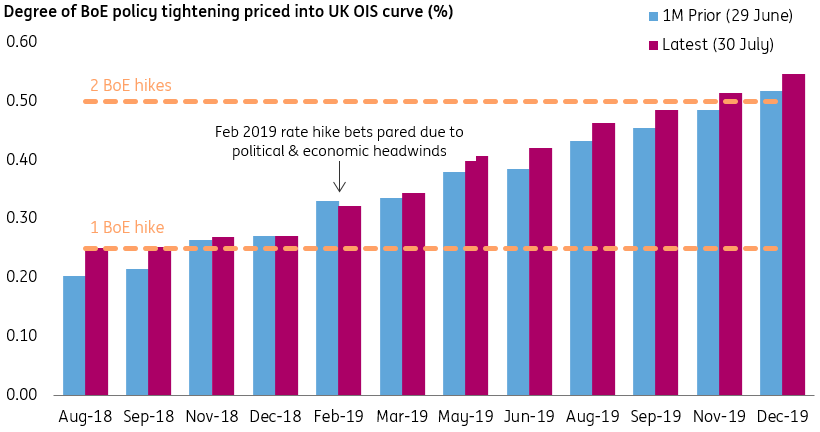

Markets unlikely to bring forward BoE policy tightening expectations given political headwinds

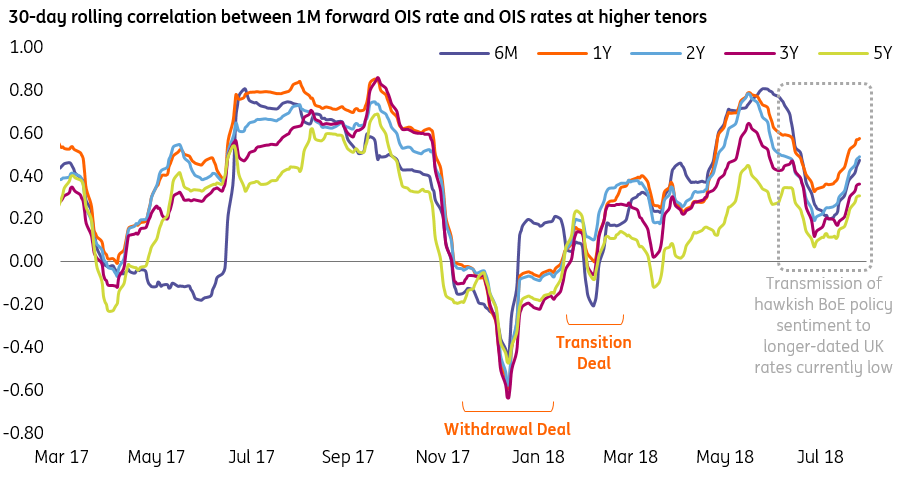

Brexit risks overshadowing BoE policy for UK rates market

Given the persistent Brexit-related uncertainties surrounding the economy, the UK rates market has typically shown the pattern of discounting potential BoE rate hikes on a quarterly meeting-by-meeting basis. We acknowledge that markets are underestimating the potential BoE rate hike path under a smooth Brexit adjustment – with the Bank’s ’gradual normalisation’ stance in our view equivalent to one 25bp hike every six months. Adjusting for likely short-term political turbulence, this would put the timing of the next rate hike in May 2019 – which is significantly earlier than what markets currently envisage (a second full 25bp rate hike is not priced in until Nov 2019).

The MPC may signal that markets are underestimating the potential BoE rate hike path – but not everyone in the market shares the same ‘smooth Brexit’ view. Longer-term UK interest rate expectations can be distorted during periods of heightened Brexit political risks; the correlation between shorter and longer-dated UK forward rates tends to materially decline ahead of crucial Brexit negotiations (ie, Withdrawal Deal in Dec-17 and Transition Deal in Mar-18). Given that Brexit risks are at a similar crunch time, we expect any follow-through of hawkish BoE rhetoric into higher short-term UK rates to be limited. Moreover, for GBP markets, the part of the curve that matters over the medium-term is the 3-5 year rate differential.

ING's BoE-Brexit matrix of GBP outcomes

Our BoE-Brexit matrix shows an array of outcomes for GBP/USD and EUR/GBP under (1) varying no deal Brexit risks and (2) alternative BoE policy stances. Given that the two drivers are not mutually exclusive – and the degree to which the Bank of England can exert a credible hawkish stance depends on the Brexit political climate – we expect sterling to ultimately settle at one of the more extreme outcomes (ie, corner points).

With our house view that a no-deal Brexit will ultimately be avoided – even if it is another fudge – we continue to see upper quadrant as the most likely settling point for GBP over the coming months. That sees GBP/USD moving up to 1.37-1.38, and EUR/GBP moving to 0.85-0.86, on the basis of a Withdrawl Deal being agreed in principle between the UK and EU. The catalyst for this positive GBP re-pricing will be a concrete resolution on the Irish border 'backstop' dispute.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”