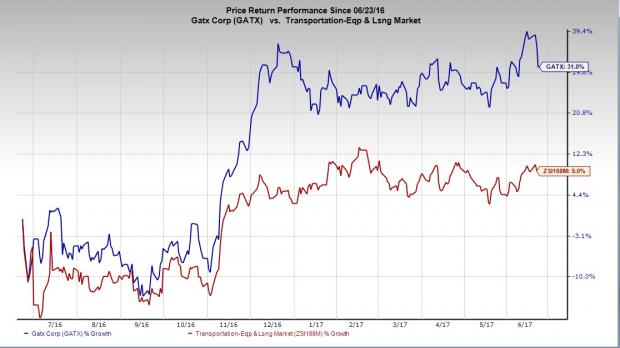

Shares of GATX Corporation (NYSE:GATX) have outperformed the Zacks categorized Transportation - Equipment and Leasing industry in the last one year on the back of a strong product portfolio as well as an impressive earnings history. The stock has rallied 31.06% compared with the industry’s gain of 9%.

The company reported better-than-expected earnings and revenues in the first quarter of 2017. Earnings (on an adjusted basis) of $1.44 per share breezed past the Zacks Consensus Estimate of $1.08. Revenues of $316.1 million were also above the Zacks Consensus Estimate of $312.2 million.

A favorable earnings history shows the company to have outshined the Zacks Consensus Estimate in each of the past four quarters. The average earnings beat is 32.8%. GATX is expected to perform well with respect to the bottom line in near future as well.

Additionally, improvement in the Rail International unit’s profit in the first quarter of 2017 is encouraging. Profits in the stated segment improved 6.3% year over year to $13.4 million.

GATX’s efforts to reward investors through share buybacks and dividend payments are appreciative too. In a shareholder friendly move, the board of directors at GATX has cleared a quarterly dividend of 42 cents per share. This payout will be made on Jun 30, 2017 to the shareholders of record as of Jun 15. In Jan 2017, the company had raised its quarterly dividend by 5% to 42 cents. It has been constantly paying regular dividends since 1919.

In another positive development, GATX received the Responsible Care 2017 Partner of the Year Award from the American Chemistry Council this May. This reward is bestowed forthe company’s outstanding performance and safety record in distribution, transportation, storage, use, treatment, disposal and/or sales and marketing of chemicals.

The above positives substantiate GATX’s Zacks Rank #2 (Buy). Seems the time is ripe for investors to add this stock to their portfolio. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks to Consider

Other favorably placed stocks worth considering in the transportation sector are CAI International, Inc. (NYSE:CAI) , Freightcar America, Inc. (NASDAQ:RAIL) and Triton International Limited (NYSE:TRTN) . All sport a Zacks Rank #1.

Shares of CAI International, Freightcar America and Triton International surged over 63%, 32% and 45%, respectively, in the last three months.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

Freightcar America, Inc. (RAIL): Free Stock Analysis Report

CAI International, Inc. (CAI): Free Stock Analysis Report

GATX Corporation (GATX): Free Stock Analysis Report

Triton International Limited (TRTN): Free Stock Analysis Report

Original post

Zacks Investment Research