It’s Friday in the Wall Street Daily Nation!

That means the long-winded analysis is out. (Hallelujah!)

And some carefully selected charts are in. (Amen!)

So without further ado, check out these snapshots that show the big thorn stuck in small business’ side; how a single penny can provide $1 billion in economic stimulus; and the latest technological fad sweeping the nation – courtesy of the internet.

The Blame Game

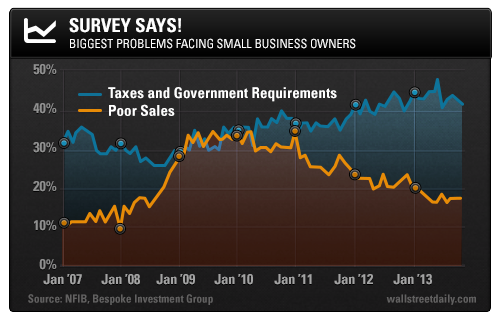

I’ve featured the NFIB Small Business Optimism Index here before. So what’s the latest reading tell us?

Even when Washington is closed, politicians are still a major problem.

In the latest survey, taxes and government regulations topped the list (again). Combined, the two categories ranked as the biggest problems facing 41% of small business owners.

Third in line? Poor sales.

As Bespoke Investment Group notes, “It doesn’t say much for the business climate in the United States when businesses are two and a half times more worried about how the government is going to regulate and tax them than they are about actually moving merchandise.”

No, it doesn’t.

Imagine for a moment what the economic recovery would be like if the government would just move and get out of the way!

I know – not going to happen. So let’s get back to reality…

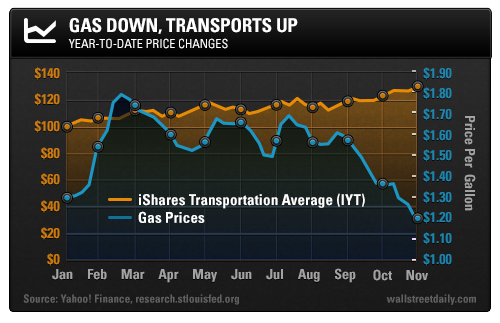

No More Pain At the Pump

I’m pretty sure every American noticed that average gasoline prices are down more than 15% since February.

What many probably don’t realize, though, is that every penny of lower gas prices per gallon yields $1 billion in economic stimulus, according to Deutsche Bank’s (DB) Joe LaVorgna.

If the price drops continue, look for consumer confidence and holiday spending numbers to perk up.

Falling oil and gas costs promise to provide a lift to the transportation sector, too, making the iShares Transportation ETF (IYT)a timely investment.

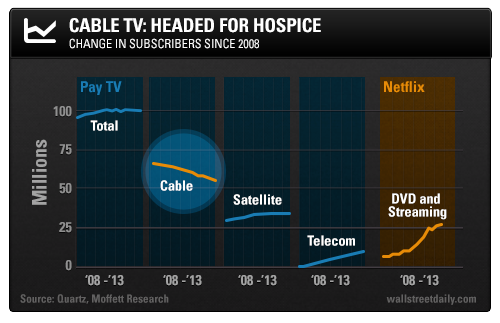

Video Killed the Radio Star… and the Internet Killed TV

The internet relegated print media to insignificance. And it’s about to do the same to traditional television.

More than five million Americans have already “cut the cord.” That is, they ditched traditional pay television services in favor of online content from the likes of Hulu, Netflix (NFLX), Aereo, YouTube, Amazon Prime, iTunes video and Google Play.

The trend is accelerating, too, according to new data from analyst Craig Moffett.

From August to September, cable TV subscriptions dropped by 687,000. Meanwhile, the 800-pound gorilla in the online streaming industry, Netflix, notched another strong quarter of growth – adding 1.3 million subscribers.

So for every one American who ditched cable TV, almost two signed up for Netflix.

The investment implications couldn’t be clearer: Go short cable television and long video streaming.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gas Prices Down, Consumer Confidence Up, Cable TV Struggles

Published 11/15/2013, 12:08 PM

Gas Prices Down, Consumer Confidence Up, Cable TV Struggles

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.