Summary- Trump declines to sanction companies involved with Nordstream 2.

- Gazprom (MCX:GAZP)'s price is depressed due to heightened political risk.

- Risk is lifting and should lift the stock price out of multi-year sideways market.

To say that the Nordstream 2 pipeline is controversial is the height of understatement. This pipeline, now officially under construction by Gazprom (OTC:OGZPY), lies at the center of a number of hot-button geopolitical imperatives.

Each step along the path to the recent announcement by President Trump where he stated he would not sanction the companies involved in Nordstream 2 has been fraught with headline-grabbing risk.

From Sputnik News:

However, Donald Trump has stated the US was not planning to slap any sanctions against companies involved in the Russian project when asked about such a possibility.

"We are not looking to do that. We just think it is very unfortunate for the people of Germany that Germany is paying billions and billions of dollars a year for their energy to Russia," Trump said to the journalists.

The US has not only spoken out against the NordStream 2, but has already taken measures to block the venture. Last year, the CAATSA law (Countering America's Adversaries Through Sanctions Act) was adopted, which stipulates the possibility of imposing unilateral sanctions on companies which are directly involved in NordStream 2.

This statement by Trump is the one Gazprom bulls have been waiting for. I’ve been very consistent on this, Nordstream 2 was always going to get built. I said as much here on Seeking Alpha back in June with an article called “ U.S. Sanctions Will Not Stop Nordstream 2”

Here’s what I said in June:

Nordstream 2 is too important politically to future Russian/European Union relations for it to fall apart at the last minute like South Stream did after U.S. pressure on Bulgaria forced Russian President Vladimir Putin to pull the project and reroute it through Turkey, resurrected as Turkish Stream.

That miscalculation cost eastern Europe gas supplies it needed for growth as well as billions in transit fees for Bulgaria. That decision cost the Bulgarian government its rule and today's leadership is openly lobbying for a new version of South Stream which Gazprom has not committed to yet. This time, it could be German Chancellor Angela Merkel who would feel the wrath of voters. Germany needs NordStream 2, and, if Gazprom's Chairman of the Board Alexander Medvedev is to be taken seriously, NordStream 3 as well.

So, if she folds here to Trump's pressure it will likely spell the end of her government within the year.

And this is exactly what has taken place with this admission by Trump that he will not impose sanctions on the five European oil majors which are Gazprom’s financiers on the project.

Ultimately, Trump had to weigh the damage to U.S. and world markets sanctioning Royal Dutch Shell (LON:RDSa), Uniper, BASF’s (OTC:BASFY) subsidiary Wintershall, France’s Engie and Austria’s OMV over his frustrations concerning Nordstream 2.

Sanctioning five of the biggest companies in Europe for making a smart business decision that goes against U.S. foreign policy objectives is simply not in the Dale Carnegie playbook of treating your customers well.

So, any further action by Trump would have been a net negative for the U.S. It would have alienated European businesses even more for little to no gain on the ground, since Novatek can still outcompete Cheniere Energy Inc (NYSE:LNG) for LNG supplies to Europe from Yamal on the Baltic Sea.

In the end all of the tough talk of ‘European energy security’ met the reality of Nordstream 2’s superior economics. And when one looks that this situation from the perspective of Europe, nothing could be more secure for them than doing more business with a supplier who has never let politics get in the way of supplying them gas.

For all of the fear-mongering around Gazprom’s market share in Europe, the truth is that the gas has always flowed. And despite numerous provocations by the European Union – changes to the European energy ownership laws which helped to scuttle South Stream in 2014, an anti-trust suit which Gazprom settled with changes to its take-or-pay contracts, going along with the U.S. on ruinous sanctions – Gazprom has been nothing but a reliable energy supplier since the days of the Cold War.

No amount of grandstanding, threats or sanctions can overcome the economic advantages of Russian piped gas to Europe over LNG shipped thousands of miles from Louisiana.

You can’t create a market like this out of whole cloth. But that is exactly what the U.S. has been attempting to do with its opposition to the Nordstream 2 pipeline.

And that has done nothing but keep the political risk surrounding Gazprom at a fever pitch with the intent of keeping the stock price low and Russian markets unattractive to foreign capital.

So, for investors today looking around the energy space the last political risk associated with Gazprom is the U.S. banning investment into any Russian stock and forceable de-listing of their ADRs.

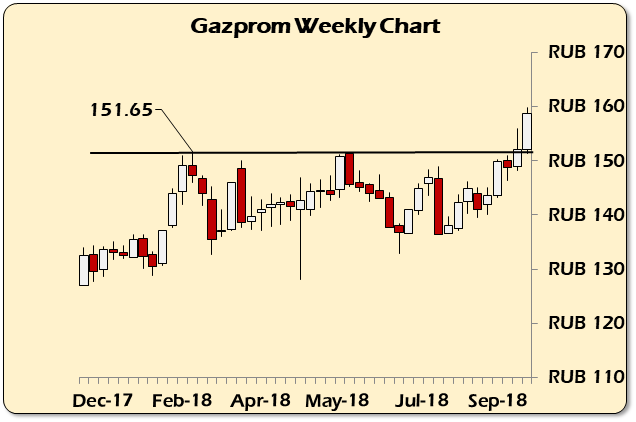

The stock jumped on the Russian MOEX this week on the news that Trump would no longer block Nordstream 2, putting in a weekly closing price above RUB 151.65.

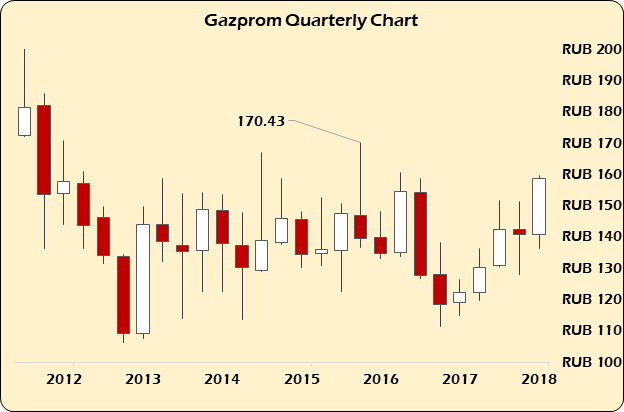

From a longer-term perspective Gazprom is mired in a six-year consolidation pattern between RUB 100 and RUB 160. A move above the May 2016 high at 170.43 would constitute a major long-term structural breakout on the stock. And the continuation of a year-long rally in the stock price in local currency terms.

For U.S. investors worried about currency risk, the U.S. has thrown about all it can to drain Russia of foreign capital and while the ruble has been caught in the backlash of emerging market stress, since it is not in the same situation as countries like Turkey, Brazil and Argentina, the weakness in the Ruble this year cannot be attributed to over-exposure to dollar-denominated corporate debt.

That was the cause of the 2014/15 ruble crisis. This year’s ruble devaluation stemmed from sanctions hitting Russian companies exposed to euro-denominated debt. This was precipitated by expanding the scope of sanctions back in May which forced massive liquidation of Russian corporate debt.

But, it’s not a reflection of the ruble’s fundamentals against the backdrop of $75+/barrel Brent crude prices and natural gas inching towards $3/mcf as we come into the winter. This says to me the ruble will likely fall back into the mid-50s as long as oil and gas prices remain buoyant, which is likely unless Trump also folds on Iran sanctions and Iranian exports fall less than the market is currently handicapping.

With Gazprom’s deliveries to Europe expanding regardless of Nordstream 2 the future looks very bright now that the last obstacles to Nordstream 2 are over.

Lastly, let’s simply look at fundamentals. Gazprom, despite the recent rally, is still trading at a price-to-sales of just over 0.5. P/E is 3.6. It’s paying a 5.7% yield and it has three major pipeline projects nearing completion over the next year which will begin adding to these numbers.

Today’s stock price represents Gazprom criminally under-priced relative to its value and its future prospects.

The market has over-reacted for years to the company’s political risk and under-played the commitment Russia’s government has to these major projects’ success. With Power of Siberia, Nordstream 2 and Turkish Stream all due to hit the bottom line by the end of 2019, buying Gazprom today at below $5 per share represents one of the best value and growth plays in the energy space.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.