There is every reason to be thankful for the Harris no-go last week, but also absolutely no case to get giddy about the prospects for a second Trumpian term, either. At best, what lies ahead is a wasted four years on the policy front, as Washington is likely to become embroiled in an even more acrimonious melee between the TDS and MAGA polarities of American politics.

Indeed, contrary to the excitement currently extant in many quarters of Team Garbage it needs to be recognized that what happened was not the vindication of Donald Trump. There was no mandate for MAGA or some grand political realignment or the birth of a new era of governance under which the people have taken back their government.

Ironically, all the realignment chatter is actually rooted in the reason the election was more likely a one-off dead-end. Proponents cite exit polls showing that Trump "outperformed" Hispanics, blacks, young people, urban, union, and working-class voters, and other left behinds, thereby suggesting a new governing coalition has formed around the Orange Man. Some even imagine it’s a Republican 1933.

But that’s just not so. These backsliding Dem constituencies voted against the soaring cost of groceries and Gasoline, not in favor of MAGA or DJT as the savior of the American Way of Life. The inflationary whirlwind that hit the US economy from 2021 to 2023 was such a powerful economic shock to everyday Dem households that on the margin it pushed a considerable slice of them out of their customary lane in the voting. In effect, they checked the GOP box in answer to Ronald Reagan’s call of 1980 under parallel circumstances, when he asked whether you are better off today than four years ago.

For instance, pump prices had been running about $2.00 per gallon through almost the exact moment of J6, and then it was off to the races for the next 18 months. By June 2022 the national average Gas price hit $5 per gallon. Given that the average US household consumes about 650 gallons of gas annually, that $3 per gallon shock drilled a $2,000 per year hole in family budgets.

Yes, prices have partially retraced, but the shock is still fresh and gasoline bills have remained upwards of $1,000 per year higher than before.

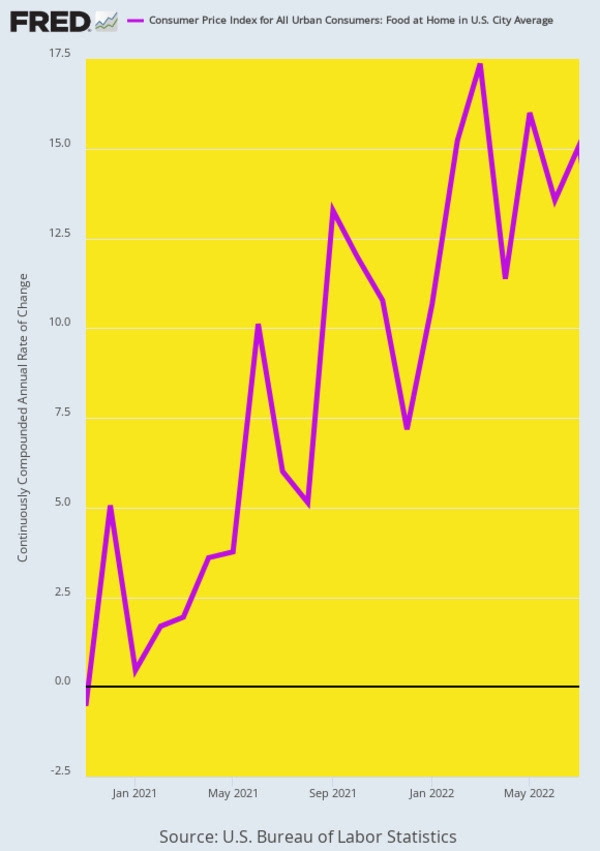

Likewise, grocery store prices after January 2021 shot upward like a bat out of hell, reaching a +11% annualized increase by June 2021 and +17% by March 2022. Again, the 20% cumulative gain through December 2022 amounted to $1,200 per year against an average household grocery bill of $6,000 per annum.

Needless to say, gas and groceries are purchased virtually every week by most households. The soaring green line above and the leaping purple line below caused millions of ordinarily Dem coalition households to scrimp, squeeze, and sacrifice in the months immediately after they had already suffered through the disruptions and hysteria of the pandemic and lockdowns.

Accordingly, the economic trauma was too severe and too fresh to be extirpated by White House bromides about the alleged roaring success of Bidonomics. Yes, according to the crooked reports of the BLS the US economy was booming along at full employment, but even a steady job did not pay for the soaring cost of everyday living in these backsliding electoral precincts.

Annualized Rate of Grocery Price Change, January 2021 to June 2022

In this context, one especially malodorous skunk on the woodpile was the Harris-Biden claim that they had cut the inflation rate by two-thirds or more. But that’s Washington and Wall Street-based Keynesian-speak.

Stated differently, Main Street households make no never mind about annualized monthly rates of change to the second decimal point on the various BLS indices. As it happens, those factoids are not even relevant to the cause of sound money, but they are especially beside the point when it comes to making ends meet in household budgets.

In fact, when it comes to measuring inflation in the Main Street context, the Reagan question would more than suffice. To wit, do your gas and groceries cost more relative to your paycheck than they did four years ago?

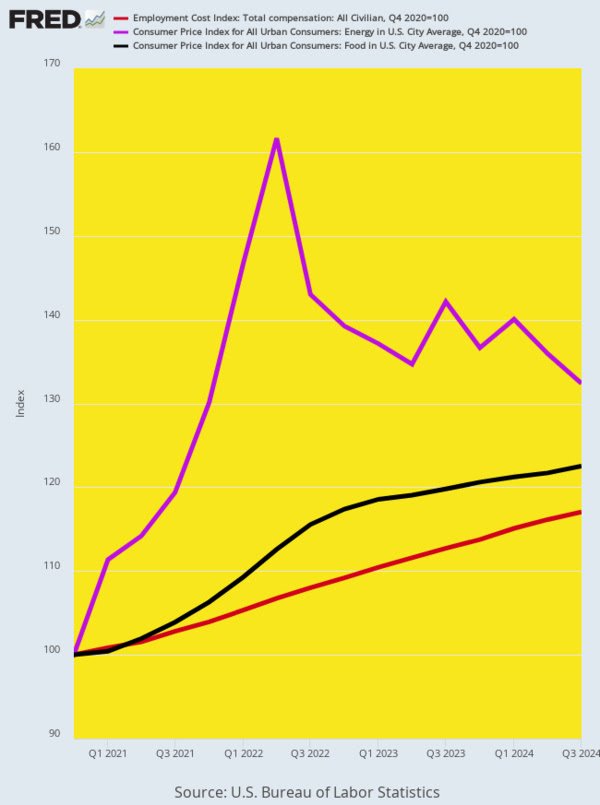

Well, yes, they do. As shown below, since Q4 2020 average worker compensation is up by 17%, which trails the 23% rise in food costs (both at home and away) and 33% gain in energy costs (including gas and electric utilities).

In round dollar terms, the average household spent about $7,500 on food and $3,000 on gas and energy in Q4 2020. Today, the combined figure is about $14,000. What voters remember, therefore, is not that the rate of price change has slowed sharply from the double-digit rates two years ago, but that today’s gas and grocery bills are nearly $4,000 per year higher than the were in 2020.

Index Of Employment Compensation Costs Versus CPI For Food and Energy, Q4 2020 to Q3 2024

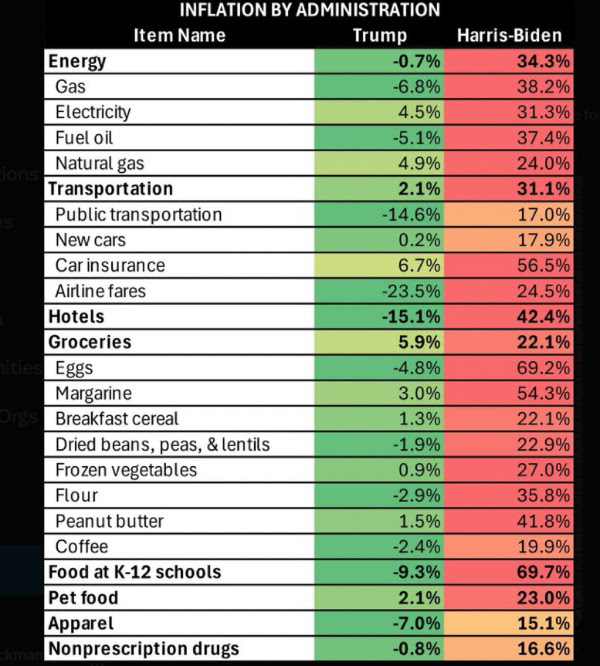

Even when you look at the entire market basket of CPI items, not just gas and groceries, the story remains much the same. The rise in the CPI during Trump’s four years was 1.94% per annum, which accelerated dramatically to 5.0% per annum during the Harris-Biden period.

As shown in the contrast between the red and green columns below, it wasn’t just gas and groceries alone that fueled the assault on main street living standards. Car insurance, for example, is up by 56.5% or more than eight times the gain during the Trump period.

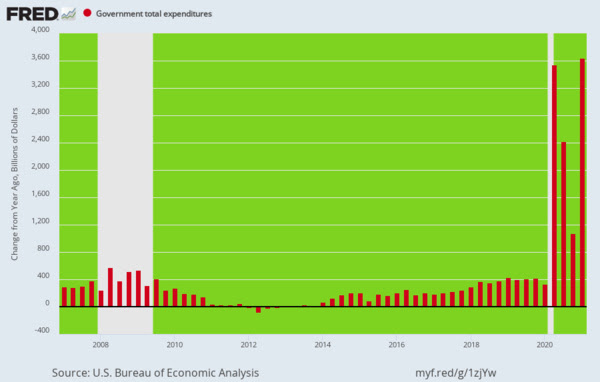

Inflation is caused by excessive government spending, borrowing, money printing, and nothing else. Yet owing to his panicked response to the so-called pandemic, the Donald unleashed fiscal and monetary shimmies that were literally off the charts of history as shown in the chart below.

Government spending, which had been rising at a $200 to $400 billion year-over-year rate, thus accelerated to a $3.6 trillion Y/Y rate of gain in Q2 of 2020 and remained at these nose-bleed elevations through Q1 2021. And even the latter officially recorded on Joe Biden's watch was mainly fueled by the Christmas Eve 2020 stimmy bill signed by the Donald and the balance of the $2,000 per capita check Trump advocated during the 2020 campaign.

Y/Y Change In Government Spending, Q1 2007 to Q1 2021

To be sure, had the Fed not "accommodated" Trump’s fiscal madness, yields in the bond pits would have exploded higher and sent the economy tumbling into the recessionary drink. Subsequent to what would have been a deep and painful recession at the level of the Great Recession or worse, there would have been no fond memories of the Greatest Economy Ever under Donald Trump.

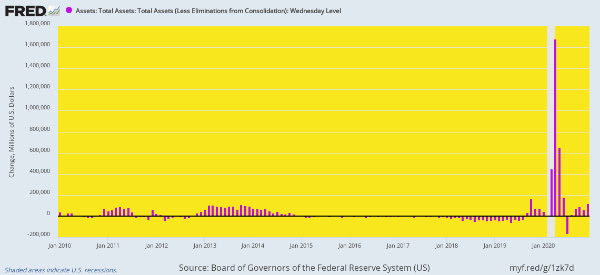

Of course, the Fed was run by Keynesians, including the Chairman appointed by the Donald. And so they unleashed the printing presses like never before, increasing the Fed’s balance sheet by $1.4 trillion in the month of April 2020 alone. That was more new fiat credit in 30 days than the Fed had printed during the first 95 years of its existence.

Needless to say, the monetary explosion shown below turned what would have been a roaring Trumpian recession into explosive inflation. After all, how could it have been otherwise in the face of the massive flood of fiat credit depicted in the chart below?

Monthly Change In Federal Reserve Balance Sheet, January 2010 to December 2020

In short, Donald Trump sowed the inflationary whirlwind with his massive economic disruptions and fiscal and monetary stimmies during 2020, while Harris-Biden reaped the whirlwind of 40-year high inflation a few months after the Donald reluctantly left town.

The chart below, which shows the annualized monthly rise in the 16% trimmed mean CPI, makes this proposition clear as a bell. It was running at a 1.5% per annum rate during the Donald’s last months but then accelerated to 5% by May and 9% by October 2021.

In a word, Biden didn’t do that because policy simply doesn’t act that fast. What hit the Main Street economy with gale-force in 2021 was the massive spending and money printing forces unleashed on Donald’s watch the prior year.

The historical truth, therefore, is that the Donald got damn lucky, tagging Harris/Biden with the "gas and groceries" inflation that caused historic Dem constituencies to cross over on November 5. Unfortunately, the voters are not going to be as lucky in the four years ahead, as the myth of the Greatest Ever Trump economy comes a cropper.