This past week I got into an intersting email discussion with Kid Dynamite, a fellow blogger. KD publishes Kid Dynamite’s World and his insightful Tweets can be followed at @KidDynamiteBlog

Our discussion centered on his keen observation that the price of some ETFs have everything to do with pure speculation and technical trading and nothing to do with the price of the underlying assets.

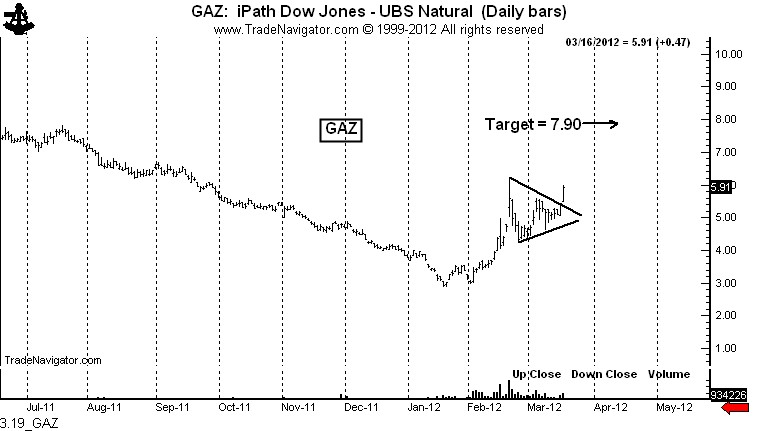

The ETF in question was GAZ - an iPath ETN that is hypothetically designed to track the price of Natural Gas via the Dow Jones UBS Natural Gas Sub Index. The reality is that the price of GAZ in recent weeks has had nothing to do with the price of Natural Gas.

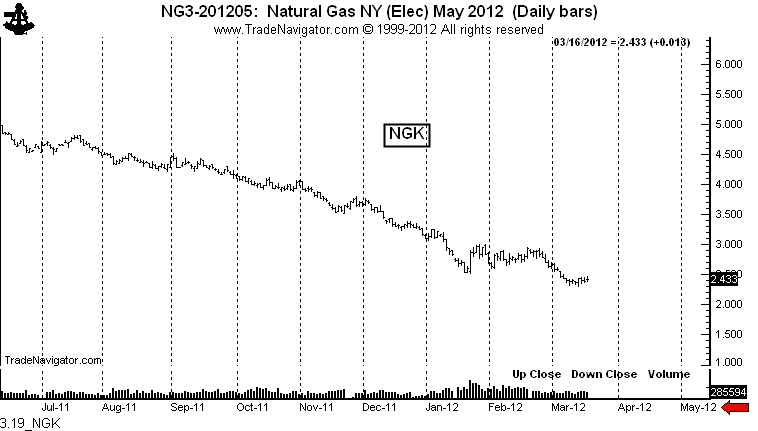

The daily charts below show the prices of the May Natural Gas futures (NG_F) and our current villain, GAZ. As you can see, prices of the ETF and the underlying commodity have diverged since the January low with Natural Gas drifting into a new low while GAZ is undergoing a bull thrust.

This divergence between GAZ and NG_F tickled my interest, so I examined the relationship over the past five years between the following:

- Natural Gas futures — the nearby futures contract

- Natural Gas futures — Dec. 2012 delivery contract

- UNG – ETF

- GAZ – ETN

- FCG – an ETF representing companies with significant stakes in the Natural Gas market

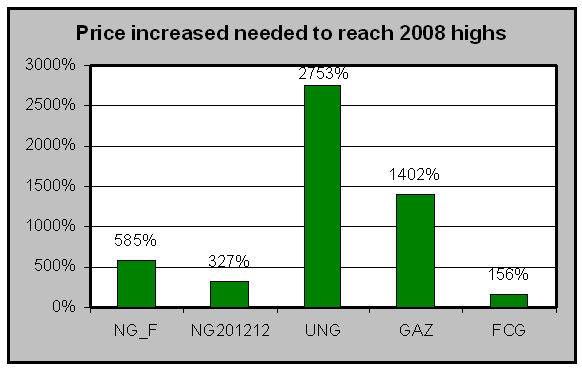

All of these markets have experienced significant declines from the 2008 high in energy prices. But, the declines have varied widely - to the point one must question the correlation between the underlying commodity and the ETFs supposedly tied to the underlying commodity.

The table below shows the price increase needed by the different markets to recover the ground lost since the 2008 highs.

Investors who bought FCG at the 2008 high need only a 156% increase to break even (dividends excluded). Traders who have been long the nearby futures contracts (rolling each month) need a 585% increase in the cost of Natural Gas to break even.

But, buyers of UNG and GAZ need a 2,753% and 1,402% respective rally to get back to the 2008 highs. This is not exactly what I would call a good correlation with the underlying asset.

These shocking statistics should alarm traders who think that commodity-specifc ETFs are anything more than vehicles for speculation.

GAZ has the ability to divert from the underlying because the price of GAZ really has no connection with reality. This highlights a real dilemma with commodity-based ETFs compared to the futures market. Futures market contracts are subject to delivery and expiration, forcing prices between futures contracts and the underlying commodity to converge.

By contrast, there is no mechanism to keep honest the ETFs and ETNs hypothetically linked to commodities or commodity indexes. The price of ETFs such as GAZ ultimately will go wherever the force of speculative fever wants to take them.

I believe that this disconnection with any reality other than the actions of speculators will be the ultimate downfall of commodity-specific ETFs. At some future time the creator of these derivatives will need to find a way to actually have the derivatives live in the same world occupied by the underlying assets. Until this happens, traders engaging with commodity-specific ETFs need to know they are just playing craps.

GAZ and similar ETFs are full of hot air. If you have contrary thinking (reasons why these ETFs have some economic connection with reality) please reply in the comments section below.