Last weekend, motorists in Illinois got the bargain of a lifetime when a computer glitch caused an impromptu sale on unleaded plus fuel for one penny per gallon.

Instead of paying about $40 to fill up a 12-gallon tank, they only had to fork over $0.13.

Naturally, word spread quickly. Cars piled up. And somebody called the cops to shut it all down (party poopers).

While this situation was an anomaly, the mad dash for cheap gas points to a broader issue facing consumers – and investors…

Lost in the Shuffle

In the midst of an emerging markets selloff, high-profile social media earnings reports and activist squabbles with Apple (AAPL), no one seems to be paying attention to the steady climb in oil prices.

They’re back above $100 per barrel again.

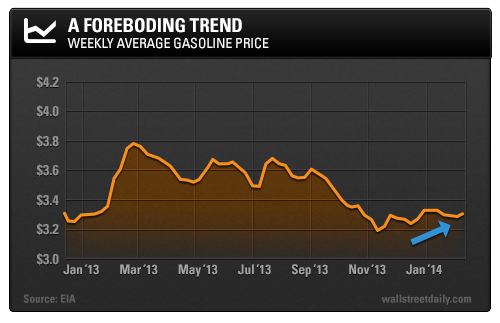

As we all know, where oil prices go, gasoline prices follow. And sure enough, since early November 2013, the national average price of gasoline has been creeping higher, too.

While the current price per gallon is still about 10% below last year’s levels, cash-strapped consumers can ill afford any more increases.

Want irrefutable proof? Look no further than the latest comments from Family Dollar Stores, Inc. (FDO).

The discount retailer concedes that even its bargain-priced goods are too expensive for low-income shoppers, which make up more than 50% of its customer base.

When the cheap stores aren’t, well… cheap anymore, we’ve got a problem.

The prospect of higher prices at the pump isn’t the only factor that promises to weigh on consumer spending in the months ahead, however…

A Perfect Storm of Negative Influences

For nearly two months now, we’ve been dealing with bone-chilling temperatures. Even typically warmer locales can’t escape the polar vortex.

For example, Reliant Energy, which supplies power to 1.5 million people in Dallas and Houston, says its customers have been forced to turn up the heat 40% to 50% more than last winter.

All told, the Energy Information Administration estimates that average heating bills will climb 17% to 23.5% this winter.

In turn, industry experts estimate that the rising costs will put a 6% drag on consumer spending.

I’m convinced those calculations are actually too conservative.

Either way, we’re talking about soaring utility bills adding to the burden on consumers.

But that’s not all…

The Number One Culprit

Get ready to blame the weather again for increased costs.

You see, once Old Man Winter goes away, we’re in for a hot and dry third quarter, according to Weather Trends International (WTI).

In case you didn’t know, California is experiencing a nasty drought right now. So more dry weather promises to exacerbate the situation.

The end result? “Limited water supplies for the start of growing season will likely limit crop production and therefore drive up prices for key food commodities,” according to WTI’s analysts.

Bottom line: Consumers are facing a triple whammy of cost increases for gasoline, heating bills and food.

That bodes terribly for consumer discretionary companies, especially those focused on low-income households and customers with fixed budgets – like Family Dollar, Dollar Tree, Inc. (DLTR), or even Wal-Mart (WMT).